Question: These are the question 1 answer, I need the question 2 answer Case 26- Revlon Inc., 2015 - pp 622. a. Prepare a Quantitative Strategic

These are the question 1 answer, I need the question 2 answer

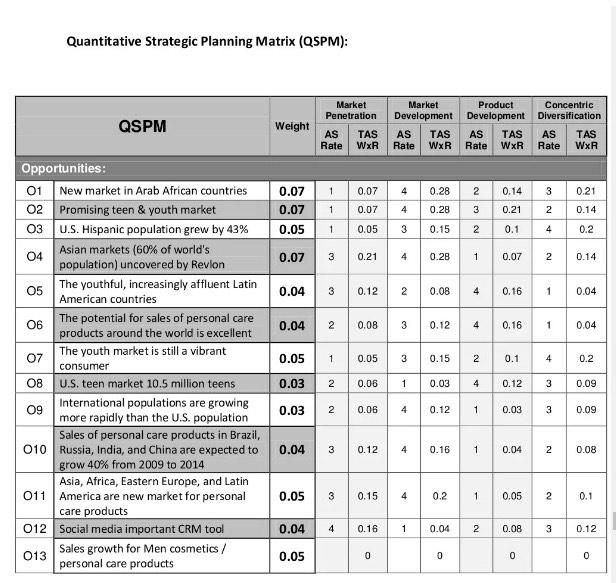

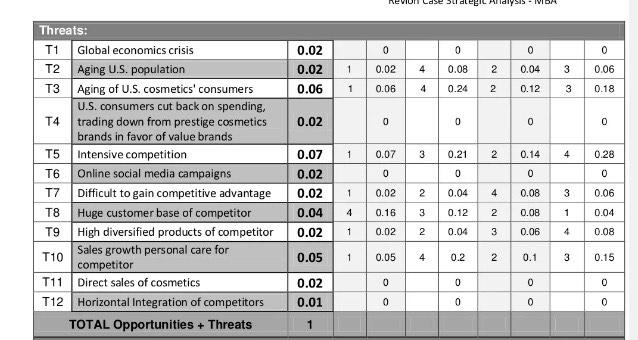

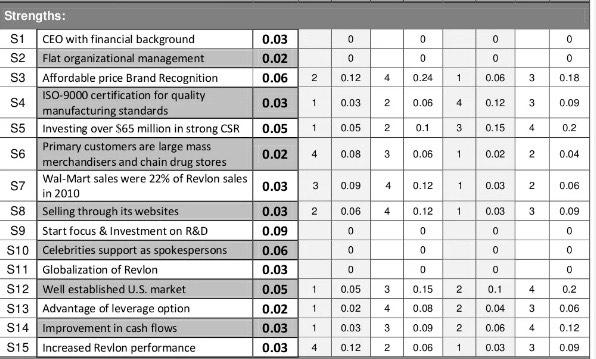

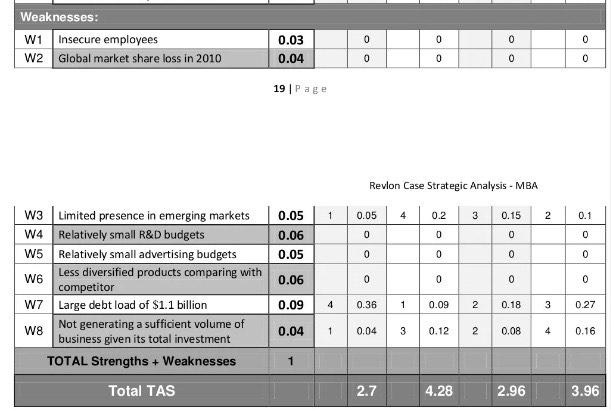

Case 26- Revlon Inc., 2015 - pp 622. a. Prepare a Quantitative Strategic Planning Matrix (QSPM) b. Extract/use only 5 relevant items independently for each option. c. Recommend a strategy that the company should adopt and justify why. Explain your recommendation not exceeding 150 words. Quantitative Strategic Planning Matrix (QSPM): Market Penetration Market Product Development Development Concentric Diversification QSPM Weight AS TAS AS TAS AS TAS AS WXR Rate TAS Rate WXR Rate WXR Rate WxR Opportunities: 01 New market in Arab African countries 0.07 1 0.07 4 0.28 2 0.14 3 0.21 02 Promising teen & youth market 0.07 1. 0.07 4 0.28 0.21 2 0.14 03 U.S. Hispanic population grew by 43% 0.05 1 0.05 3 0.15 0.1 4 0.2 Asian markets (60% of world's 04 0.07 3 0.21 4 0.28 1 0.07 2 0.14 population) uncovered by Revlon 05 The youthful, increasingly affluent Latin American countries 0.04 3 0.12 2 0.08 4 0.16 1 0.04 06 0.04 2 0.08 3 0.12 4 0.16 1 0.04 The potential for sales of personal care products around the world is excellent The youth market is still a vibrant 07 0.05 1 0.05 0.15 0.1 4 0.2 consumer 08 0.03 2 0.06 0.03 4 0.12 3 0.09 09 0.03 2 0.06 0.12 1 0.03 3 0.09 U.S. teen market 10.5 million teens International populations are growing more rapidly than the U.S. population Sales of personal care products in Brazil, 010 Russia, India, and China are expected to grow 40% from 2009 to 2014 0.04 3 0.12 0.16 1 0.04 2 0.08 011 Asia, Africa, Eastern Europe, and Latin America are new market for personal care products 0.05 3 0.15 0.2 0.05 2 0.1 012 0.04 4 0.16 0.04 0.08 3 0.12 Social media important CRM tool Sales growth for Men cosmetics / personal care products 013 0.05 0 0 0 0 1 4 4 4 1 NWN 3 2 N 1 2 Threats: T1 Global economics crisis T2 Aging U.S. population T3 Aging of U.S. cosmetics' consumers U.S. consumers cut back on spending, trading down from prestige cosmetics brands in favor of value brands T4 T5 Intensive competition T7 T6 Online social media campaigns Difficult to gain competitive advantage Huge customer base of competitor T8 T9 High diversified products of competitor Sales growth personal care for competitor T10 T11 Direct sales of cosmetics T12 Horizontal Integration of competitors TOTAL Opportunities + Threats 56 Revion Case Strategic Analysis - MIDA 0.02 0 0 0 0.02 0.02 4 0.08 2 0.04 0.06 1 0.06 4 0.24 0.12 0.02 0 0 0 0.07 1 0.07 3 0.21 0.14 0.02 0 0 0 0.02 1 0.02 0.04 0.08 0.04 4 0.16 0.12 0.08 0.02 1 0.02 0.04 0.06 0.05 1 0.05 0.2 0.1 0.02 0 0 0 0.01 0 0 1 1 2 NWN 3 2 4 0 19: 2 2 4 NA 2 3 2 3 3 4 3 1 3 0 0.06 0.18 0 0.28 0 0.06 0.04 0.08 0.15 0 0 Strengths: S1 CEO with financial background S2 Flat organizational management S3 Affordable price Brand Recognition S4 ISO-9000 certification for quality manufacturing standards S5 Investing over $65 million in strong CSR S6 Primary customers are large mass merchandisers and chain drug stores Wal-Mart sales were 22% of Revlon sales in 2010 S7 S8 Selling through its websites S9 Start focus & Investment on R&D S10 Celebrities support as spokespersons S11 Globalization of Revlon S12 Well established U.S. market S13 Advantage of leverage option S14 Improvement in cash flows S15 Increased Revlon performance 0.03 0 0.02 0 0.06 2 0.12 0.03 1 0.03 0.05 1 0.05 0.02 4 0.08 0.03 0.09 0.03 2 0.06 0.09 0 0.06 0 0.03 0 0.05 1 0.05 0.02 1 0.02 0.03 1 0.03 3 0.03 4 0.12 2 0 34 0 0 1 0.06 3 4 0.12 3 3 0.15 4 1 0.02 2 1 0.03 2 1 0.03 3 0 0 0 0.1 0.04 0.06 0.03 0 4 0.24 2 0.06 2 0.1 3 0.06 4 0.12 4 0.12 0 0 0 0.15 2 0.08 2 0.09 2 0.06 1 4 3 4 0 0 0.18 0.09 0.2 0.04 0.06 0.09 0 0 0 0.2 0.06 0.12 0.09 Weaknesses: W1 Insecure employees W2 Global market share loss in 2010 W3 Limited presence in emerging markets W4 Relatively small R&D budgets W5 Relatively small advertising budgets W6 Less diversified products comparing with competitor W7 Large debt load of $1.1 billion W8 Not generating a sufficient volume of business given its total investment TOTAL Strengths + Weaknesses Total TAS 0.03 0 0 0.04 0 0 19 | Page Revlon Case Strategic Analysis MBA 0.05 0.05 4 0.2 3 0.15 2 0.06 0 0 0 0.05 0 0 0 0.06 0 0 0.09 4 0.36 1 2 0.18 3 0.04 1 0.04 3 2 0.08 4 1 2.7 2.96 1 0 0 0 0.09 0.12 4.28 0 0 0.1 0 0 0 0.27 0.16 3.96 Case 26- Revlon Inc., 2015 - pp 622. a. Prepare a Quantitative Strategic Planning Matrix (QSPM) b. Extract/use only 5 relevant items independently for each option. c. Recommend a strategy that the company should adopt and justify why. Explain your recommendation not exceeding 150 words. Quantitative Strategic Planning Matrix (QSPM): Market Penetration Market Product Development Development Concentric Diversification QSPM Weight AS TAS AS TAS AS TAS AS WXR Rate TAS Rate WXR Rate WXR Rate WxR Opportunities: 01 New market in Arab African countries 0.07 1 0.07 4 0.28 2 0.14 3 0.21 02 Promising teen & youth market 0.07 1. 0.07 4 0.28 0.21 2 0.14 03 U.S. Hispanic population grew by 43% 0.05 1 0.05 3 0.15 0.1 4 0.2 Asian markets (60% of world's 04 0.07 3 0.21 4 0.28 1 0.07 2 0.14 population) uncovered by Revlon 05 The youthful, increasingly affluent Latin American countries 0.04 3 0.12 2 0.08 4 0.16 1 0.04 06 0.04 2 0.08 3 0.12 4 0.16 1 0.04 The potential for sales of personal care products around the world is excellent The youth market is still a vibrant 07 0.05 1 0.05 0.15 0.1 4 0.2 consumer 08 0.03 2 0.06 0.03 4 0.12 3 0.09 09 0.03 2 0.06 0.12 1 0.03 3 0.09 U.S. teen market 10.5 million teens International populations are growing more rapidly than the U.S. population Sales of personal care products in Brazil, 010 Russia, India, and China are expected to grow 40% from 2009 to 2014 0.04 3 0.12 0.16 1 0.04 2 0.08 011 Asia, Africa, Eastern Europe, and Latin America are new market for personal care products 0.05 3 0.15 0.2 0.05 2 0.1 012 0.04 4 0.16 0.04 0.08 3 0.12 Social media important CRM tool Sales growth for Men cosmetics / personal care products 013 0.05 0 0 0 0 1 4 4 4 1 NWN 3 2 N 1 2 Threats: T1 Global economics crisis T2 Aging U.S. population T3 Aging of U.S. cosmetics' consumers U.S. consumers cut back on spending, trading down from prestige cosmetics brands in favor of value brands T4 T5 Intensive competition T7 T6 Online social media campaigns Difficult to gain competitive advantage Huge customer base of competitor T8 T9 High diversified products of competitor Sales growth personal care for competitor T10 T11 Direct sales of cosmetics T12 Horizontal Integration of competitors TOTAL Opportunities + Threats 56 Revion Case Strategic Analysis - MIDA 0.02 0 0 0 0.02 0.02 4 0.08 2 0.04 0.06 1 0.06 4 0.24 0.12 0.02 0 0 0 0.07 1 0.07 3 0.21 0.14 0.02 0 0 0 0.02 1 0.02 0.04 0.08 0.04 4 0.16 0.12 0.08 0.02 1 0.02 0.04 0.06 0.05 1 0.05 0.2 0.1 0.02 0 0 0 0.01 0 0 1 1 2 NWN 3 2 4 0 19: 2 2 4 NA 2 3 2 3 3 4 3 1 3 0 0.06 0.18 0 0.28 0 0.06 0.04 0.08 0.15 0 0 Strengths: S1 CEO with financial background S2 Flat organizational management S3 Affordable price Brand Recognition S4 ISO-9000 certification for quality manufacturing standards S5 Investing over $65 million in strong CSR S6 Primary customers are large mass merchandisers and chain drug stores Wal-Mart sales were 22% of Revlon sales in 2010 S7 S8 Selling through its websites S9 Start focus & Investment on R&D S10 Celebrities support as spokespersons S11 Globalization of Revlon S12 Well established U.S. market S13 Advantage of leverage option S14 Improvement in cash flows S15 Increased Revlon performance 0.03 0 0.02 0 0.06 2 0.12 0.03 1 0.03 0.05 1 0.05 0.02 4 0.08 0.03 0.09 0.03 2 0.06 0.09 0 0.06 0 0.03 0 0.05 1 0.05 0.02 1 0.02 0.03 1 0.03 3 0.03 4 0.12 2 0 34 0 0 1 0.06 3 4 0.12 3 3 0.15 4 1 0.02 2 1 0.03 2 1 0.03 3 0 0 0 0.1 0.04 0.06 0.03 0 4 0.24 2 0.06 2 0.1 3 0.06 4 0.12 4 0.12 0 0 0 0.15 2 0.08 2 0.09 2 0.06 1 4 3 4 0 0 0.18 0.09 0.2 0.04 0.06 0.09 0 0 0 0.2 0.06 0.12 0.09 Weaknesses: W1 Insecure employees W2 Global market share loss in 2010 W3 Limited presence in emerging markets W4 Relatively small R&D budgets W5 Relatively small advertising budgets W6 Less diversified products comparing with competitor W7 Large debt load of $1.1 billion W8 Not generating a sufficient volume of business given its total investment TOTAL Strengths + Weaknesses Total TAS 0.03 0 0 0.04 0 0 19 | Page Revlon Case Strategic Analysis MBA 0.05 0.05 4 0.2 3 0.15 2 0.06 0 0 0 0.05 0 0 0 0.06 0 0 0.09 4 0.36 1 2 0.18 3 0.04 1 0.04 3 2 0.08 4 1 2.7 2.96 1 0 0 0 0.09 0.12 4.28 0 0 0.1 0 0 0 0.27 0.16 3.96Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock