Question: The two key elements for the income statement are revenues and expenses. Net income or net loss is determined by subtracting total expenses from total

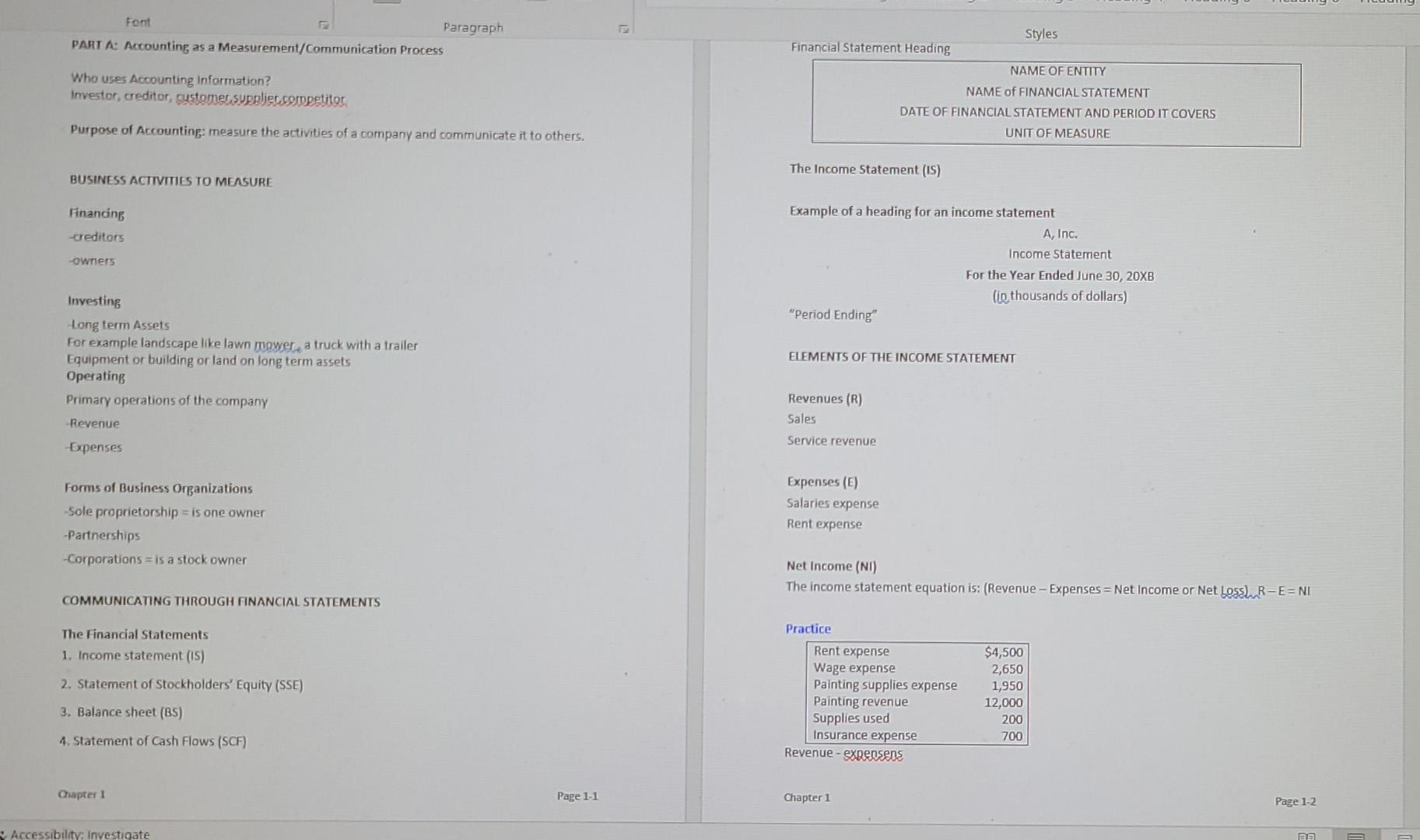

The two key elements for the income statement are revenues and expenses. Net income or net loss is determined by subtracting total expenses from total revenues. What was the amount of net income determined in the practice problem on the bottom of page 1-2 of the VLN? Font Paragraph PART A: Accounting as a Measurement/Communication Process Who uses Accounting information? Investor, creditor, customer supplier.ompetitor Styles Financial Statement Heading NAME OF ENTITY NAME of FINANCIAL STATEMENT DATE OF FINANCIAL STATEMENT AND PERIOD IT COVERS UNIT OF MEASURE Purpose of Accounting: measure the activities of a company and communicate it to others. The Income Statement (IS) BUSINESS ACTIVITIES TO MEASURE Financing creditors -owriers Example of a heading for an income statement A, Inc. Income Statement For the Year Ended June 30, 20XB (in thousands of dollars) Period Ending" ELEMENTS OF THE INCOME STATEMENT Investing Hong term Assets For example landscape like lawn mower, a truck with a trailer Equipment or building or land on long term assets Operating Primary operations of the company Revenue Expenses Revenues (R) Sales Service revenue Forms of Business Organizations sole proprietorship = is one owner -Partnerships -Corporations = is a stock owner Expenses (6) Salaries expense Rent expense Net Income (NI) The income statement equation is: (Revenue - Expenses = Net Income or Net LossLR-E=NI COMMUNICATING THROUGH FINANCIAL STATEMENTS The Financial Statements 1. Income statement (IS) 2. Statement of Stockholders' Equity (SSE) Practice Rent expense Wage expense Painting supplies expense Painting revenue Supplies used Insurance expense Revenue - expensens $4,500 2,650 1,950 12,000 200 700 3. Balance sheet (BS) 4. Statement of Cash Flows (SCF) Chapter 1 Page 1.1 Chapter 1 Page 1-2 Accessibility: Investigate ha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts