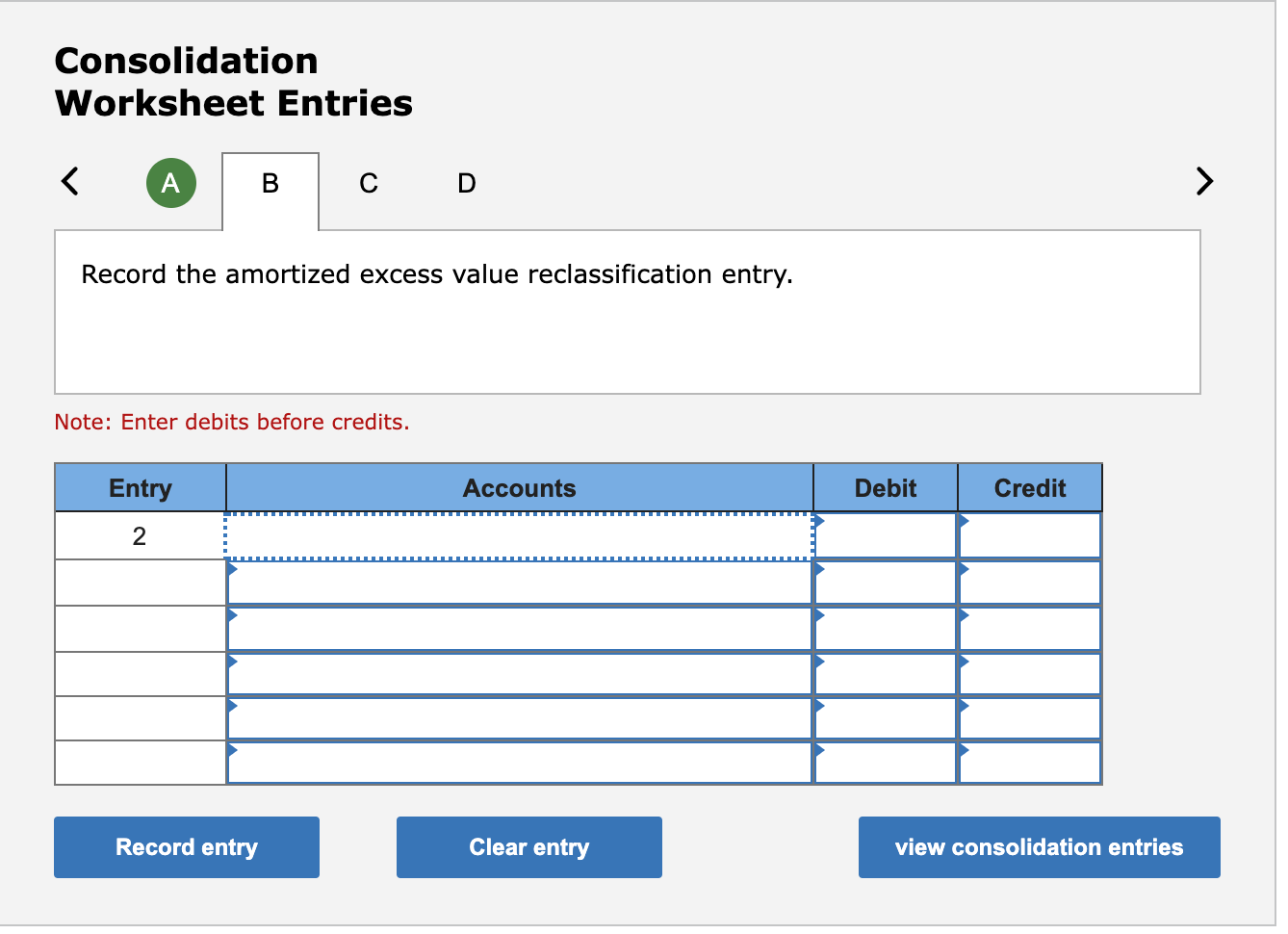

Question: Third Journal Entry Requires: Record the excess value (differential) reclassification entry. Fourth Journal Entry Requires: Record the optional accumulated depreciation consolidation entry. If you can

Third Journal Entry Requires: Record the excess value (differential) reclassification entry.

Third Journal Entry Requires: Record the excess value (differential) reclassification entry.

Fourth Journal Entry Requires: Record the optional accumulated depreciation consolidation entry.

If you can include your work, I would appreciate that. If the answer is correct, I will leave a thumbs up.

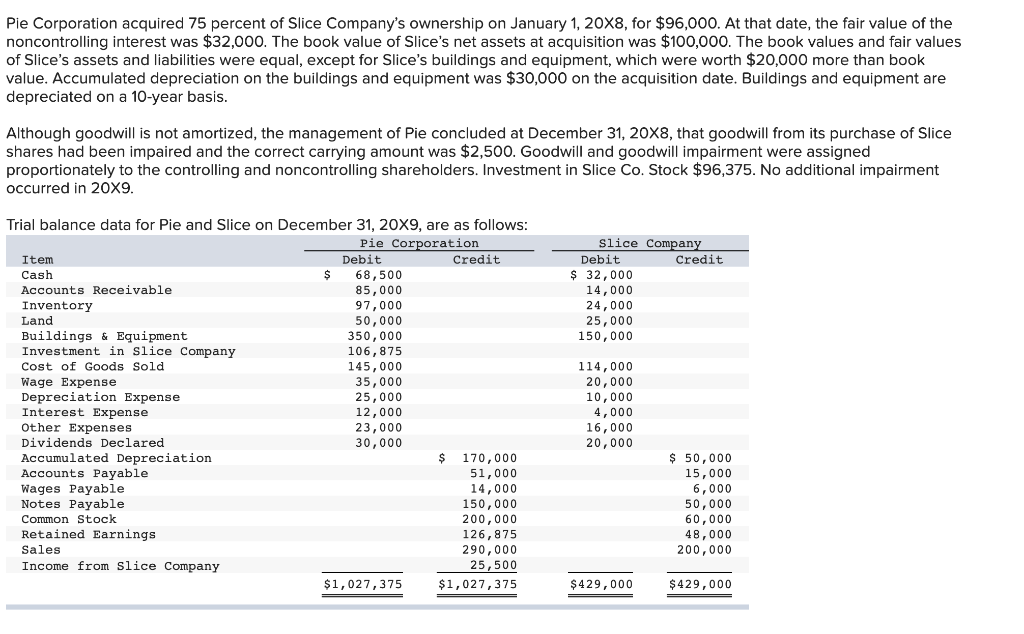

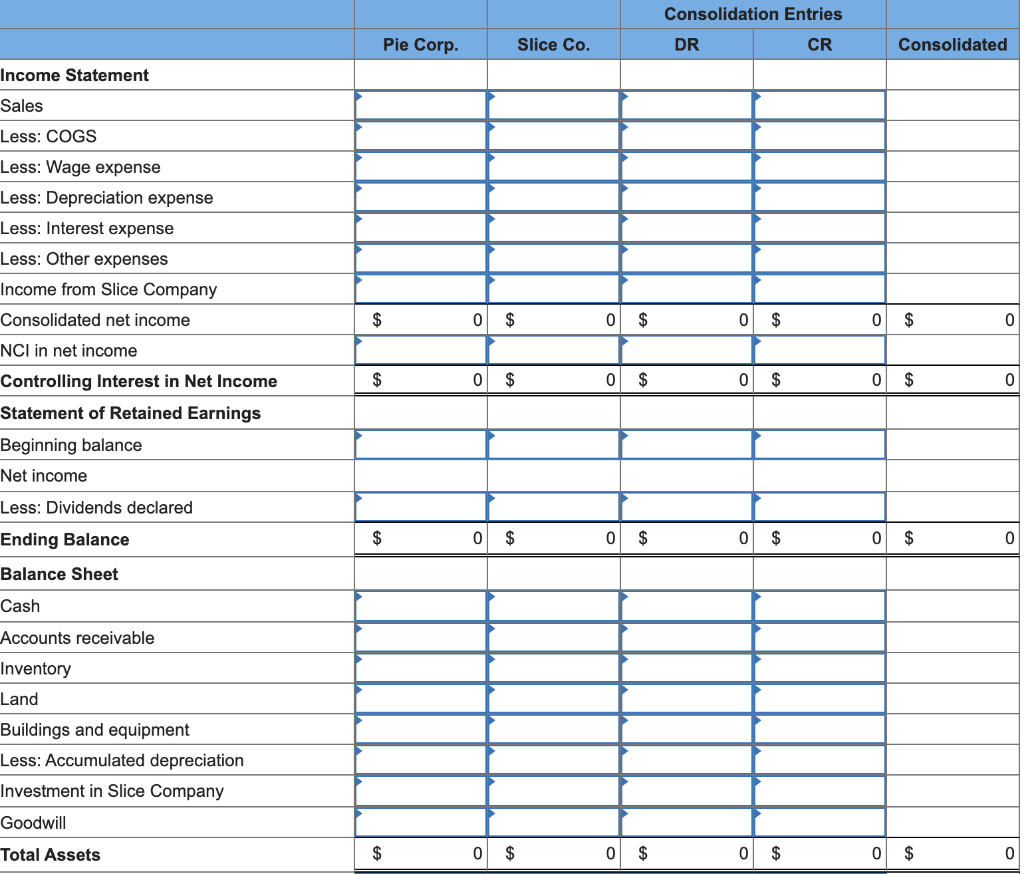

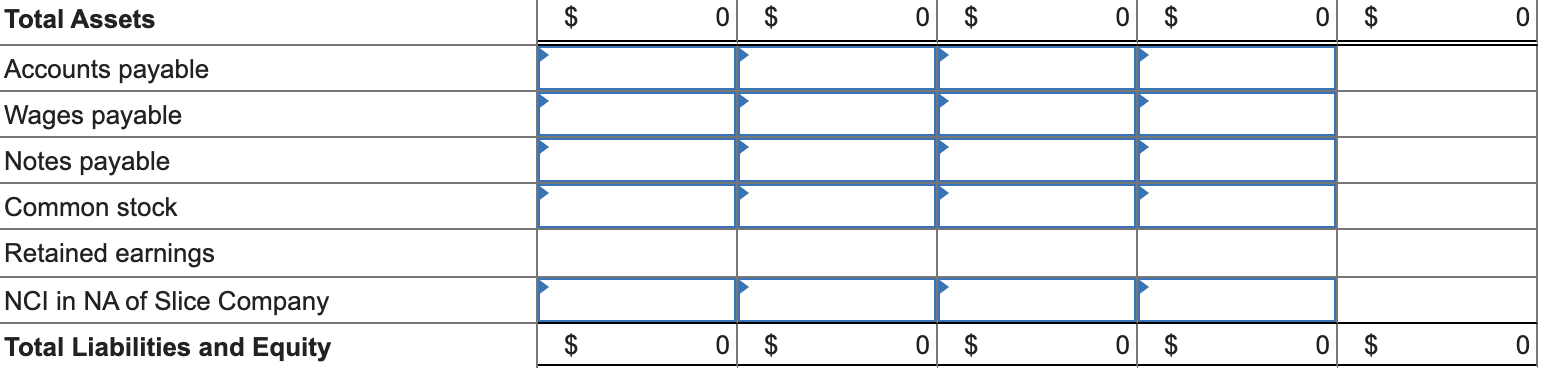

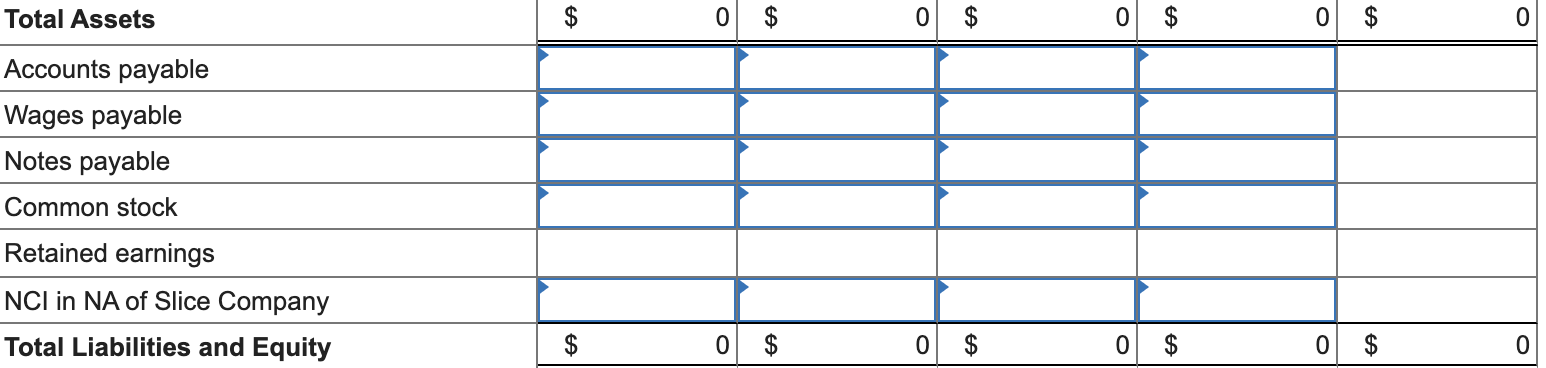

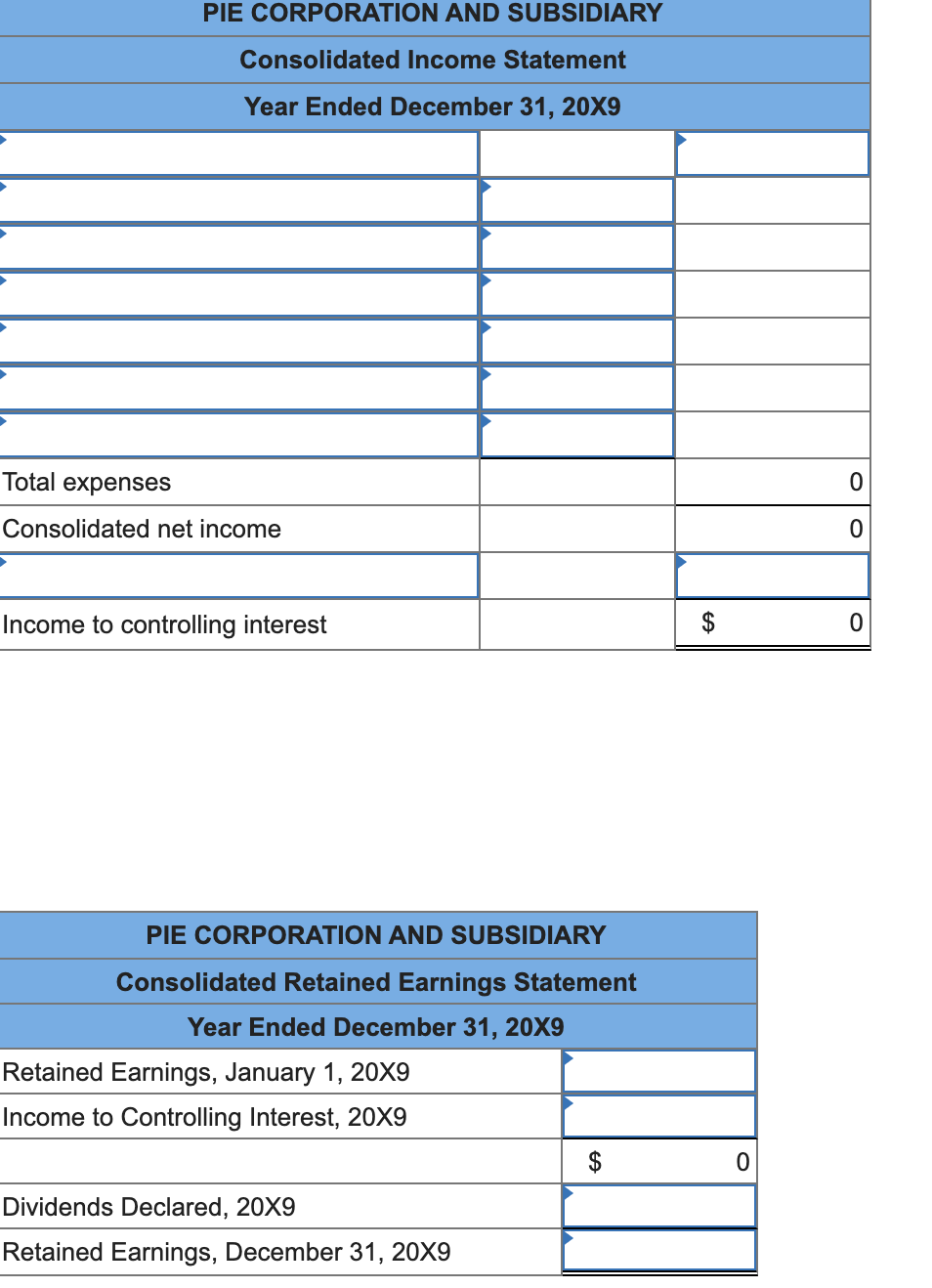

Pie Corporation acquired 75 percent of Slice Company's ownership on January 1, 20X8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of Slice's net assets at acquisition was $100,000. The book values and fair values of Slice's assets and liabilities were equal, except for Slice's buildings and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the buildings and equipment was $30,000 on the acquisition date. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Pie concluded at December 31, 20X8, that goodwill from its purchase of Slice shares had been impaired and the correct carrying amount was $2,500. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. Investment in Slice Co. Stock $96,375. No additional impairment occurred in 20X9. Slice Company Debit Credit $ 32,000 14,000 24,000 25,000 150,000 Trial balance data for Pie and Slice on December 31, 20X9, are as follows: Pie Corporation Item Debit Credit Cash $ 68,500 Accounts Receivable 85,000 Inventory 97,000 Land 50,000 Buildings & Equipment 350,000 Investment in Slice Company 106,875 Cost of Goods Sold 145,000 Wage Expense 35,000 Depreciation Expense 25,000 Interest Expense 12,000 Other Expenses 23,000 Dividends Declared 30,000 Accumulated Depreciation $ 170,000 Accounts Payable 51,000 Wages Payable 14,000 Notes Payable 150,000 Common Stock 200,000 Retained Earnings 126,875 Sales 290,000 Income from Slice Company 25,500 $1,027,375 $1,027,375 114,000 20,000 10,000 4,000 16,000 20,000 $ 50,000 15,000 6,000 50,000 60,000 48,000 200,000 $429,000 $429,000 Consolidation Worksheet Entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts