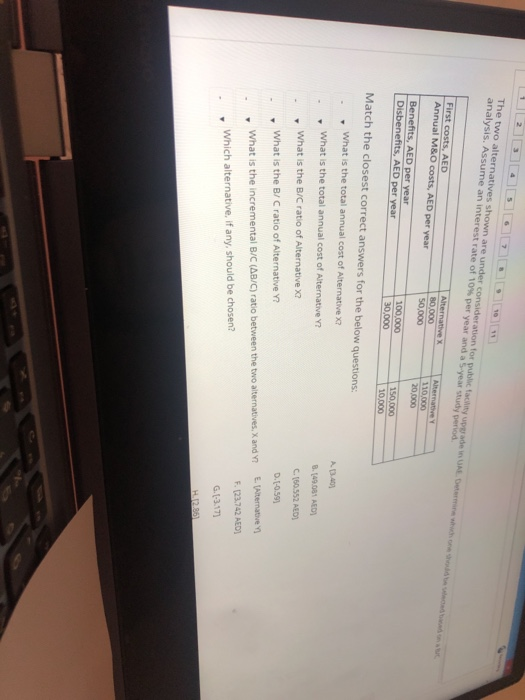

Question: The two alternatives shown are under consideration for public facility upade analysis. Assume an interest rate of 10% per year and a 5-year study period

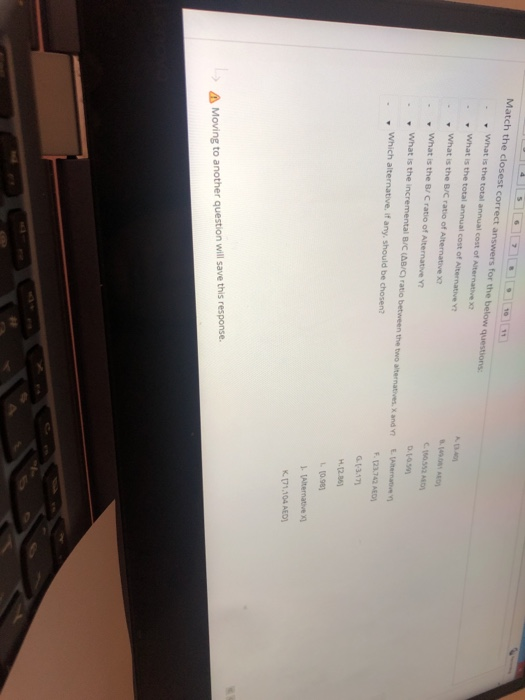

The two alternatives shown are under consideration for public facility upade analysis. Assume an interest rate of 10% per year and a 5-year study period First costs, AED Annual MBO costs, AED per year Alternative 0 000 50.000 NY 110.000 20.000 Benefits, AED per year Disbenefits, AED per year 100,000 30.000 150,000 10.000 A340 Match the closest correct answers for the below questions: What is the total annual cost of Alternative What is the total annual cost of Alternative ? What is the B/C ratio of Alternative x? What is the B/C ratio of Alternative Y 8.10.08 AED) C.160.552 ALDI D.(-0.59) What is the incremental B/C (AB/C) ratio between the two alternatives, X and Y E. Alternative F. 123.742 AED Which alternative, if any, should be chosen? G.(-3.17) Match the closest correct answers for the below questions What is the total annual cost of Alternative What is the total annual cost of Alternative What is the ratio of Alternative CO What is the B/C ratio of Alternative D. What is the incremental ICBI ratio between the two alternatives and EU 5.2374 Which alternative, if any, should be chosen? 6.1-3.17) 4.12. L 10.981 1. Alternative K.171.104 AED) Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts