Question: These two stocks should have the same price. b. These two stocks must have the same dividend yield. c. These two stocks should have the

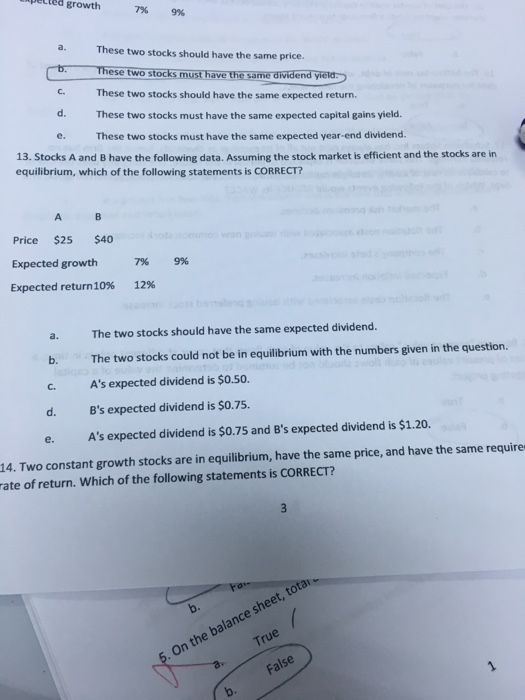

These two stocks should have the same price. b. These two stocks must have the same dividend yield. c. These two stocks should have the same expected return. d. These two stocks must have the same expected capital gains yield. e. These two stocks must have the same expected year-end dividend. Stocks A and B have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements Is CORRECT? a. The two stocks should have the same expected dividend. b. The two stocks could not be in equilibrium with the numbers given in the question. c. A's expected dividend is $0.50. d. B's expected dividend is $0.75. e. A's expected dividend is $0.75 and B*s expected dividend is $1.20. Two constant growth stocks are in equilibrium, have the same price, and have the same require rate of return. Which of the following statements is CORRECT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts