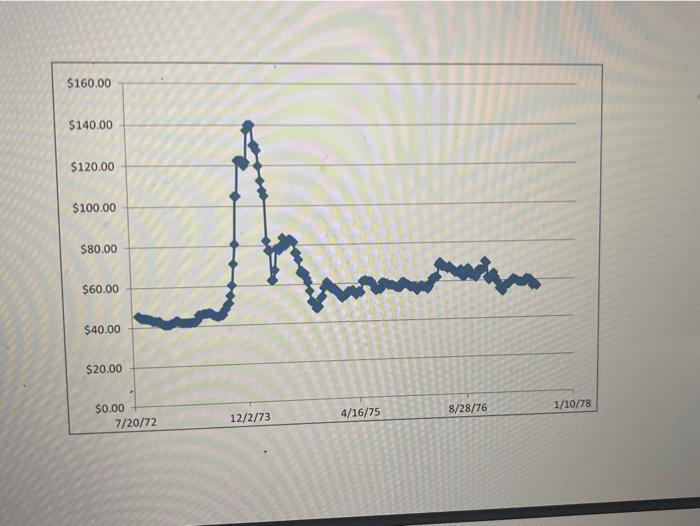

Question: there is no exactly right answer, just write down the rationale and the only info you have is the graph . $160.00 $140.00 $120.00 $100.00

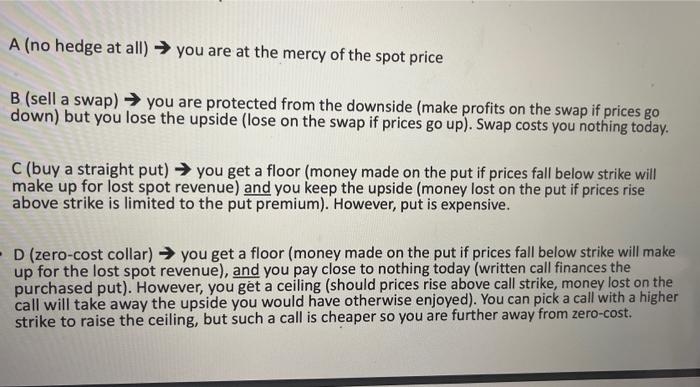

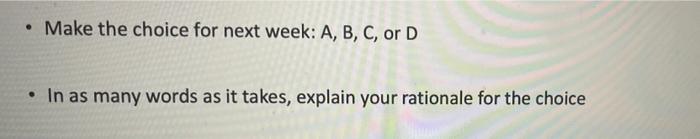

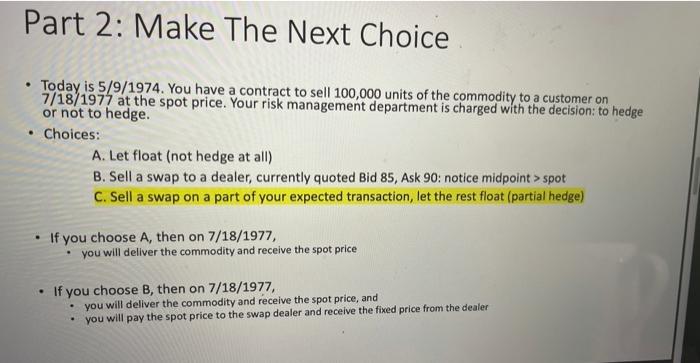

$160.00 $140.00 $120.00 $100.00 $80.00 $60.00 $40.00 $20.00 8/28/76 1/10/78 $0.00 7/20/72 4/16/75 12/2/73 A (no hedge at all) you are at the mercy of the spot price B (sell a swap) you are protected from the downside (make profits on the swap if prices go down) but you lose the upside (lose on the swap if prices go up). Swap costs you nothing today. C (buy a straight put) you get a floor (money made on the put if prices fall below strike will make up for lost spot revenue) and you keep the upside (money lost on the put if prices rise above strike is limited to the put premium). However, put is expensive. - D (zero-cost collar) you get a floor (money made on the put if prices fall below strike will make up for the lost spot revenue), and you pay close to nothing today (written call finances the purchased put). However, you get a ceiling (should prices rise above call strike, money lost on the call will take away the upside you would have otherwise enjoyed). You can pick a call with a higher strike to raise the ceiling, but such a call is cheaper so you are further away from zero-cost. Make the choice for next week: A, B, C, or D In as many words as it takes, explain your rationale for the choice Part 2: Make The Next Choice . Today is 5/9/1974. You have a contract to sell 100,000 units of the commodity to a customer on 7/18/1977 at the spot price. Your risk management department is charged with the decision: to hedge or not to hedge. Choices: A. Let float (not hedge at all) B. Sell a swap to a dealer, currently quoted Bid 85, Ask 90: notice midpoint > spot C. Sell a swap on a part of your expected transaction, let the rest float (partial hedge) If you choose A, then on 7/18/1977, you will deliver the commodity and receive the spot price If you choose B, then on 7/18/1977, you will deliver the commodity and receive the spot price, and you will pay the spot price to the swap dealer and receive the fixed price from the dealer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts