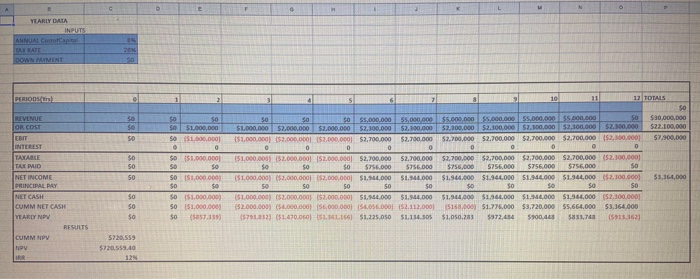

Question: There is no example I can provide with this, the only thing which I could provide is this cash flow example of how they want

Your Excel should the following attributes:-Sales, Revenues, Costs (both recurring and non- recurring, fixed and variable), Earnings before Interest and Taxes (EBIT), Interest Taxes, and Net Cash vs time, and the resulting Net Present Value (NPV) and Internal Rate of Return (IRR) of the Project. Your Presentation should clearly explain the following terms along with the respective formulas to be followed by demonstration on the excel spreadsheet. 1. NPV - Net Present Value 2. IRR - Internal Rate of Return 3. Relation Between NPV & IRR 4. MARR - Minimum Acceptable rate of return The model needs to have the elements of the cash flow calculation vertically in the first column and the entries in the rows versus time with a total column on the right for each of the elements. These elements include sales, revenue, cost of goods sold, EBIT, interest earnings or cost, taxes, cash (earnings after interest and taxes), and cum cash all displayed versus time. Below this should be an entry for the cost of capital and the tax rate, the calculated Net Present Value, IRR, and ROI. You should also be able to display a plot of cash and cum cash versus time to identify the breakeven point. You should have one version of the tool for time in years and one for time in months. When the time in months version is used the user should be able to enter an annual cost of capital and the tool should calculate the monthly equivalent compounded cost of capital that goes with the specified annual cost of capital The Team will then use this tool to develop and create a cash flow analysis of simple projects like the one provided in the example problem. YEARLY DAIA DOWNPAMINT $0 50 $1,000,000 151.000.000 $1,000,000 151.000.000) 0 $7,000,000 $2.000.000 5 0 $2,000,000 $2,000,000 $5,000,000 52. $2,300,000 $3,700,000 $5,000,000 $2,300,000 53.100.000 $2,700,000 $5.000.000 $2,100,000 100.000 $,700,000 $5.000.000 $2,300 52.300.000 $2.700.000 $5.000.000 55.000.000 $2.000.000 $2,100,000 $2,700,000 $2,700,000 $2.500.000 152,300,000) SSSSSS 50 151.000.000) 51.000.000 52.000.000 52.000.000 52.700,000 $2,700,000 $2,700,000 $2,700,000 $2,700.000 52.700,000 $2,300,000) SO SCIDOOSTS 000 $756.000 556.00 $256.000 5000 SO $1.000.000 $1.000.000) $2.000.000 $2,000,000 $1.44,000 $1, 000 $1.944.000 51.944,000 $1.944,000 $1.944,000 52.100.000 53.GIDO CUMM NET CASH YEARLY NPV $0 50 $0 $1.000.000) 51.000.000 $657.159 $1.000.000) (52.000.000 52.000.000 $1 4.000 $1, 000 52.000.000) (56.000.000 156.000.000 150.056.000] 152.112 000) 5751.352) ($1.070.00 51.161.166 $1.225.050 $1,154,50$ $1.944,000 5158.000 $1,050.255 $1.960,000 51.775.000 $972,454 $1. 000 53.720,000 $900,45 $1,364,000 55,664,000 $53,748 52.300.000 53.364,000 5913.162] CUMM NPV 5220 559 Your Excel should the following attributes:-Sales, Revenues, Costs (both recurring and non- recurring, fixed and variable), Earnings before Interest and Taxes (EBIT), Interest Taxes, and Net Cash vs time, and the resulting Net Present Value (NPV) and Internal Rate of Return (IRR) of the Project. Your Presentation should clearly explain the following terms along with the respective formulas to be followed by demonstration on the excel spreadsheet. 1. NPV - Net Present Value 2. IRR - Internal Rate of Return 3. Relation Between NPV & IRR 4. MARR - Minimum Acceptable rate of return The model needs to have the elements of the cash flow calculation vertically in the first column and the entries in the rows versus time with a total column on the right for each of the elements. These elements include sales, revenue, cost of goods sold, EBIT, interest earnings or cost, taxes, cash (earnings after interest and taxes), and cum cash all displayed versus time. Below this should be an entry for the cost of capital and the tax rate, the calculated Net Present Value, IRR, and ROI. You should also be able to display a plot of cash and cum cash versus time to identify the breakeven point. You should have one version of the tool for time in years and one for time in months. When the time in months version is used the user should be able to enter an annual cost of capital and the tool should calculate the monthly equivalent compounded cost of capital that goes with the specified annual cost of capital The Team will then use this tool to develop and create a cash flow analysis of simple projects like the one provided in the example problem. YEARLY DAIA DOWNPAMINT $0 50 $1,000,000 151.000.000 $1,000,000 151.000.000) 0 $7,000,000 $2.000.000 5 0 $2,000,000 $2,000,000 $5,000,000 52. $2,300,000 $3,700,000 $5,000,000 $2,300,000 53.100.000 $2,700,000 $5.000.000 $2,100,000 100.000 $,700,000 $5.000.000 $2,300 52.300.000 $2.700.000 $5.000.000 55.000.000 $2.000.000 $2,100,000 $2,700,000 $2,700,000 $2.500.000 152,300,000) SSSSSS 50 151.000.000) 51.000.000 52.000.000 52.000.000 52.700,000 $2,700,000 $2,700,000 $2,700,000 $2,700.000 52.700,000 $2,300,000) SO SCIDOOSTS 000 $756.000 556.00 $256.000 5000 SO $1.000.000 $1.000.000) $2.000.000 $2,000,000 $1.44,000 $1, 000 $1.944.000 51.944,000 $1.944,000 $1.944,000 52.100.000 53.GIDO CUMM NET CASH YEARLY NPV $0 50 $0 $1.000.000) 51.000.000 $657.159 $1.000.000) (52.000.000 52.000.000 $1 4.000 $1, 000 52.000.000) (56.000.000 156.000.000 150.056.000] 152.112 000) 5751.352) ($1.070.00 51.161.166 $1.225.050 $1,154,50$ $1.944,000 5158.000 $1,050.255 $1.960,000 51.775.000 $972,454 $1. 000 53.720,000 $900,45 $1,364,000 55,664,000 $53,748 52.300.000 53.364,000 5913.162] CUMM NPV 5220 559

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts