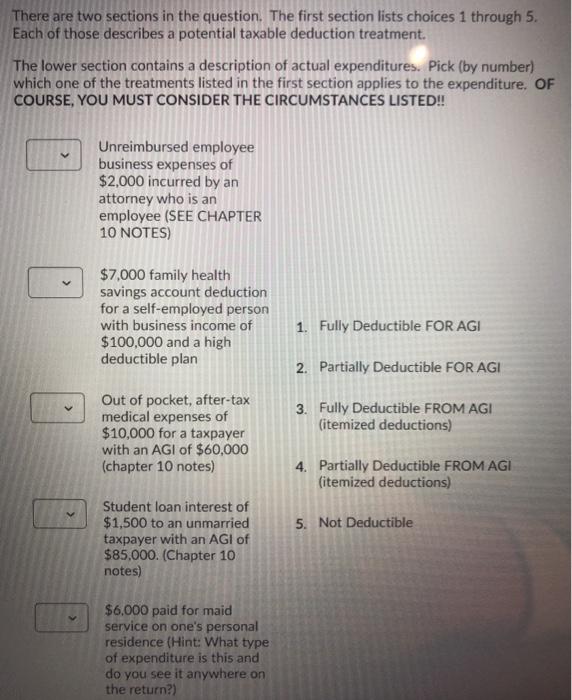

Question: There are two sections in the question. The first section lists choices 1 through 5. Each of those describes a potential taxable deduction treatment. The

There are two sections in the question. The first section lists choices 1 through 5. Each of those describes a potential taxable deduction treatment. The lower section contains a description of actual expenditures. Pick (by number) which one of the treatments listed in the first section applies to the expenditure. OF COURSE, YOU MUST CONSIDER THE CIRCUMSTANCES LISTED!! Unreimbursed employee business expenses of $2,000 incurred by an attorney who is an employee (SEE CHAPTER 10 NOTES) $7.000 family health savings account deduction for a self-employed person with business income of $100,000 and a high deductible plan 1. Fully Deductible FOR AGI 2. Partially Deductible FOR AGI Out of pocket, after-tax medical expenses of $10,000 for a taxpayer with an AGI of $60,000 (chapter 10 notes) 3. Fully Deductible FROM AGI (itemized deductions) 4. Partially Deductible FROM AGI (itemized deductions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts