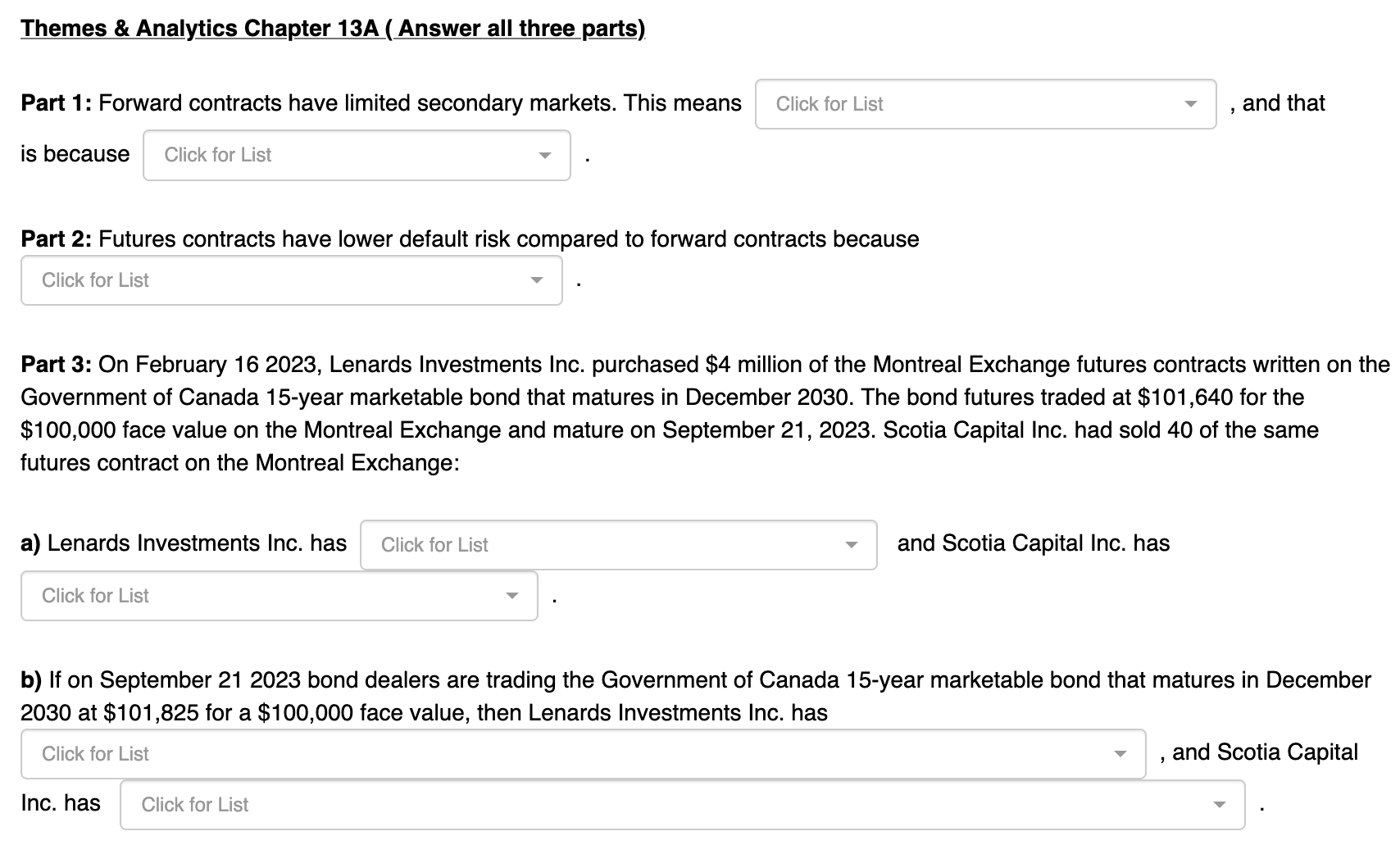

Question: Themes & Analytics Chapter 1 3 A ( Answer all three parts ) . Part 1 : Forward contracts have limited secondary markets. This means

Themes & Analytics Chapter A Answer all three parts

Part : Forward contracts have limited secondary markets. This means

and that

is because

Part : Futures contracts have lower default risk compared to forward contracts because

Part : On February Lenards Investments Inc. purchased $ million of the Montreal Exchange futures contracts written on the

Government of Canada year marketable bond that matures in December The bond futures traded at $ for the

$ face value on the Montreal Exchange and mature on September Scotia Capital Inc. had sold of the same

futures contract on the Montreal Exchange:

a Lenards Investments Inc. has

and Scotia Capital Inc. has

b If on September bond dealers are trading the Government of Canada year marketable bond that matures in December

at $ for a $ face value, then Lenards Investments Inc. has

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock