Question: These need to be computed on a calculator using N, PV, PMT, FV, and I/Y (only as needed) instead of using formulas thanks! 12. The

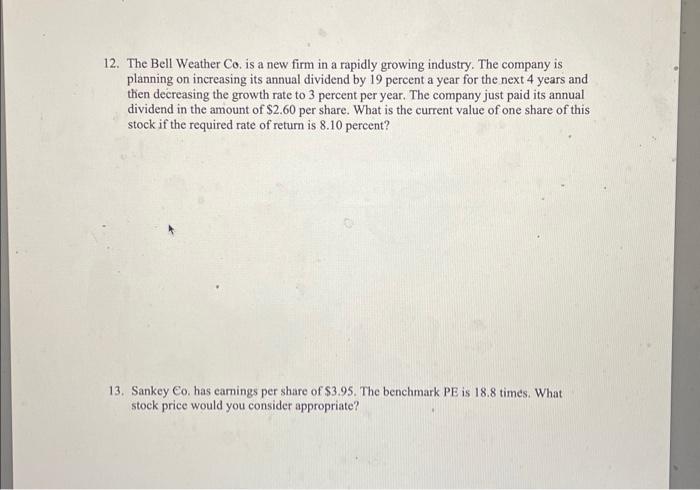

12. The Bell Weather Co, is a new firm in a rapidly growing industry. The company is planning on increasing its annual dividend by 19 percent a year for the next 4 years and then decreasing the growth rate to 3 percent per year. The company just paid its annual dividend in the amount of $2.60 per share. What is the current value of one share of this stock if the required rate of return is 8.10 percent? 13. Sankey C0. has earnings per share of $3.95. The benchmark PE is 18.8 times. What stock price would you consider appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts