Question: there true and false and require a two sentence minimum explanation please and thank you so much 5. The annual risk free rate is 2%.

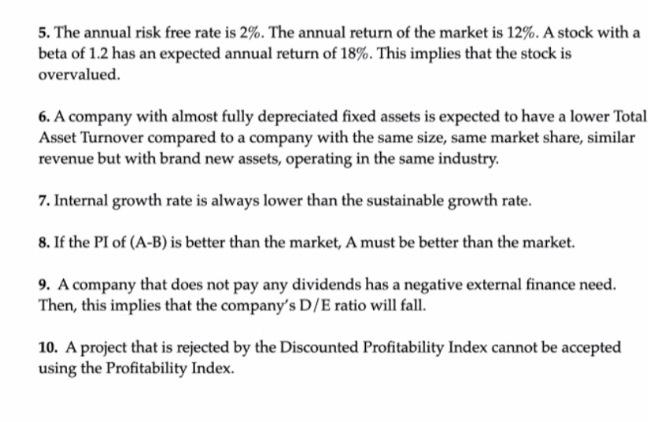

5. The annual risk free rate is 2%. The annual return of the market is 12%. A stock with a beta of 1.2 has an expected annual return of 18%. This implies that the stock is overvalued. 6. A company with almost fully depreciated fixed assets is expected to have a lower Total Asset Turnover compared to a company with the same size, same market share, similar revenue but with brand new assets, operating in the same industry. 7. Internal growth rate is always lower than the sustainable growth rate. 8. If the PI of (A-B) is better than the market, A must be better than the market. 9. A company that does not pay any dividends has a negative external finance need, Then, this implies that the company's D/E ratio will fall. 10. A project that is rejected by the Discounted Profitability Index cannot be accepted using the Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts