Question: The US Treasury issues a bond with the following features Face Value = $1,000 Maturity in years = 7 Coupon Rate = 6.00% The bond's

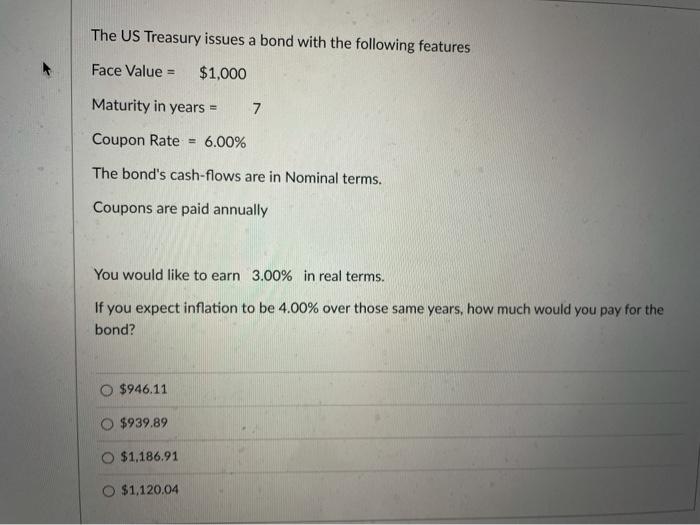

The US Treasury issues a bond with the following features Face Value = $1,000 Maturity in years = 7 Coupon Rate = 6.00% The bond's cash-flows are in Nominal terms. Coupons are paid annually You would like to earn 3.00% in real terms. If you expect inflation to be 4.00% over those same years, how much would you pay for the bond? $946.11 $939.89 $1.186.91 $1,120.04

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock