Question: There is no need to do this in Excel, but you can if you wish. Using the Balance Sheet, Income Statement, and Statement of Owners

There is no need to do this in Excel, but you can if you wish.

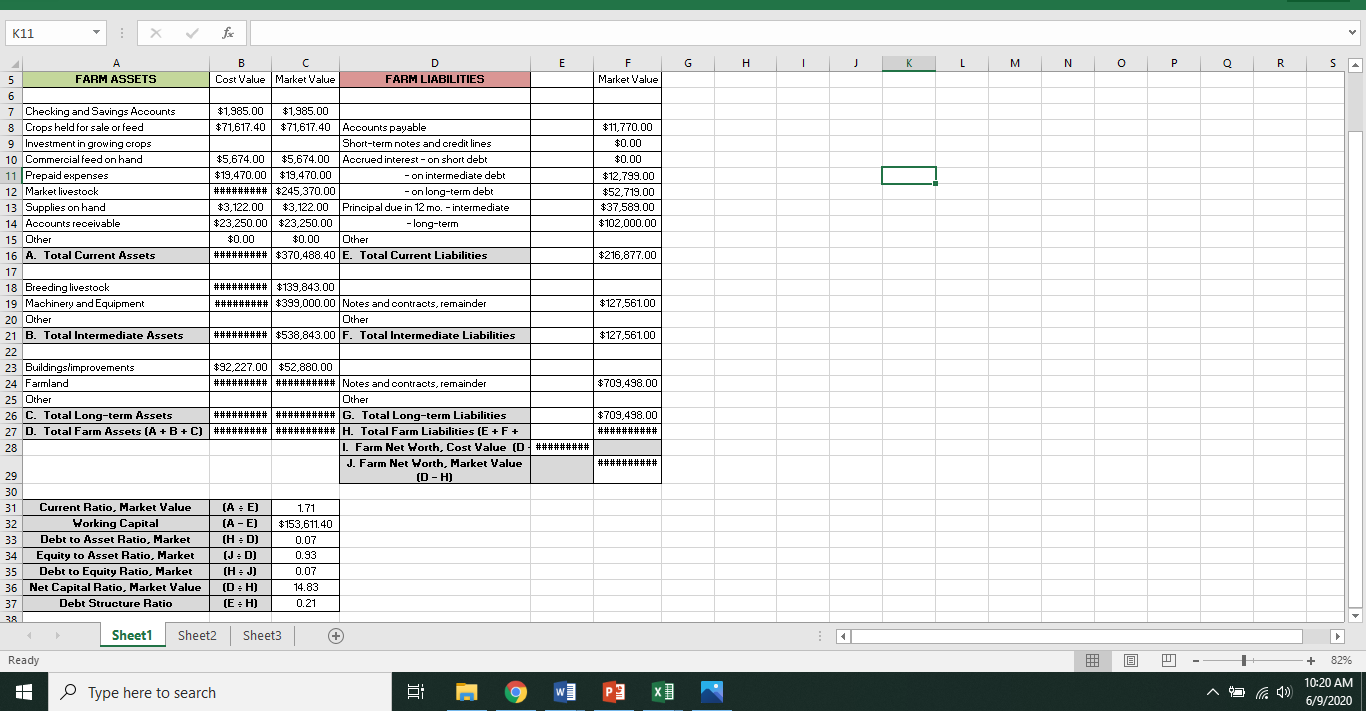

Using the Balance Sheet, Income Statement, and Statement of Owners Equity answer keys from your homework (I attached them to your graded Excel homeworks, but will also post them in the Week 6 Module), provide me with the following (you must show your work):

- Two measures of liquidity

- Two measures of solvency

- One measure of repayment capacity

- Two measures of financial efficiency

Based on your calculations above, tell me the strongest part of this business and the weakest part of the business. Make sure you explain why/how you reached these decisions.

G H J - K L M N o O R S F Market Value 11 Prepaid expenses $11,770.00 $0.00 $0.00 $12,799.00 $52,719.00 $37,589.00 $102,000.00 12 Market livestock $216,877.00 $127,561.00 10 Commercialfe K11 X fx B D E 5 FARM ASSETS Cost Value Market Value FARM LIABILITIES 6 7 Checking and Savings Accounts $1,985.00 $1.985.00 8 Crops held for sale or feed $71,617.40 $71,617.40 Accounts payable 9 Investment in growing crops Short-term notes and credit lines $5,674.00 $5,674.00 Accrued interest - on short debt $19,470.00 $19,470.00 - on intermediate debt ######### $245,370.00 - on long-term debt 13 Supplies on hand $3,122.00 $3,122.00 Principal due in 12 mo. - intermediate 14 Accounts receivable 17 novo $23,250.00 $23,250.00 - long-term 15 Other $0.00 $0.00 Other *0.00 16 A Total Current Assets ######### $370,488.40 E. Total Current Liabilities 17 18 Breeding livestock ######### $139,843.00 19 Machinery and Equipment ######### $399,000.00 Notes and contracts, remainder 20 Other Other 21 B. Total Intermediate Assets ######### $538,843.00 F. Total Intermediate Liabilities 22 23 Buildings/improvements $92,227.00 $52,880.00 24 Farmland ################### Notes and contracts, remainder 25 Other Other 26 C. Total Long-term Assets ################### G. Total Long-term Liabilities 27 D. Total Farm Assets (A+B+C) ######### ########## H. Total Farm Liabilities (E + F + 28 I Farm Net Worth, Cost Value (D######### J. Farm Net Worth, Market Value 29 (D - H) 30 31 s! Current Ratio, Market Value (A = E) 1.71 32 Working Capital (A - E) $153,611.40 33 Debt to Asset Ratio, Market (H :D) 0.07 34 Equity to Asset Ratio, Market (J:D) 0.93 35 33 Debt to Equity Ratio, Market (H: J) 0.07 36 Sb Net Capital Ratio, Market Value (D : H) 14.83 37 Debt Structure Ratio (E = H) 0.21 38 Sheet1 Sheet2 Sheet3 $127,561.00 $709.498,00 $709.498,00 ########## ########## Ready + 82% Type here to search HI 10:20 AM 6/9/2020 G H J - K L M N o O R S F Market Value 11 Prepaid expenses $11,770.00 $0.00 $0.00 $12,799.00 $52,719.00 $37,589.00 $102,000.00 12 Market livestock $216,877.00 $127,561.00 10 Commercialfe K11 X fx B D E 5 FARM ASSETS Cost Value Market Value FARM LIABILITIES 6 7 Checking and Savings Accounts $1,985.00 $1.985.00 8 Crops held for sale or feed $71,617.40 $71,617.40 Accounts payable 9 Investment in growing crops Short-term notes and credit lines $5,674.00 $5,674.00 Accrued interest - on short debt $19,470.00 $19,470.00 - on intermediate debt ######### $245,370.00 - on long-term debt 13 Supplies on hand $3,122.00 $3,122.00 Principal due in 12 mo. - intermediate 14 Accounts receivable 17 novo $23,250.00 $23,250.00 - long-term 15 Other $0.00 $0.00 Other *0.00 16 A Total Current Assets ######### $370,488.40 E. Total Current Liabilities 17 18 Breeding livestock ######### $139,843.00 19 Machinery and Equipment ######### $399,000.00 Notes and contracts, remainder 20 Other Other 21 B. Total Intermediate Assets ######### $538,843.00 F. Total Intermediate Liabilities 22 23 Buildings/improvements $92,227.00 $52,880.00 24 Farmland ################### Notes and contracts, remainder 25 Other Other 26 C. Total Long-term Assets ################### G. Total Long-term Liabilities 27 D. Total Farm Assets (A+B+C) ######### ########## H. Total Farm Liabilities (E + F + 28 I Farm Net Worth, Cost Value (D######### J. Farm Net Worth, Market Value 29 (D - H) 30 31 s! Current Ratio, Market Value (A = E) 1.71 32 Working Capital (A - E) $153,611.40 33 Debt to Asset Ratio, Market (H :D) 0.07 34 Equity to Asset Ratio, Market (J:D) 0.93 35 33 Debt to Equity Ratio, Market (H: J) 0.07 36 Sb Net Capital Ratio, Market Value (D : H) 14.83 37 Debt Structure Ratio (E = H) 0.21 38 Sheet1 Sheet2 Sheet3 $127,561.00 $709.498,00 $709.498,00 ########## ########## Ready + 82% Type here to search HI 10:20 AM 6/9/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts