Question: [There are 12 things to answer below, but this question will be worth 10 marks in total] A trader establishes an option-trading strategy as follows:

![be worth 10 marks in total] A trader establishes an option-trading strategy](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6fac26f9ea_08266f6fac211515.jpg)

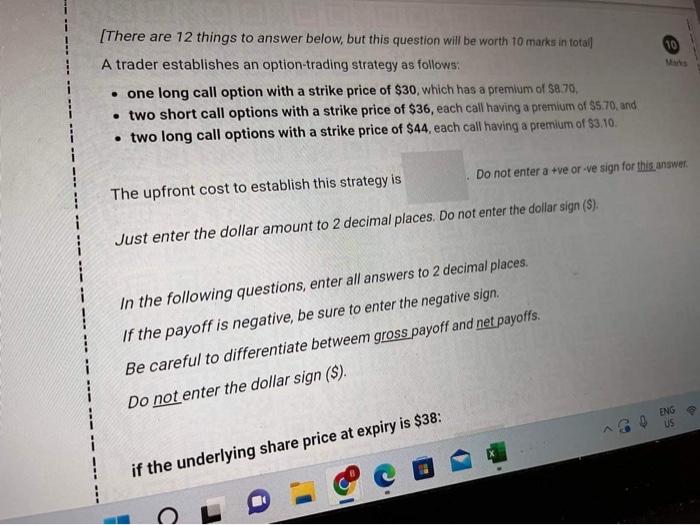

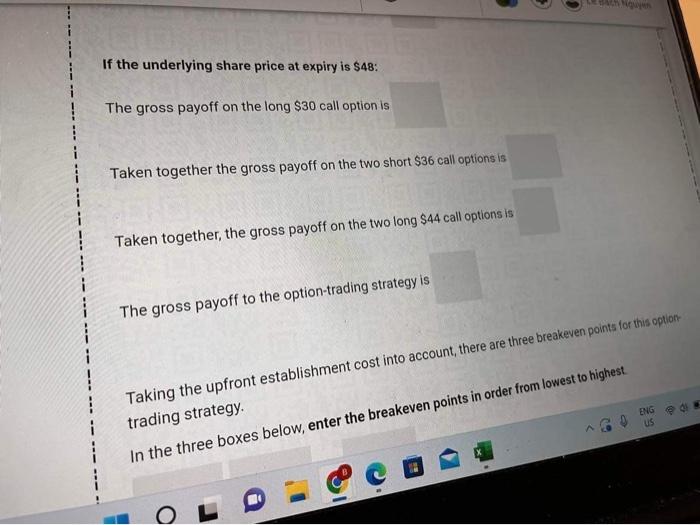

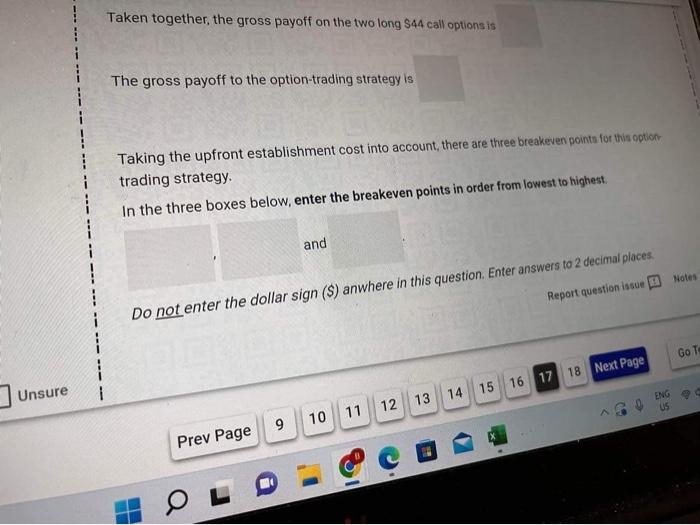

[There are 12 things to answer below, but this question will be worth 10 marks in total] A trader establishes an option-trading strategy as follows: - one long call option with a strike price of $30, which has a premium of $8.70, - two short call options with a strike price of $36, each call having a premium of $5.70, and - two long call options with a strike price of $44, each call having a premium of $3.10. The upfront cost to establish this strategy is . Do not enter a +ve or-ve sign for this unswer. Just enter the dollar amount to 2 decimal places. Do not enter the dollar sign (\$). In the following questions, enter all answers to 2 decimal places. If the payoff is negative, be sure to enter the negative sign. Be careful to differentiate betweem gross payoff and net payoffs. Do not enter the dollar sign (\$). if the underlying share price at expiry is $38 : The gross payoff on the long $30 call option is Taken together, the gross payoff on the two short $36 call options is Taken together, the gross payoff on the two long $44 call options is The gross payoff to the option-trading strategy is If the underlying share price at expiry is $48 : The gross payoff on the long $30 call option is If the underlying share price at expiry is $48 : The gross payoff on the long $30 call option is Taken together the gross payoff on the two short $36 call options is Taken together, the gross payoff on the two long $44 call options is The gross payoff to the option-trading strategy is Taking the upfront establishment cost into account, there are three breakeven points for this optionf trading strategy. In the three boxes below, enter the breakeven points in order from lowest to highest. The gross payoff to the option-trading strategy is Taking the upfront establishment cost into account, there are three breakeven pointa for this option trading strategy. In the three boxes below, enter the breakeven points in order from lowest to highest. and Do not enter the dollar sign (S) anwhere in this question. Enter answers to 2 decimal ploces

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts