Question: There are two risky assets, D and E . The expected returns of D and E are 8% and 12%, respectively. The standard deviation of

There are two risky assets, D and E. The expected returns of D and E are 8% and 12%, respectively. The standard deviation of D and E are 10% and 25%, respectively. The correlation between the assets is positive and less than 1.

(a)Suppose an investor is indifferent between holding 100% in D and holding 100% in E. What is his risk aversion A?

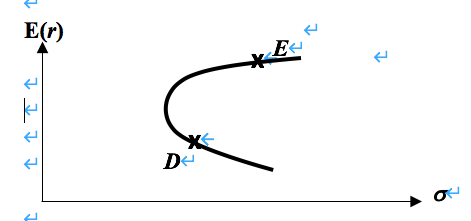

(b) From the different combinations of D and E, you can identify the portfolio that gives you the lowest standard deviation, which is the minimum variance portfolio, A. Can A, D, and E lie on the same utility indifference curve for the investor in part (a)? Briefly explain. (No calculations necessary.) (Hint: Consider the portfolio opportunity set, shown below).

a D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts