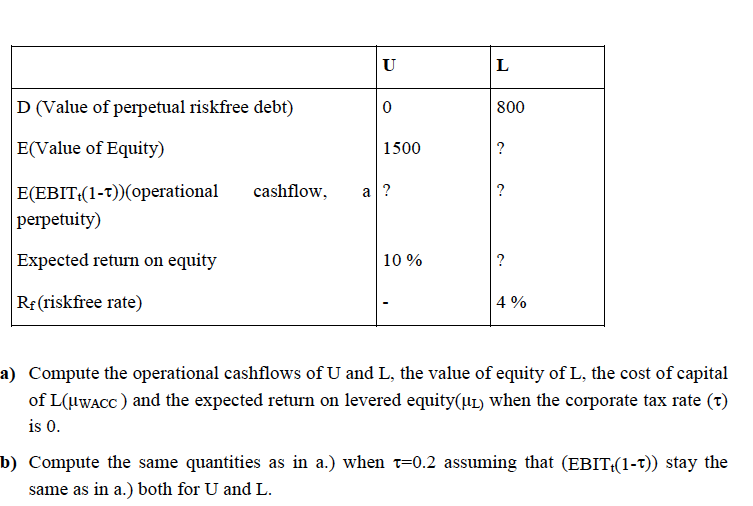

Question: The two firms U and L differ only in their capital structure. You have the following information (? denotes missing data): D (Value of perpetual

The two firms U and L differ only in their capital structure. You have the following information (? denotes missing data):

D (Value of perpetual riskfree debt) E(Value of Equity) E(EBIT(1-T)(operational cashflow, a? 0 800 1500 perpetuity) Expected return on equity Re(riskfree rate) 10% 4% a) Compute the operational cashflows of U and L, the value of equity of L, the cost of capital of L(HwACC) and the expected return on levered equity(HL) when the corporate tax rate (t) is 0. b) Compute the same quantities as in a.) when -0.2 assuming that (EBIT(1-t)) stay the same as in a.) both for U and L

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock