Question: there are 3 problems Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Concord Company had

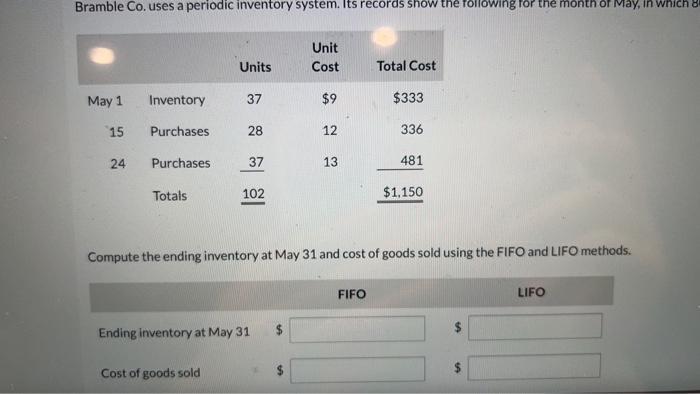

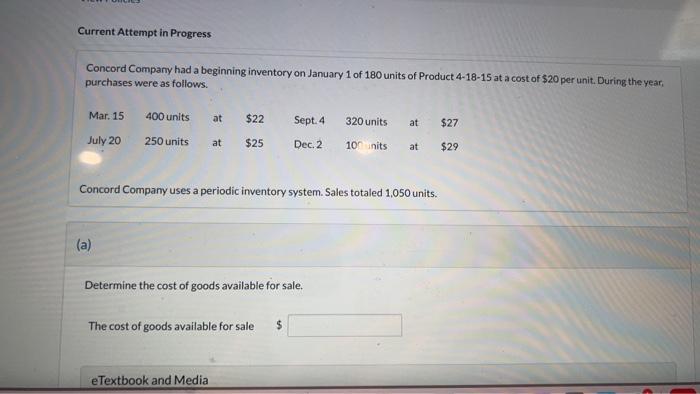

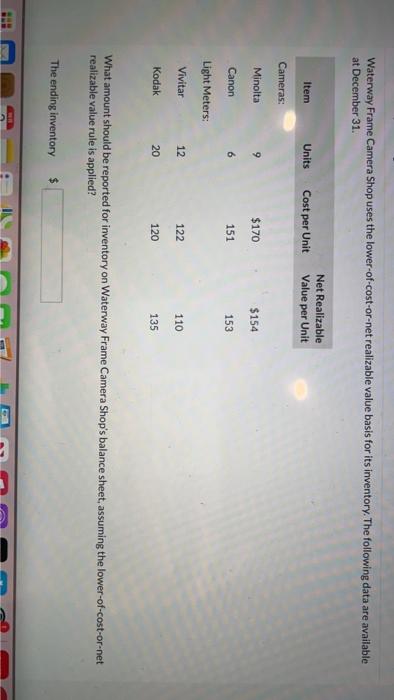

Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Concord Company had a beginning inventory on January 1 of 180 units of Product 41815 at a cost of $20 per unit. During the year, purchases were as follows. Concord Company uses a periodic inventory system. Sales totaled 1,050 units. (a) Determine the cost of goods available for sale. The cost of goods available for sale Waterway Frame Camera Shop uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. What amount should be reported for inventory on Waterway Frame Camera Shop's balance sheet, assuming the lower-of-cost-or-net realizable value rule is applied? The ending inventory Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Concord Company had a beginning inventory on January 1 of 180 units of Product 41815 at a cost of $20 per unit. During the year, purchases were as follows. Concord Company uses a periodic inventory system. Sales totaled 1,050 units. (a) Determine the cost of goods available for sale. The cost of goods available for sale Waterway Frame Camera Shop uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. What amount should be reported for inventory on Waterway Frame Camera Shop's balance sheet, assuming the lower-of-cost-or-net realizable value rule is applied? The ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts