Question: there are some missing points, but i want see solution way you can assume that missing datas. please clear detailed solution. Suppose that the expected

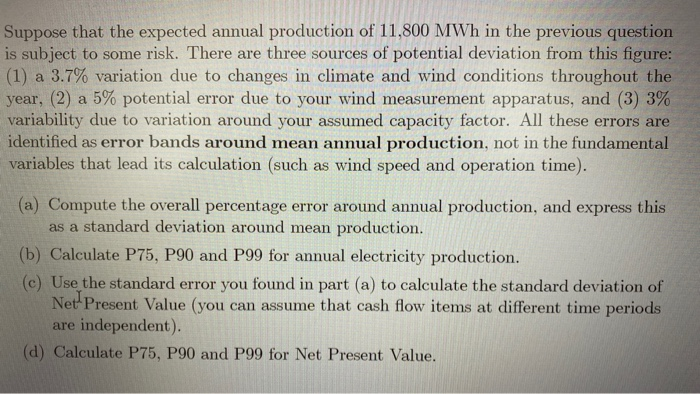

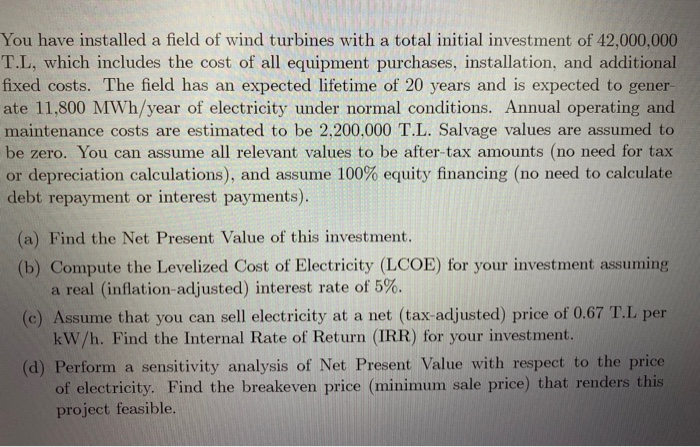

Suppose that the expected annual production of 11,800 MWh in the previous question is subject to some risk. There are three sources of potential deviation from this figure: (1) a 3.7% variation due to changes in climate and wind conditions throughout the year, (2) a 5% potential error due to your wind measurement apparatus, and (3) 3% variability due to variation around your assumed capacity factor. All these errors are identified as error bands around mean annual production, not in the fundamental variables that lead its calculation (such as wind speed and operation time). (a) Compute the overall percentage error around annual production, and express this as a standard deviation around mean production. (b) Calculate P75, P90 and P99 for annual electricity production. (c) Use the standard error you found in part (a) to calculate the standard deviation of Net Present Value (you can assume that cash flow items at different time periods are independent) (d) Calculate P75, P90 and P99 for Net Present Value. You have installed a field of wind turbines with a total initial investment of 42,000,000 T.L, which includes the cost of all equipment purchases, installation, and additional fixed costs. The field has an expected lifetime of 20 years and is expected to gener ate 11,800 MWh/year of electricity under normal conditions. Annual operating and maintenance costs are estimated to be 2.200,000 T.L. Salvage values are assumed to be zero. You can assume all relevant values to be after-tax amounts (no need for tax or depreciation calculations), and assume 100% equity financing (no need to calculate debt repayment or interest payments). (a) Find the Net Present Value of this investment. (b) Compute the Levelized Cost of Electricity (LCOE) for your investment assuming a real (inflation-adjusted) interest rate of 5%. (c) Assume that you can sell electricity at a net (tax-adjusted) price of 0.67 T.L per kW/h. Find the Internal Rate of Return (IRR) for your investment. (d) Perform a sensitivity analysis of Net Present Value with respect to the price of electricity. Find the breakeven price (minimum sale price) that renders this project feasible. Suppose that the expected annual production of 11,800 MWh in the previous question is subject to some risk. There are three sources of potential deviation from this figure: (1) a 3.7% variation due to changes in climate and wind conditions throughout the year, (2) a 5% potential error due to your wind measurement apparatus, and (3) 3% variability due to variation around your assumed capacity factor. All these errors are identified as error bands around mean annual production, not in the fundamental variables that lead its calculation (such as wind speed and operation time). (a) Compute the overall percentage error around annual production, and express this as a standard deviation around mean production. (b) Calculate P75, P90 and P99 for annual electricity production. (c) Use the standard error you found in part (a) to calculate the standard deviation of Net Present Value (you can assume that cash flow items at different time periods are independent) (d) Calculate P75, P90 and P99 for Net Present Value. You have installed a field of wind turbines with a total initial investment of 42,000,000 T.L, which includes the cost of all equipment purchases, installation, and additional fixed costs. The field has an expected lifetime of 20 years and is expected to gener ate 11,800 MWh/year of electricity under normal conditions. Annual operating and maintenance costs are estimated to be 2.200,000 T.L. Salvage values are assumed to be zero. You can assume all relevant values to be after-tax amounts (no need for tax or depreciation calculations), and assume 100% equity financing (no need to calculate debt repayment or interest payments). (a) Find the Net Present Value of this investment. (b) Compute the Levelized Cost of Electricity (LCOE) for your investment assuming a real (inflation-adjusted) interest rate of 5%. (c) Assume that you can sell electricity at a net (tax-adjusted) price of 0.67 T.L per kW/h. Find the Internal Rate of Return (IRR) for your investment. (d) Perform a sensitivity analysis of Net Present Value with respect to the price of electricity. Find the breakeven price (minimum sale price) that renders this project feasible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts