Question: These need to be computed on a calculator using N, PV, PMT, FV, and I/Y ( only as needed) instead of formulas thanks! 17. You

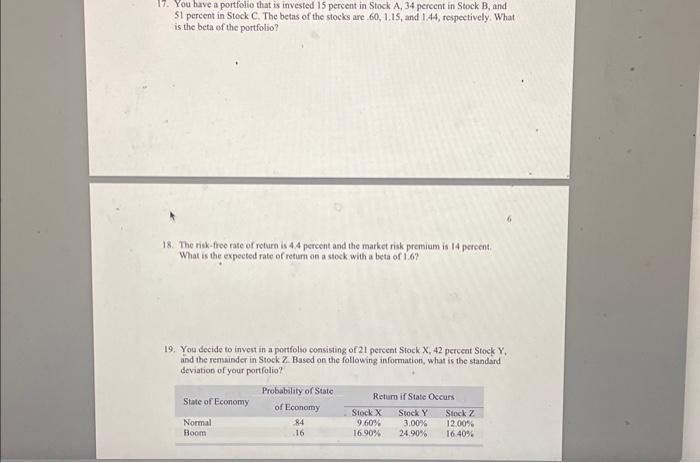

17. You have a portfolio that is invested 15 percent in Stock A, 34 percent in Stock B, and 51 pereent in Stock C. The betas of the stocks are 60,1.15, and 1.44 , respectively. What is the beta of the portfolio? 6 18. The risk-free rate of return is 4.4 pereent and the market risk premium is 14 percent. What is the expected rate of returm on a stock with a beta of 1.6 ? 19. You decide to invest in a portfolio consisting of 21 percent Stock X,42 percent Stock Y, and the remainder in Stock Z. Basod on the following information, what is the standard deviation of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts