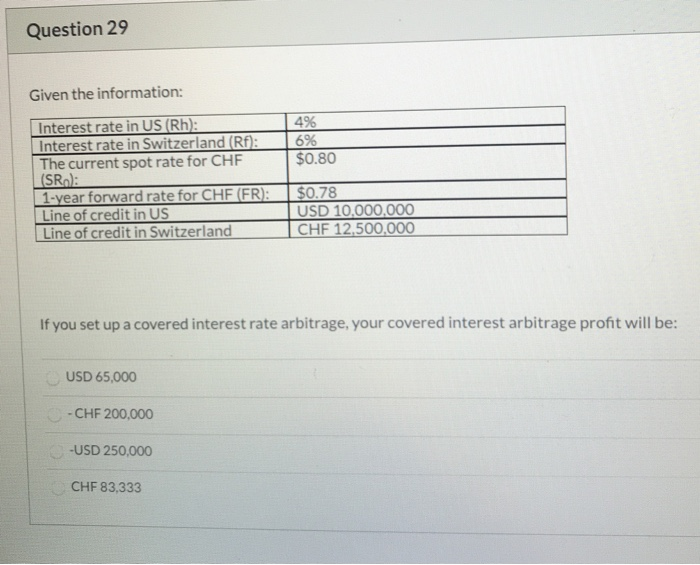

Question: they both go together Question 29 Given the information: 4% 6% $0.80 Interest rate in US (Rh): Interest rate in Switzerland (Rf): The current spot

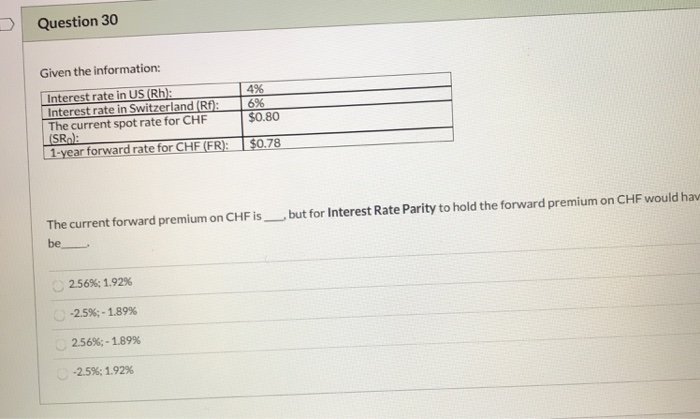

Question 29 Given the information: 4% 6% $0.80 Interest rate in US (Rh): Interest rate in Switzerland (Rf): The current spot rate for CHF (SRo: 1-year forward rate for CHF (FR): Line of credit in US Line of credit in Switzerland $0.78 USD 10.000.000 CHF 12.500.000 If you set up a covered interest rate arbitrage, your covered interest arbitrage profit will be: USD 65,000 - CHF 200,000 -USD 250,000 CHF 83,333 Question 30 Given the information: Interest rate in US (Rh): Interest rate in Switzerland (RF): The current spot rate for CHF (SRA): 1-year forward rate for CHF (FR): 4% 6% $0.80 $0.78 but for Interest Rate Parity to hold the forward premium on CHF would hav The current forward premium on CHF is be 2.56%; 1.92% -2.5%; -1.89% 2.56%; - 1,89% -2.5%: 1.92%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts