Question: There is nothing wrong with the question. I want to verify my solution for question c. So expert can post the solution for c and

There is nothing wrong with the question. I want to verify my solution for question "c". So expert can post the solution for "c" and skip the other two questions. And there is answers over the internet for similar question please don't copy and paste that solution in here. Thank you!

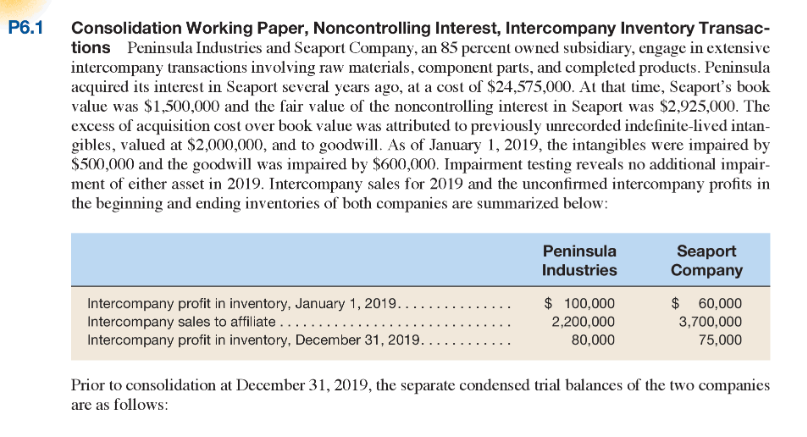

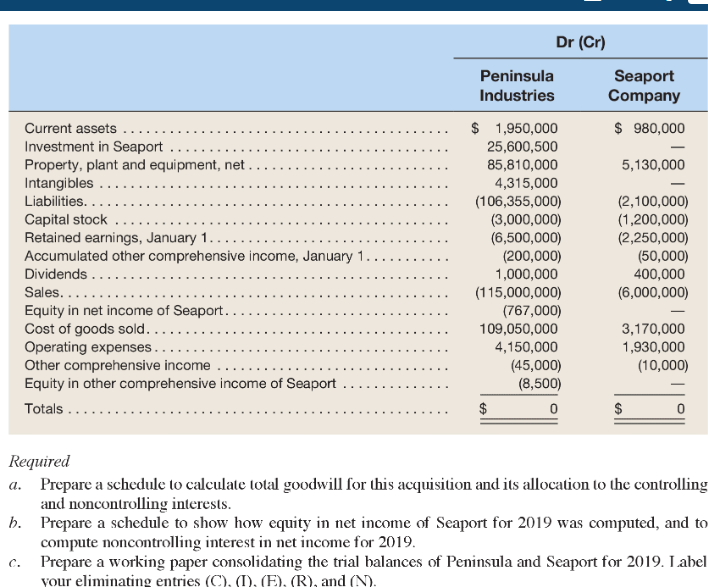

P6.1 Consolidation Working Paper, Noncontrolling Interest, Intercompany Inventory Transac- tions Peninsula Industries and Seaport Company, an 85 percent owned subsidiary, engage in extensive intercompany transactions involving raw materials, component parts, and complcted products. Peninsula acquired its interest in Seaport several years ago, at a cost of $24,575,000. At that time, Seaport's book value was $1,500,000 and the fair value of the noncontrolling interest in Scaport was $2,925,000. The excess of acquisition cost over book value was attributed to previously unrecorded indefinite-lived intan gibles, valued at $2,000,000, and to goodwl. As of January 1, 2019, the intangibles were impaired by 500,000 and the goodwill was impaired by $600,000. Impairment testing reveals no additional impair ment of either asset in 2019. Intercompany sales for 2019 and the unconfirmed intercompany profits in the beginning and ending inventories of both companies are summarized below Peninsula Industries Seaport Company $ 100,000 2,200,000 80,000 $ 60,000 3,700,000 75,000 Prior to consolidation at December 31,2019, the separate condensed trial balances of the two companies are as follows: Dr (Cr) Peninsula Industries Seaport Company $ 980,000 25,600,500 85,810,000 4,315,000 5,130,000 (3,000,000) (6,500,000) (200,000) 1,000,000 (2,100,000) (1,200,000) (2,250,000) (50,000) 400,000 (6,000,000) Accumulated other comprehensiv (767,000) 109,050,000 4,150,000 (45,000) (8,500) 0 3,170,000 1,930,000 (10,000) Equity in other comprehensive income of Seaport . . . . .. . . . . . . . ire Prepare a schedule to calculate total goodwill for this acquisition and its allocation to the controlling and noncontrolling interests Prepare a schedule to show how equity in net income of Seaport for 2019 was computed, and to compute noncontrolling interest in net income for 2019 Prepare a working paper consolidating the trial balances of Peninsula and Seaport for 2019. T abel your eliminating entries (C). (!), (E), (R), and (N) a. b. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts