Question: There are four steps in making closing entries for a merchandising business: STEP 1. Close the revenue accounts and the other accounts that appear on

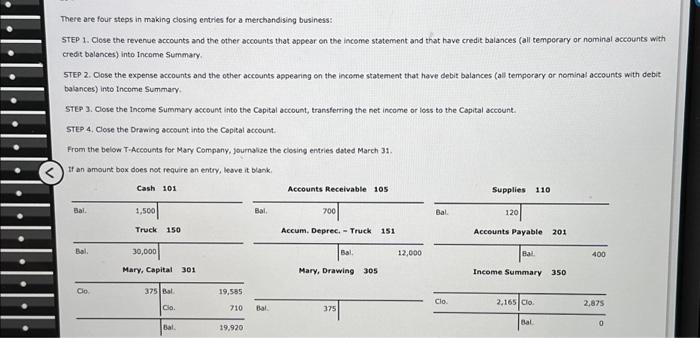

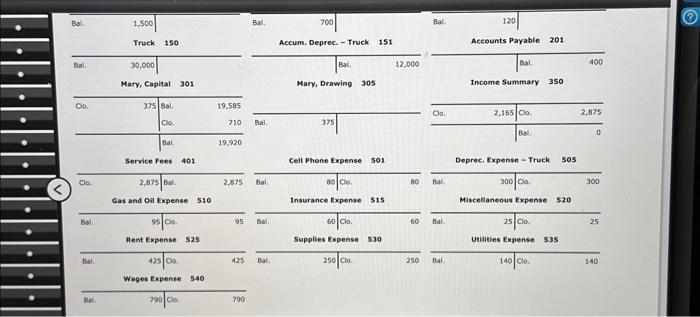

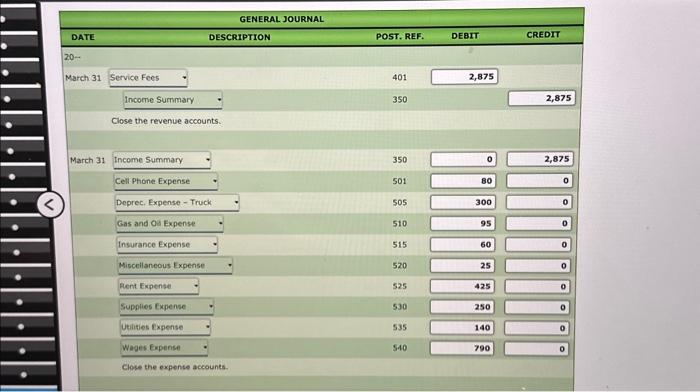

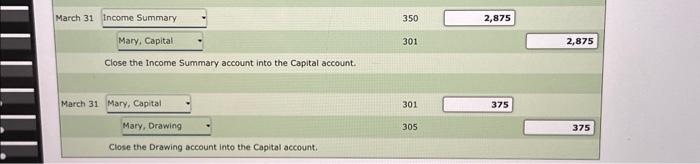

There are four steps in making closing entries for a merchandising business: STEP 1. Close the revenue accounts and the other accounts that appear on the income statement and that have credit balances (all temporary or nominal accounts with credt balances) into income Summary. STEP 2. Cose the expense accounts and the other accounts appearing on the income statement that have debit balances (all temporary or nominal accounts with debit balances) into lncome Summary. STEP 3. Close the income Summary account into the Capital atcount, transferring the net income or loss to the Capital account. StEP 4, Close the Drareing account into the Capital account. From the below T-Accounts for Mary Company, joumalize the closing entries dated March 31. \begin{tabular}{l|r|r|} \hline March 31 & 350 & 2,875 \\ \hline Mary, Capital & 301 \\ \hline March 31 Mary, Capital the income Summary account into the Capital account. \\ \hline Mary, Drawing Close the Drawing account into the Capital account. & 301 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts