Question: The value premium in the stock market refers to that high book-to-market (value) stocks tend to earn higher returns than low book-to-market (growth) stocks.

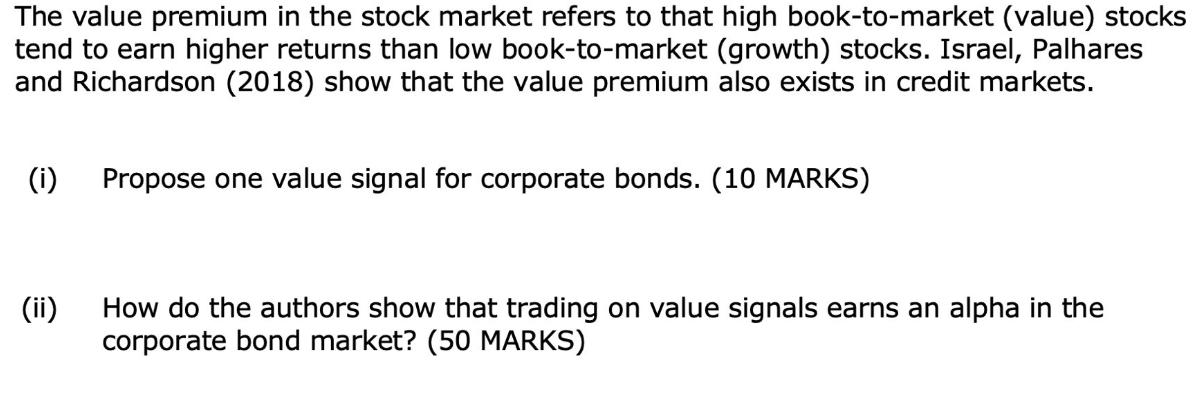

The value premium in the stock market refers to that high book-to-market (value) stocks tend to earn higher returns than low book-to-market (growth) stocks. Israel, Palhares and Richardson (2018) show that the value premium also exists in credit markets. (i) (ii) Propose one value signal for corporate bonds. (10 MARKS) How do the authors show that trading on value signals earns an alpha in the corporate bond market? (50 MARKS)

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

i One value signal for corporate bonds could be the credit spread The credit spread is the difference in yield between a corporate bond and a benchmar... View full answer

Get step-by-step solutions from verified subject matter experts