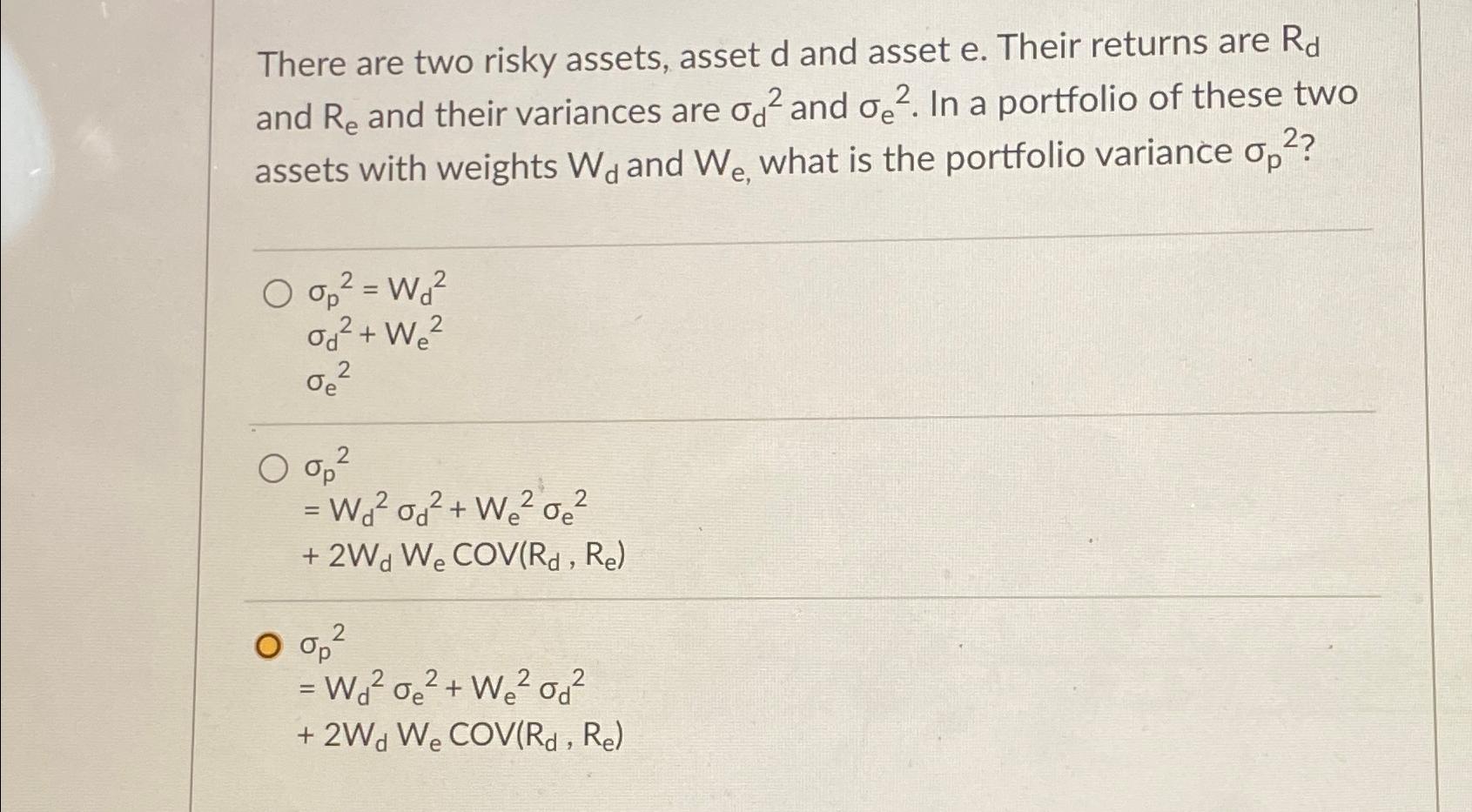

Question: There are two risky assets, asset d and asset e. Their returns are R_(d) and R_(e) and their variances are sigma _(d)^(2) and sigma _(e)^(2)

There are two risky assets, asset

dand asset e. Their returns are

R_(d)and

R_(e)and their variances are

\\\\sigma _(d)^(2)and

\\\\sigma _(e)^(2). In a portfolio of these two assets with weights

W_(d)and

W_(e), what is the portfolio variance

\\\\sigma _(p)^(2)?\

\\\\sigma _(p)^(2)=W_(d)^(2)\ \\\\sigma _(d)^(2)+W_(e)^(2)\ \\\\sigma _(e)^(2)\

\\\\sigma _(p)^(2)\ =W_(d)^(2)\\\\sigma _(d)^(2)+W_(e)^(2)\\\\sigma _(e)^(2)\ +2W_(d)W_(e)COV(R_(d),R_(e))\

\\\\sigma _(p)^(2)\ =W_(d)^(2)\\\\sigma _(e)^(2)+W_(e)^(2)\\\\sigma _(d)^(2)\ +2W_(d)W_(e)COV(R_(d),R_(e))

There are two risky assets, asset d and asset e. Their returns are Rd and Re and their variances are d2 and e2. In a portfolio of these two assets with weights Wd and We, what is the portfolio variance p2 ? p2=Wd2d2+We2e2 p2 =Wd2d2+We2e2+2WdWecoV(Rd,Re) p2=Wd2e2+We2d2+2WdWeCOV(Rd,Re)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock