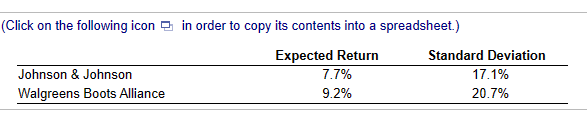

Question: **There is no additional information to be added. The expected return and standard deviations are provided in the chart above the question. The correlation is

**There is no additional information to be added. The expected return and standard deviations are provided in the chart above the question. The correlation is 22%. Calculate the expected return and volatility of a portfolio that is equally invested (so 50% for each stock).

Click on the following icon in order to copy its contents into a spreadsheet.) deviaton) of a poetolio that is equally levested in Johnson s Johnson's and Walgreens' stock a. Calculate the expected retum. The expected retum is K. (Found to two decimal place.) b. Calculate teve volatiliy (standed deelabisn) The volatility is th. (Round so two decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts