Question: There are 3 possible Swiss project under consideration with different projected cash flows and different cost of capital. Calculate the NPV and IRR for each

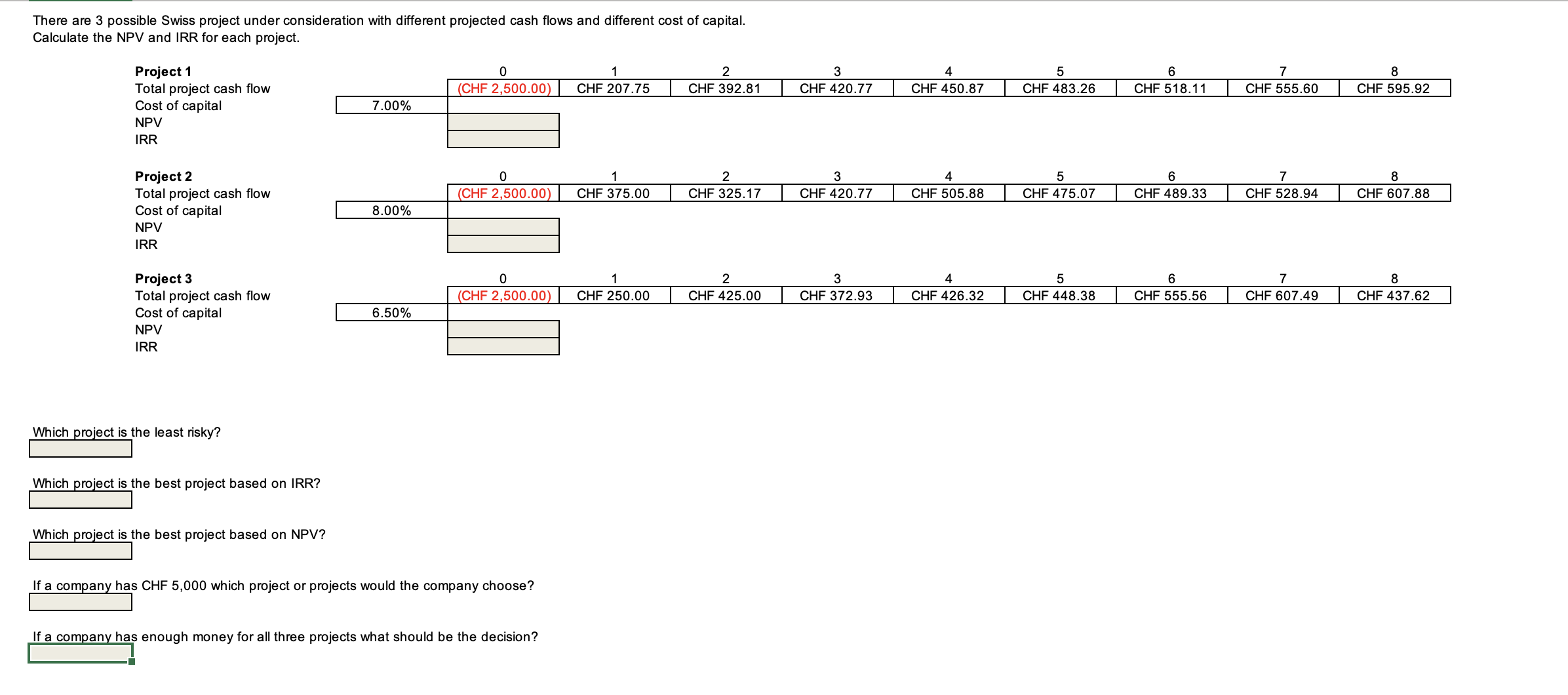

There are 3 possible Swiss project under consideration with different projected cash flows and different cost of capital.

Calculate the NPV and IRR for each project.

| Project 1 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

| Total project cash flow | (CHF 2,500.00) | CHF 207.75 | CHF 392.81 | CHF 420.77 | CHF 450.87 | CHF 483.26 | CHF 518.11 | CHF 555.60 | CHF 595.92 | ||

| Cost of capital | 7.00% | ||||||||||

| NPV | ? | ||||||||||

| IRR | ? | ||||||||||

| Project 2 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

| Total project cash flow | (CHF 2,500.00) | CHF 375.00 | CHF 325.17 | CHF 420.77 | CHF 505.88 | CHF 475.07 | CHF 489.33 | CHF 528.94 | CHF 607.88 | ||

| Cost of capital | 8.00% | ||||||||||

| NPV | ? | ||||||||||

| IRR | ? | ||||||||||

| Project 3 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

| Total project cash flow | (CHF 2,500.00) | CHF 250.00 | CHF 425.00 | CHF 372.93 | CHF 426.32 | CHF 448.38 | CHF 555.56 | CHF 607.49 | CHF 437.62 | ||

| Cost of capital | 6.50% | ||||||||||

| NPV | ? | ||||||||||

| IRR | ? |

| Which project is the least risky? |

| ? |

| Which project is the best project based on IRR? |

| ? |

| Which project is the best project based on NPV? |

| ? |

| If a company has CHF 5,000 which project or projects would the company choose? |

| ? |

| If a company has enough money for all three projects what should be the decision? |

| ? |

There are 3 possible Swiss project under consideration with different projected cash flows and different cost of capital. Calculate the NPV and IRR for each project. Which proiect is the least risky? Which proiect is the best project based on IRR? Which project is the best project based on NPV? If a company has CHF 5,000 which project or projects would the company choose? If a companv has enough money for all three projects what should be the decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts