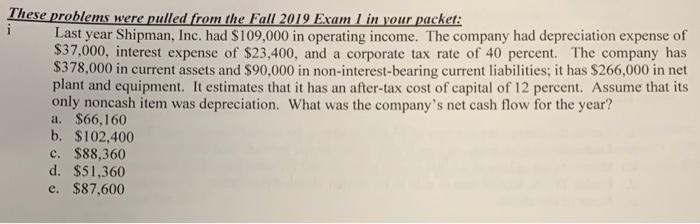

Question: These problems were pulled from the Fall 2019 Exam 1 in your packet: i Last year Shipman, Inc. had $109,000 in operating income. The company

These problems were pulled from the Fall 2019 Exam 1 in your packet: i Last year Shipman, Inc. had $109,000 in operating income. The company had depreciation expense of $37,000, interest expense of $23,400, and a corporate tax rate of 40 percent. The company has $378,000 in current assets and $90,000 in non-interest-bearing current liabilities; it has $266,000 in net plant and equipment. It estimates that it has an after-tax cost of capital of 12 percent. Assume that its only noncash item was depreciation. What was the company's net cash flow for the year? a. $66,160 b. $102,400 c. $88,360 d. $51,360 e. $87,600

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock