Question: please explain to me [There are 8 things to answer below, but this question will be worth 5 marks in total] A trader establishes an

![this question will be worth 5 marks in total] A trader establishes](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe42109e094_08866fe42101861c.jpg)

please explain to me

please explain to me

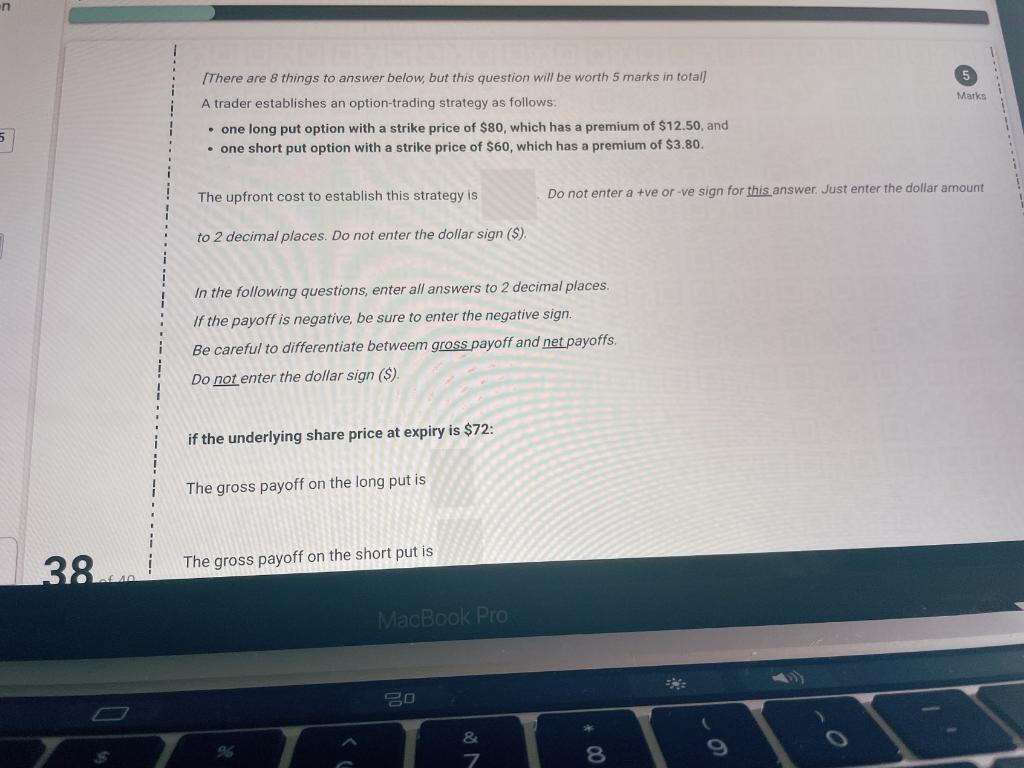

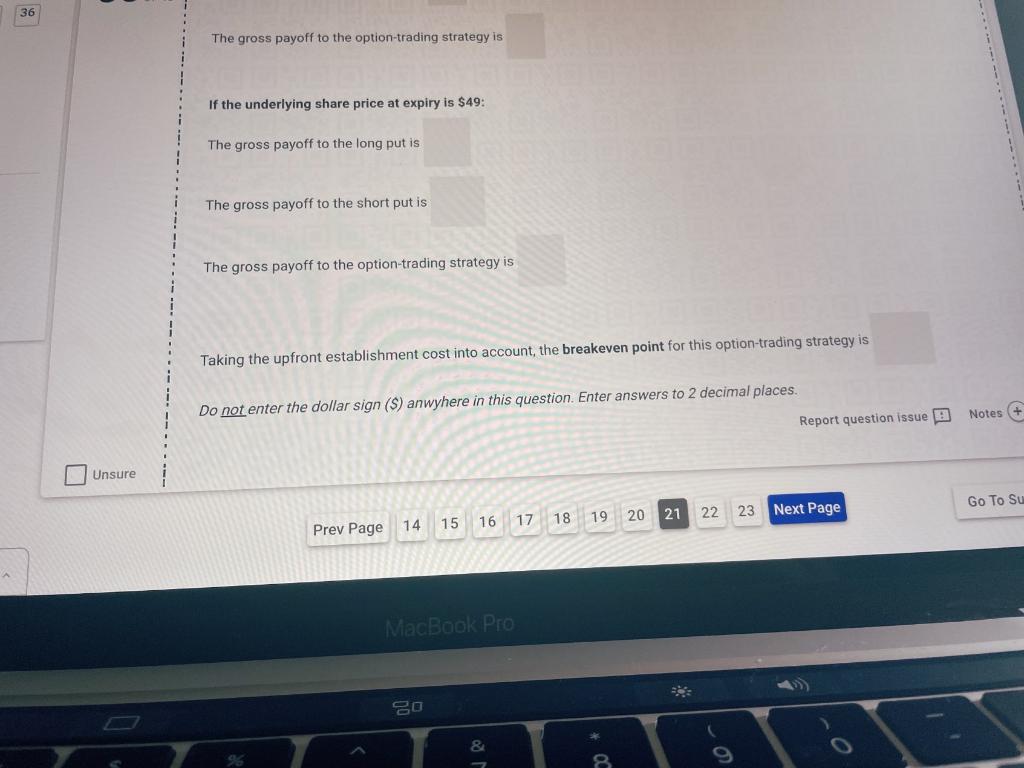

[There are 8 things to answer below, but this question will be worth 5 marks in total] A trader establishes an option-trading strategy as follows: - one long put option with a strike price of $80, which has a premium of $12.50, and - one short put option with a strike price of $60, which has a premium of $3.80. The upfront cost to establish this strategy is Do not enter a +ve or -ve sign for this answer. Just enter the dollar amount to 2 decimal places. Do not enter the dollar sign (S). In the following questions, enter all answers to 2 decimal places. If the payoff is negative, be sure to enter the negative sign. Be careful to differentiate betweem gross payoff and net payoffs. Do not enter the dollar sign ( $ ). if the underlying share price at expiry is $72 : The gross payoff on the long put is The gross payoff to the option-trading strategy is If the underlying share price at expiry is $49 : The gross payoff to the long put is The gross payoff to the short put is The gross payoff to the option-trading strategy is The gross payoff to the option-trading strategy is If the underlying share price at expiry is $49: The gross payoff to the long put is The gross payoff to the short put is The gross payoff to the option-trading strategy is Taking the upfront establishment cost into account, the breakeven point for this option-trading strategy is Do not enter the dollar sign (S) anwyhere in this question. Enter answers to 2 decimal places. Report question issue $ Notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts