Question: **THERE IS A $2M DEDUCTION FOR NET OPERATING LOSS CARRYOVER Answer a, b, and c please! b-1. What is the maximum amount of business interest

**THERE IS A $2M DEDUCTION FOR NET OPERATING LOSS CARRYOVER Answer a, b, and c please!  b-1. What is the maximum amount of business interest expense that Renee can deduct this year? c. Suppose that Renee's revenue includes $5 million of business interest income. What is the maximum amount of business interest expense that could be deducted this year under the business interest limitation?

b-1. What is the maximum amount of business interest expense that Renee can deduct this year? c. Suppose that Renee's revenue includes $5 million of business interest income. What is the maximum amount of business interest expense that could be deducted this year under the business interest limitation?

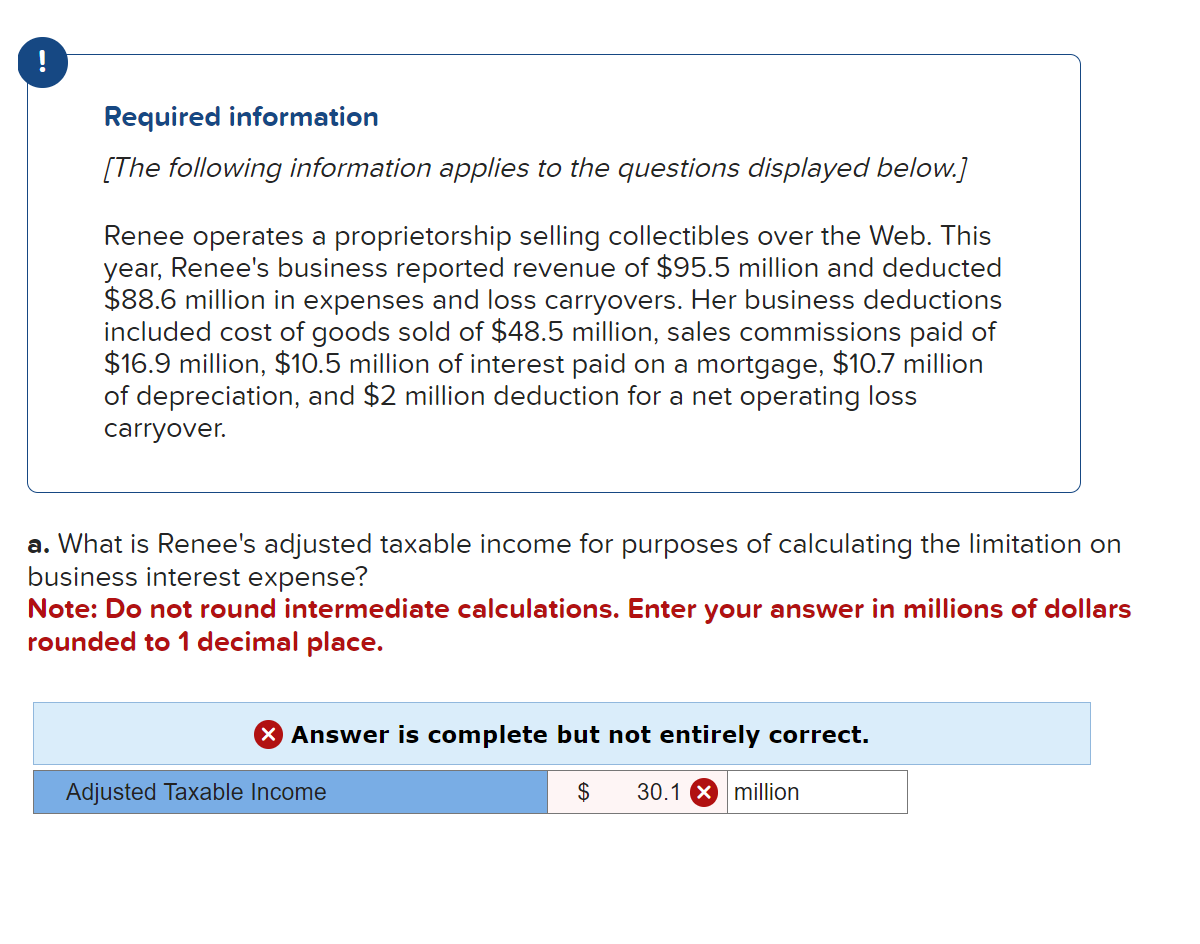

Required information [The following information applies to the questions displayed below.] Renee operates a proprietorship selling collectibles over the Web. This year, Renee's business reported revenue of $95.5 million and deducted $88.6 million in expenses and loss carryovers. Her business deductions included cost of goods sold of $48.5 million, sales commissions paid of $16.9 million, $10.5 million of interest paid on a mortgage, \$10.7 million of depreciation, and $2 million deduction for a net operating loss carryover. a. What is Renee's adjusted taxable income for purposes of calculating the limitation on ousiness interest expense? Note: Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 1 decimal place. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

To determine the answers lets go through each part of the problem a Adjusted Taxable Income ATI The ... View full answer

Get step-by-step solutions from verified subject matter experts