Question: This assignment has two exercises related to topics covered in chapters 9 and 17-18 of the book (Managing Economic Exposure, International Capital Structure and the

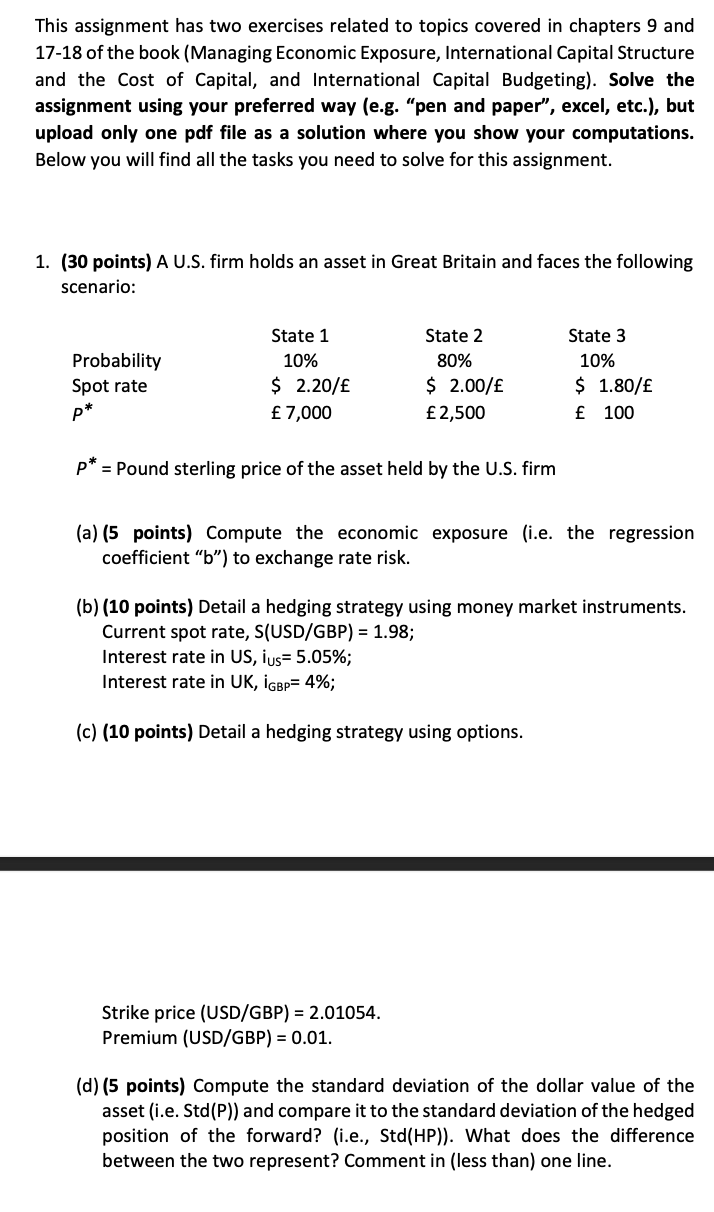

This assignment has two exercises related to topics covered in chapters 9 and 17-18 of the book (Managing Economic Exposure, International Capital Structure and the Cost of Capital, and International Capital Budgeting). Solve the assignment using your preferred way (e.g. "pen and paper", excel, etc.), but upload only one pdf file as a solution where you show your computations. Below you will find all the tasks you need to solve for this assignment. 1. (30 points) A U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate p* State 1 10% $ 2.20/ 7,000 State 2 80% $ 2.00/ 2,500 State 3 10% $ 1.80/ 100 p* = Pound sterling price of the asset held by the U.S. firm (a) (5 points) Compute the economic exposure (i.e. the regression coefficient "b") to exchange rate risk. (b) (10 points) Detail a hedging strategy using money market instruments. Current spot rate, S(USD/GBP) = 1.98; Interest rate in US, ius=5.05%; Interest rate in UK, IGBp= 4%; (c) (10 points) Detail a hedging strategy using options. Strike price (USD/GBP) = 2.01054. Premium (USD/GBP) = 0.01. (d) (5 points) Compute the standard deviation of the dollar value of the asset (i.e. Std(P)) and compare it to the standard deviation of the hedged position of the forward? (i.e., Std(HP)). What does the difference between the two represent? Comment in (less than) one line. This assignment has two exercises related to topics covered in chapters 9 and 17-18 of the book (Managing Economic Exposure, International Capital Structure and the Cost of Capital, and International Capital Budgeting). Solve the assignment using your preferred way (e.g. "pen and paper", excel, etc.), but upload only one pdf file as a solution where you show your computations. Below you will find all the tasks you need to solve for this assignment. 1. (30 points) A U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate p* State 1 10% $ 2.20/ 7,000 State 2 80% $ 2.00/ 2,500 State 3 10% $ 1.80/ 100 p* = Pound sterling price of the asset held by the U.S. firm (a) (5 points) Compute the economic exposure (i.e. the regression coefficient "b") to exchange rate risk. (b) (10 points) Detail a hedging strategy using money market instruments. Current spot rate, S(USD/GBP) = 1.98; Interest rate in US, ius=5.05%; Interest rate in UK, IGBp= 4%; (c) (10 points) Detail a hedging strategy using options. Strike price (USD/GBP) = 2.01054. Premium (USD/GBP) = 0.01. (d) (5 points) Compute the standard deviation of the dollar value of the asset (i.e. Std(P)) and compare it to the standard deviation of the hedged position of the forward? (i.e., Std(HP)). What does the difference between the two represent? Comment in (less than) one line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts