Question: This assignment is based on Course Learning Objectives CLO1, CLO2 & CLO4, and the following Module 4 Learning Objectives: - Be able to evaluate investment

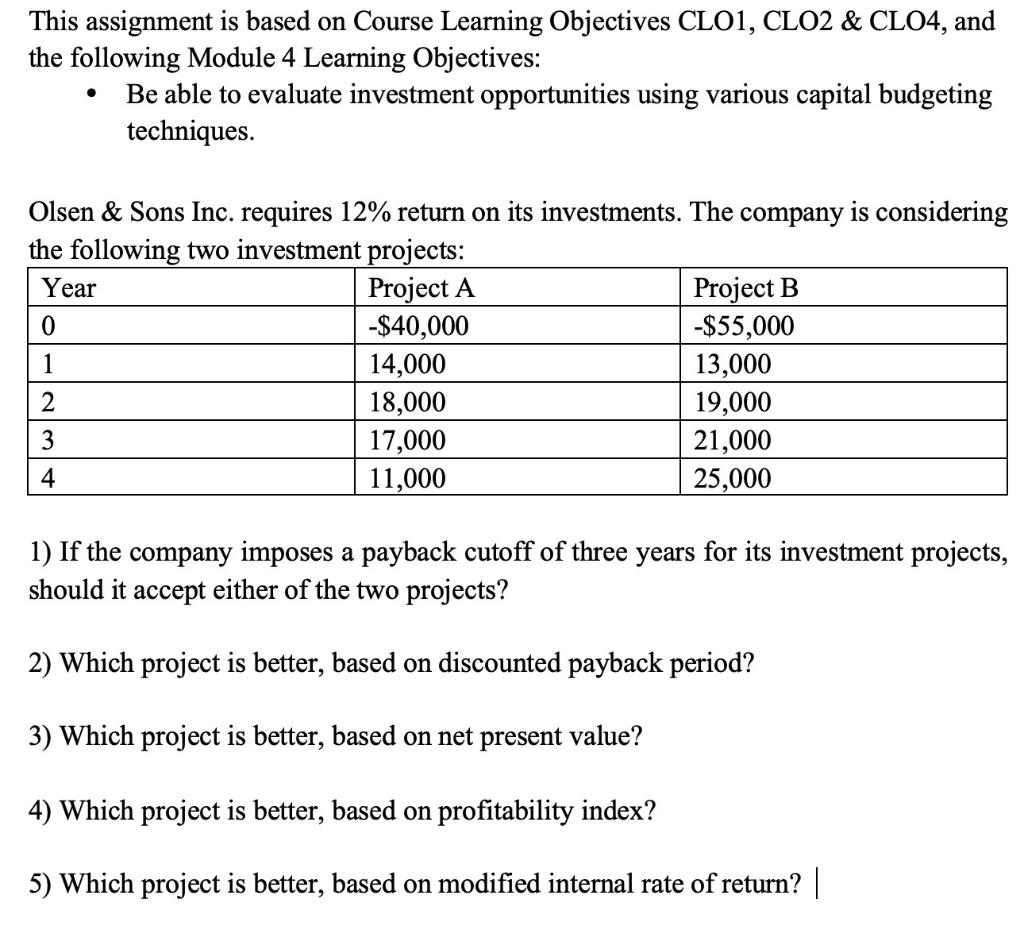

This assignment is based on Course Learning Objectives CLO1, CLO2 \& CLO4, and the following Module 4 Learning Objectives: - Be able to evaluate investment opportunities using various capital budgeting techniques. Olsen \& Sons Inc. requires 12% return on its investments. The company is considering the following two investment projects: 1) If the company imposes a payback cutoff of three years for its investment projects, should it accept either of the two projects? 2) Which project is better, based on discounted payback period? 3) Which project is better, based on net present value? 4) Which project is better, based on profitability index? 5) Which project is better, based on modified internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts