Question: There will be another question for the present value of Alternative 2 and which Alternative is the better option (preferred option). A company must make

There will be another question for the present value of Alternative 2 and which Alternative is the better option (preferred option).

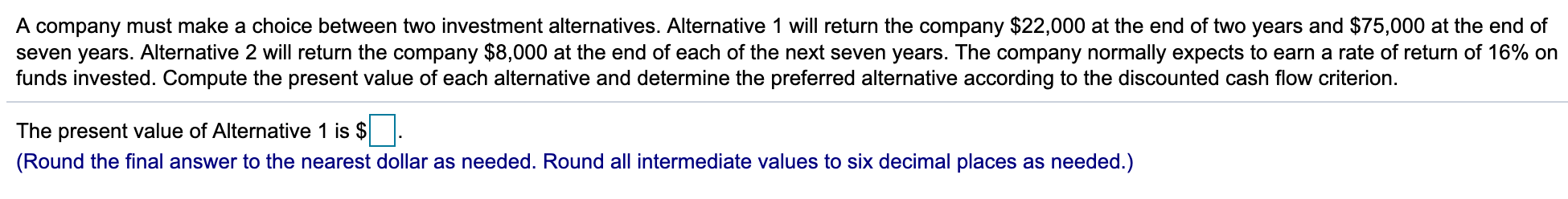

A company must make a choice between two investment alternatives. Alternative 1 will return the company $22,000 at the end of two years and $75,000 at the end of seven years. Alternative 2 will return the company $8,000 at the end of each of the next seven years. The company normally expects to earn a rate of return of 16% on funds invested. Compute the present value of each alternative and determine the preferred alternative according to the discounted cash flow criterion. The present value of Alternative 1 is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts