Question: Please help me with these ASAP! PLEASE Question 14 (0.2 points) The risk-free rate is 2.2% and the market risk premium is 6.0%. A stock

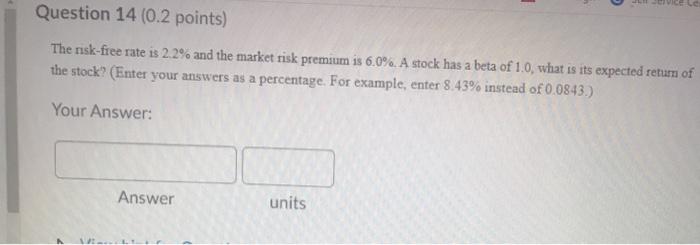

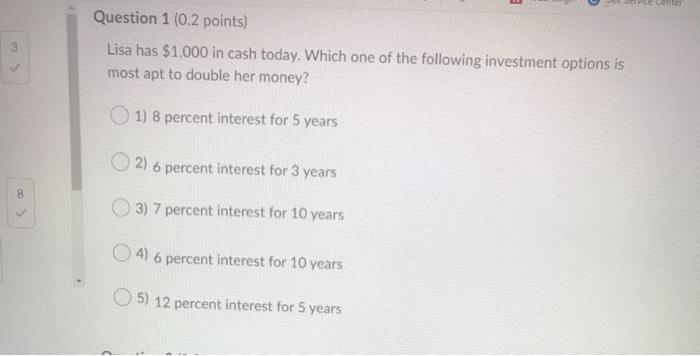

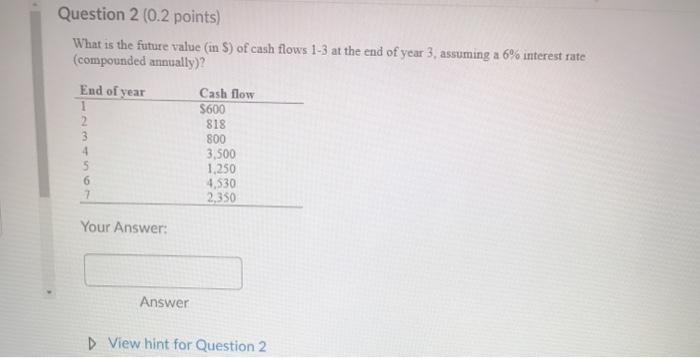

Question 14 (0.2 points) The risk-free rate is 2.2% and the market risk premium is 6.0%. A stock has a beta of 1.0, what is its expected return of the stock? (Enter your answers as a percentage. For example, enter 8.43% instead of 0.0843.) Your Answer: Answer units CNC 3 Question 1 (0.2 points) Lisa has $1,000 in cash today. Which one of the following investment options is most apt to double her money? 1) 8 percent interest for 5 years 2) 6 percent interest for 3 years 8 3) 7 percent interest for 10 years 4) 6 percent interest for 10 years 5) 12 percent interest for 5 years Question 2 (0.2 points) What is the future value in S) of cash flows 1-3 at the end of year 3, assuming a 6% interest rate (compounded annually)? End of year Cash flow 1 $600 2 818 800 3,500 5 1.250 6 4,530 7 2.350 Your Answer: Answer View hint for Question 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts