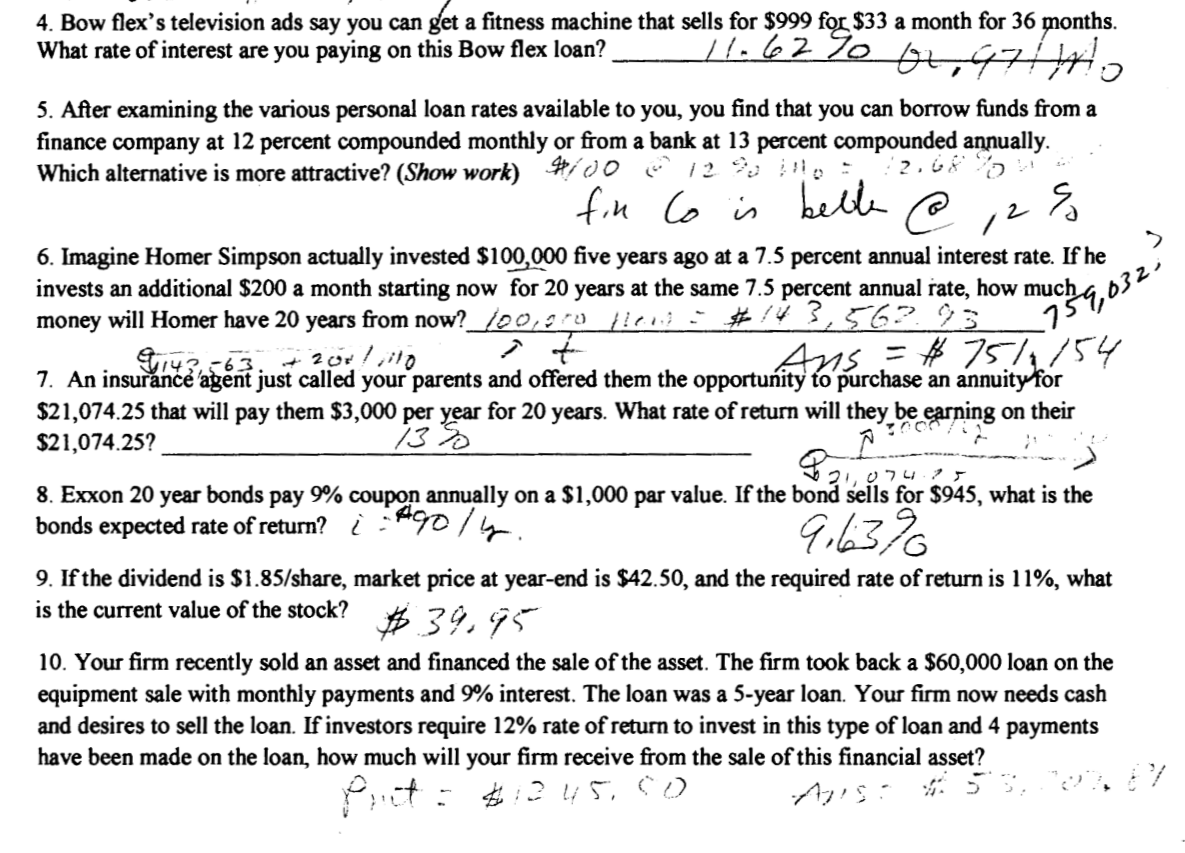

Question: I need help with these question by using financial calculator HP lOBII. Please write the steps with timeline. 4. Bow flex's television ads say you

I need help with these question by using financial calculator HP lOBII. Please write the steps with timeline.

4. Bow flex's television ads say you can get a fitness machine that sells for $999 for $33 a month for 36 months. - 11. 62 70 f What rate of interest are you paying on this Bow flex loan? 47 . 5. After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at 12 percent compounded monthly or from a bank at 13 percent compounded annually. Which alternative is more attractive? (Show work) Do in 12 !!: :2.67 - fin Co is belle @ 12 % 6. Imagine Homer Simpson actually invested $100,000 five years ago at a 7.5 percent annual interest rate. If he invests an additional $200 a month starting now for 20 years at the same 7.5 percent annual rate, how much 9,03 money will Homer have 20 years from now?_100,70 002: #!43,56? s 15" ans =$75/754 7. An insuran 7. An insurance agent just called your parents and offered them the opportunity to purchase an annuity for 63. + zorilo $21,074.25 that will pay them $3,000 per year for 20 years. What rate of return will they be earning on their $21,074.25? 8. Exxon 20 year bonds pay 9% coupon annually on a $1,000 par value. If the bond sells for $945, what is the bonds expected rate of return? .*90 / 1370 9. If the dividend is $1.85/share, market price at year-end is $42.50, and the required rate of return is 11%, what is the current value of the stock? 10. Your firm recently sold an asset and financed the sale of the asset. The firm took back a $60,000 loan on the equipment sale with monthly payments and 9% interest. The loan was a 5-year loan. Your firm now needs cash and desires to sell the loan. If investors require 12% rate of return to invest in this type of loan and 4 payments have been made on the loan, how much will your firm receive from the sale of this financial asset? HP 1Obll Financial Calculator 1,180.36 (PV I/YR NOM% PMT P/YR FV AMORT XP/YR EFF% INPUT MU CST IRR/YR PRC MAR BEG/END NPV CFi SWAP %CHG RND +/- -M RM M+ RCL STO Xx? CLE y 7 8 Oxo CALL IN + ON = OFF * DISP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts