Question

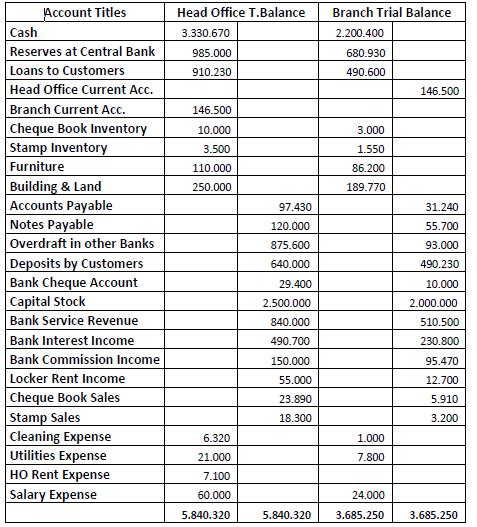

The Unadjusted trial balance of North Bank on 31st December 2019, follows 1- Consolidate the trial balance of head office and the branch. Other data:

The Unadjusted trial balance of North Bank on 31st December 2019, follows 1- Consolidate the trial balance of head office and the branch.

Account Titles Cash Reserves at Central Bank Loans to Customers Head Office Current Acc. Branch Current Acc. Cheque Book Inventory Stamp Inventory Furniture Building & Land Accounts Payable Notes Payable Overdraft in other Banks Deposits by Customers Bank Cheque Account Capital Stock Bank Service Revenue Bank Interest Income Bank Commission Income Locker Rent Income Cheque Book Sales Stamp Sales Cleaning Expense Utilities Expense HO Rent Expense Salary Expense Head Office T.Balance 3.330.670 985.000 910.230 146.500 10.000 3.500 110.000 250.000 6.320 21.000 7.100 60.000 5.840.320 97.430 120.000 875.600 640.000 29.400 2.500.000 840.000 490.700 150.000 55.000 23.890 18.300 Branch Trial Balance 2.200.400 680.930 490.600 3.000 1.550 86.200 189.770 1.000 7.800 146.500 31.240 55.700 93.000 490.230 10.000 2.000.000 510.500 230.800 95.470 12.700 5.910 3.200 24.000 5.840.320 3.685.250 3.685.250

Step by Step Solution

3.35 Rating (124 Votes )

There are 3 Steps involved in it

Step: 1

In the books of Head Office Adjusted Journal Entries for the month ended 31 December 2019 Transaction No Account Titles Debit Credit 1 Cash 35000 Branch Current Acc 35000 2 Cash 1000 Stamp Sales 1000 ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started