Question: there is no extra information needed 4. An agent is trying to decide how much to invest in a safe asset that yields return 1

there is no extra information needed

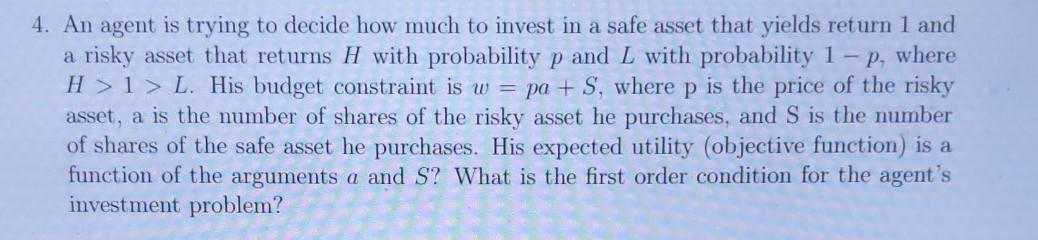

4. An agent is trying to decide how much to invest in a safe asset that yields return 1 and a risky asset that returns H with probability p and L with probability 1 - p, where H> 1 > L. His budget constraint is w = pa + S, where p is the price of the risky asset, a is the number of shares of the risky asset he purchases, and S is the number of shares of the safe asset he purchases. His expected utility (objective function) is a function of the arguments a and S? What is the first order condition for the agent's investment problem? 4. An agent is trying to decide how much to invest in a safe asset that yields return 1 and a risky asset that returns H with probability p and L with probability 1 - p, where H> 1 > L. His budget constraint is w = pa + S, where p is the price of the risky asset, a is the number of shares of the risky asset he purchases, and S is the number of shares of the safe asset he purchases. His expected utility (objective function) is a function of the arguments a and S? What is the first order condition for the agent's investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts