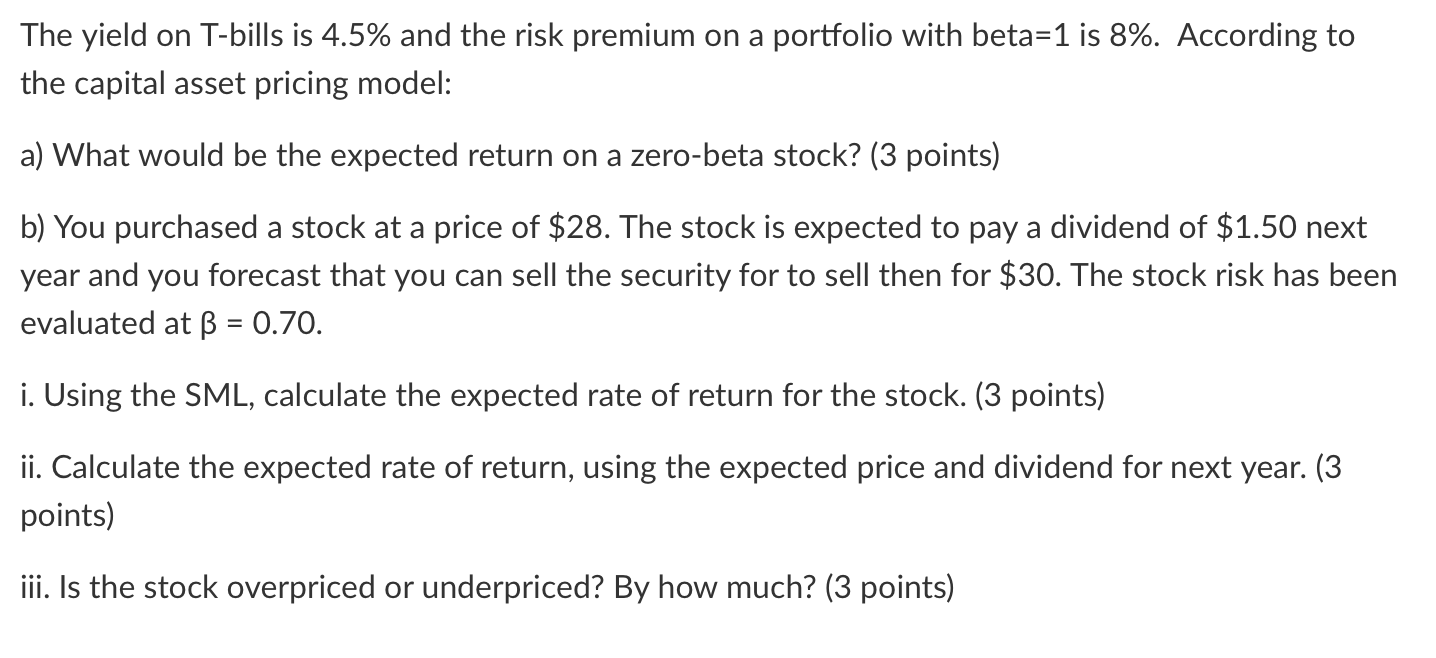

Question: The yield on T - bills is 4 . 5 % and the risk premium on a portfolio with beta = 1 is 8 %

The yield on Tbills is and the risk premium on a portfolio with beta is According to

the capital asset pricing model:

a What would be the expected return on a zerobeta stock? points

b You purchased a stock at a price of $ The stock is expected to pay a dividend of $ next

year and you forecast that you can sell the security for to sell then for $ The stock risk has been

evaluated at

i Using the SML calculate the expected rate of return for the stock. points

ii Calculate the expected rate of return, using the expected price and dividend for next year.

points

iii. Is the stock overpriced or underpriced? By how much? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock