Question: THERE ARE FOUR QUESTIONS IN THIS SET. PLEASE SELECT FOUR ANSWERS IN TOTAL. Today is September 24th. An organic Tofu manufacturer needs to purchase a

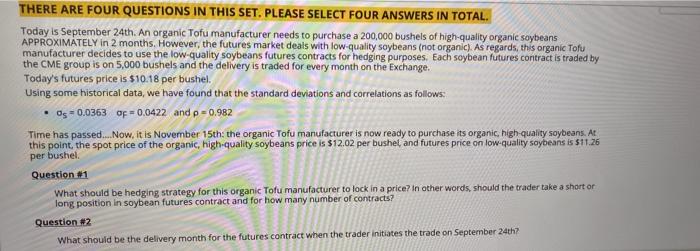

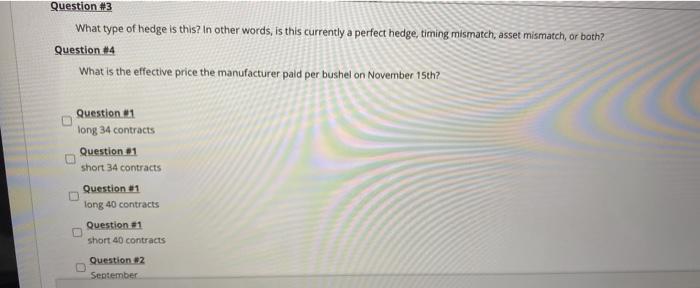

THERE ARE FOUR QUESTIONS IN THIS SET. PLEASE SELECT FOUR ANSWERS IN TOTAL. Today is September 24th. An organic Tofu manufacturer needs to purchase a 200,000 bushels of high-quality organic soybeans APPROXIMATELY in 2 months. However, the futures market deals with low-quality soybeans (not organic). As regards, this organic Tofu manufacturer decides to use the low quality soybeans futures contracts for hedging purposes. Each soybean futures contract is traded by the CME group is on 5,000 bushels and the delivery is traded for every month on the Exchange. Today's futures price is $10.18 per bushel. Using some historical data, we have found that the standard deviations and correlations as follows: . Os = 0.0363 OF-0,0422 and p = 0.982 Time has passed. Now, it is November 15th the organic Tofu manufacturer is now ready to purchase its organic, high quality soybeans. At this point the spot price of the organic, high-quality soybeans price is $12.02 per bushel and futures price on low quality soybeans is $11.26 per bushel Question 1 What should be hedging strategy for this organic Tofu manufacturer to lock in a price? In other words, should the trader take a short or long position in soybean futures contract and for how many number of contracts? Question #2 What should be the delivery month for the futures contract when the trader Initiates the trade on September 24th? Question #3 What type of hedge is this? In other words, is this currently a perfect hedge, timing mismatch, asset mismatch, or both? Question #4 What is the effective price the manufacturer paid per bushel on November 15th? Question 1 long 34 contracts Question 1 short 34 contracts Question #1 long 40 contracts Question #1 short 40 contracts Question 2 September THERE ARE FOUR QUESTIONS IN THIS SET. PLEASE SELECT FOUR ANSWERS IN TOTAL. Today is September 24th. An organic Tofu manufacturer needs to purchase a 200,000 bushels of high-quality organic soybeans APPROXIMATELY in 2 months. However, the futures market deals with low-quality soybeans (not organic). As regards, this organic Tofu manufacturer decides to use the low quality soybeans futures contracts for hedging purposes. Each soybean futures contract is traded by the CME group is on 5,000 bushels and the delivery is traded for every month on the Exchange. Today's futures price is $10.18 per bushel. Using some historical data, we have found that the standard deviations and correlations as follows: . Os = 0.0363 OF-0,0422 and p = 0.982 Time has passed. Now, it is November 15th the organic Tofu manufacturer is now ready to purchase its organic, high quality soybeans. At this point the spot price of the organic, high-quality soybeans price is $12.02 per bushel and futures price on low quality soybeans is $11.26 per bushel Question 1 What should be hedging strategy for this organic Tofu manufacturer to lock in a price? In other words, should the trader take a short or long position in soybean futures contract and for how many number of contracts? Question #2 What should be the delivery month for the futures contract when the trader Initiates the trade on September 24th? Question #3 What type of hedge is this? In other words, is this currently a perfect hedge, timing mismatch, asset mismatch, or both? Question #4 What is the effective price the manufacturer paid per bushel on November 15th? Question 1 long 34 contracts Question 1 short 34 contracts Question #1 long 40 contracts Question #1 short 40 contracts Question 2 September

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts