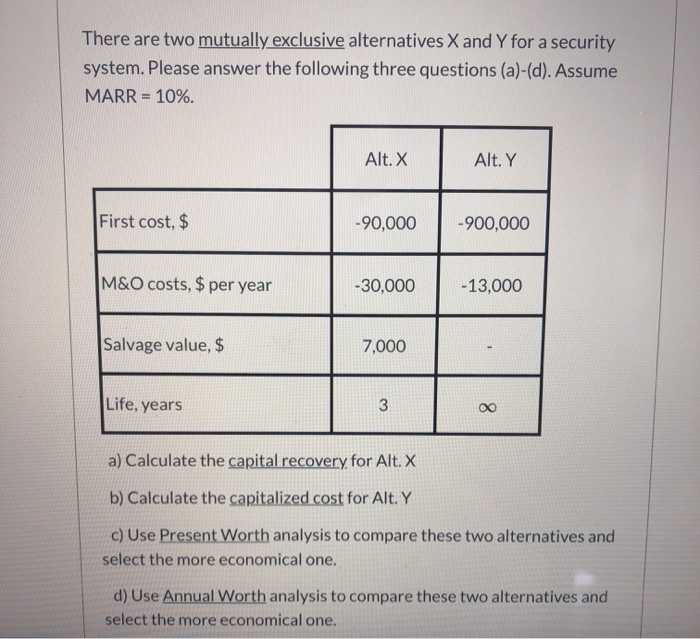

Question: There are two mutually exclusive alternatives X and Y for a security system. Please answer the following three questions (a)-(d). Assume MARR = 10%. Alt.

There are two mutually exclusive alternatives X and Y for a security system. Please answer the following three questions (a)-(d). Assume MARR = 10%. Alt. X Alt. Y First cost, $ -90,000 -900,000 M&O costs, $ per year -30,000 - 13,000 Salvage value, $ 7,000 Life, years 3 8 a) Calculate the capital recovery for Alt. X b) Calculate the capitalized cost for Alt. Y c) Use Present Worth analysis to compare these two alternatives and select the more economical one. d) Use Annual Worth analysis to compare these two alternatives and select the more economical one. There are two mutually exclusive alternatives X and Y for a security system. Please answer the following three questions (a)-(d). Assume MARR = 10%. Alt. X Alt. Y First cost, $ -90,000 -900,000 M&O costs, $ per year -30,000 - 13,000 Salvage value, $ 7,000 Life, years 3 8 a) Calculate the capital recovery for Alt. X b) Calculate the capitalized cost for Alt. Y c) Use Present Worth analysis to compare these two alternatives and select the more economical one. d) Use Annual Worth analysis to compare these two alternatives and select the more economical one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts