Question: The TRF = 4% and TM = 15%. A portfolio has a = .60. In the market the actual expected return of the portfolio

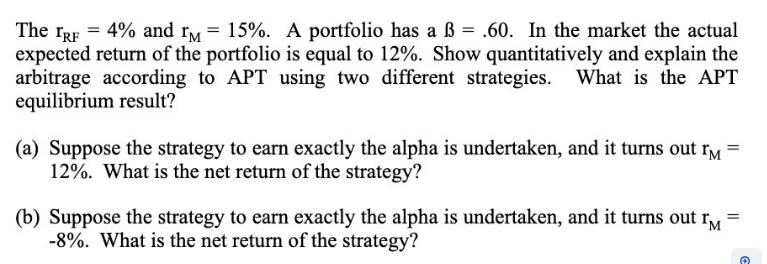

The TRF = 4% and TM = 15%. A portfolio has a = .60. In the market the actual expected return of the portfolio is equal to 12%. Show quantitatively and explain the arbitrage according to APT using two different strategies. What is the APT equilibrium result? (a) Suppose the strategy to earn exactly the alpha is undertaken, and it turns out M = 12%. What is the net return of the strategy? = (b) Suppose the strategy to earn exactly the alpha is undertaken, and it turns out IM -8%. What is the net return of the strategy?

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

The Arbitrage Pricing Theory APT is a multifactor asset pricing model that implies that if an asset has an expected return that does not align with it... View full answer

Get step-by-step solutions from verified subject matter experts