Question: there is also a part C and D but it is not showing me those parts until i complete B. maybe you can assume what

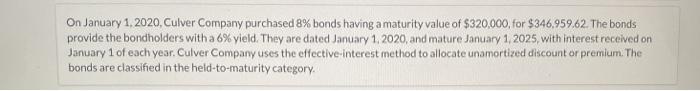

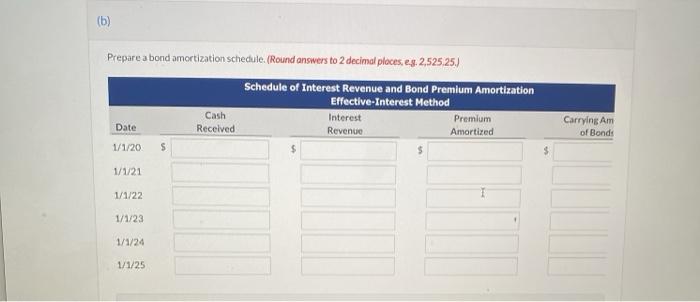

On January 1, 2020, Culver Company purchased 8% bonds having a maturity value of $320,000, for $346,959.62 The bonds provide the bondholders with a 6% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Culver Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category (6) Prepare a bond amortization schedule. (Round answers to 2 decimal places, es 2,525.25.) Schedule of Interest Revenue and Bond Premium Amortization Effective-Interest Method Cash Interest Premium Date Received Revenue Amortixed 1/1/20 $ Carrying Am of Bonds 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts