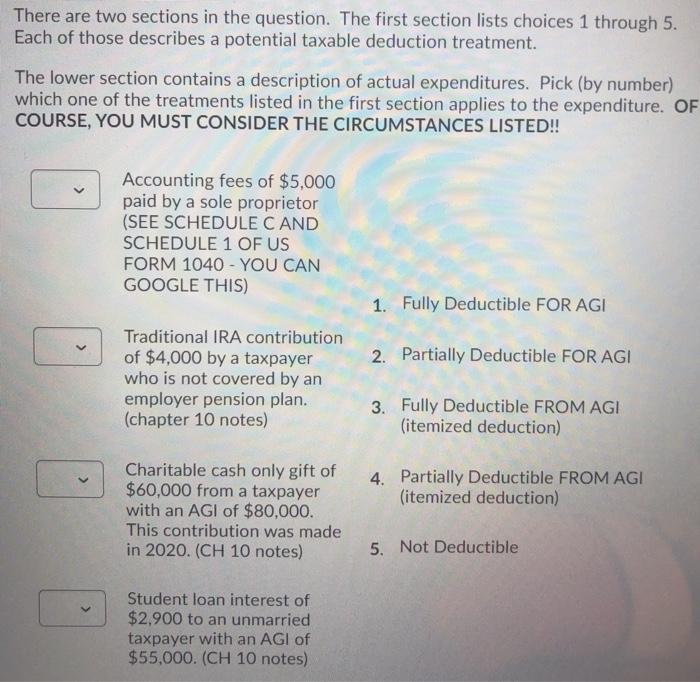

Question: There are two sections in the question. The first section lists choices 1 through 5. Each of those describes a potential taxable deduction treatment. The

There are two sections in the question. The first section lists choices 1 through 5. Each of those describes a potential taxable deduction treatment. The lower section contains a description of actual expenditures. Pick (by number) which one of the treatments listed in the first section applies to the expenditure. OF COURSE, YOU MUST CONSIDER THE CIRCUMSTANCES LISTED!! Accounting fees of $5,000 paid by a sole proprietor (SEE SCHEDULE C AND SCHEDULE 1 OF US FORM 1040 - YOU CAN GOOGLE THIS) 1. Fully Deductible FOR AGI 2. Partially Deductible FOR AGI Traditional IRA contribution of $4,000 by a taxpayer who is not covered by an employer pension plan. (chapter 10 notes) 3. Fully Deductible FROM AGI (itemized deduction) 4. Partially Deductible FROM AGI (itemized deduction) Charitable cash only gift of $60,000 from a taxpayer with an AGI of $80,000. This contribution was made in 2020. (CH 10 notes) 5. Not Deductible Student loan interest of $2,900 to an unmarried taxpayer with an AGI of $55,000. (CH 10 notes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts