Question: There are two factors that affect stock returns, unexpected inflation (factor 1) and unexpected changes in production (factor 2). Over the next month, inflation

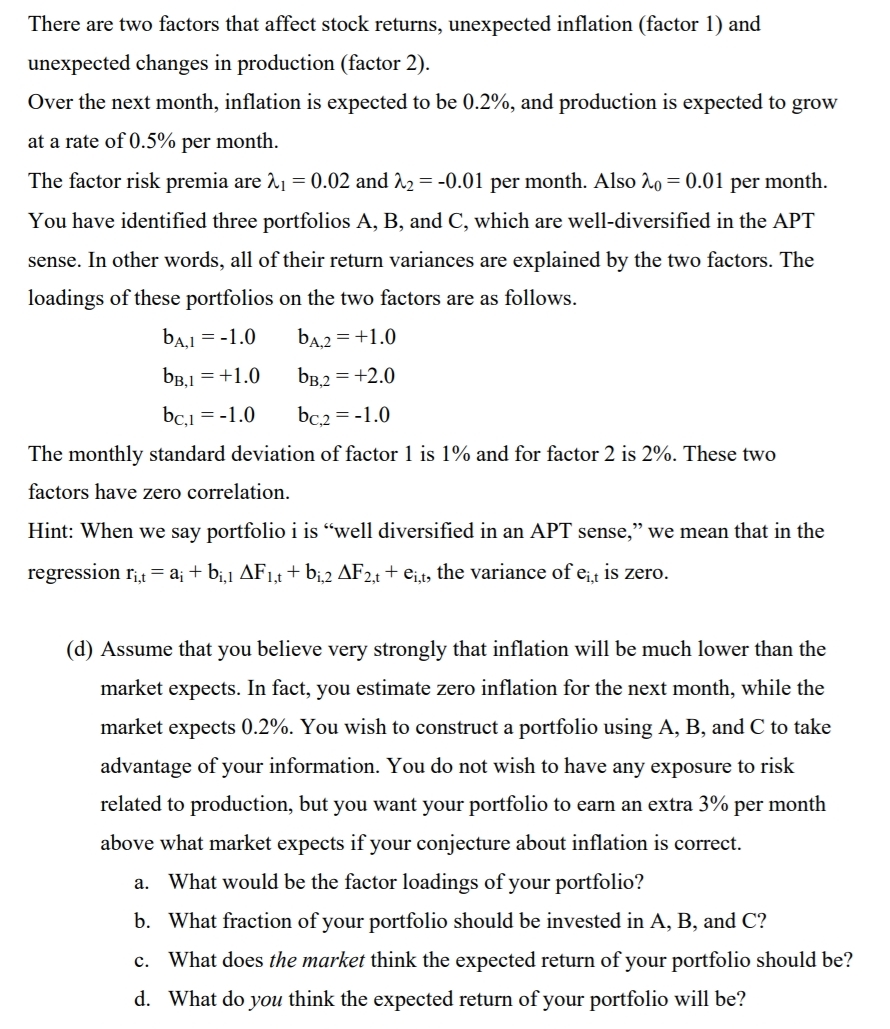

There are two factors that affect stock returns, unexpected inflation (factor 1) and unexpected changes in production (factor 2). Over the next month, inflation is expected to be 0.2%, and production is expected to grow at a rate of 0.5% per month. The factor risk premia are 2 = 0.02 and 22 = -0.01 per month. Also 20 = 0.01 per month. You have identified three portfolios A, B, and C, which are well-diversified in the APT sense. In other words, all of their return variances are explained by the two factors. The loadings of these portfolios on the two factors are as follows. bA,1 = -1.0 bA,2 = +1.0 bB.1 = +1.0 bB.2 = +2.0 bc,1 = -1.0 bc2=-1.0 The monthly standard deviation of factor 1 is 1% and for factor 2 is 2%. These two factors have zero correlation. Hint: When we say portfolio i is "well diversified in an APT sense," we mean that in the regression ri,t = a; + b,1 AF1,t + bi,2 AF 2,t + ei,t, the variance of ei,t is zero. (d) Assume that you believe very strongly that inflation will be much lower than the market expects. In fact, you estimate zero inflation for the next month, while the market expects 0.2%. You wish to construct a portfolio using A, B, and C to take advantage of your information. You do not wish to have any exposure to risk related to production, but you want your portfolio to earn an extra 3% per month above what market expects if your conjecture about inflation is correct. a. What would be the factor loadings of your portfolio? b. What fraction of your portfolio should be invested in A, B, and C? c. What does the market think the expected return of your portfolio should be? d. What do you think the expected return of your portfolio will be?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Constructing a Portfolio to Exploit Inflation Expectations Heres how to construct a portfolio based on your belief about lower inflation a Factor Load... View full answer

Get step-by-step solutions from verified subject matter experts