Question: This assignment is designed for practicing both the retailer/merchandiser accounting cycle and your basic excel skills. Below are select sales transactions for Road Runner Racers.

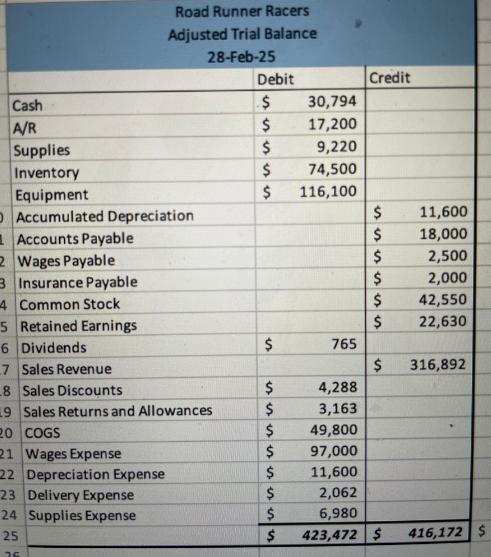

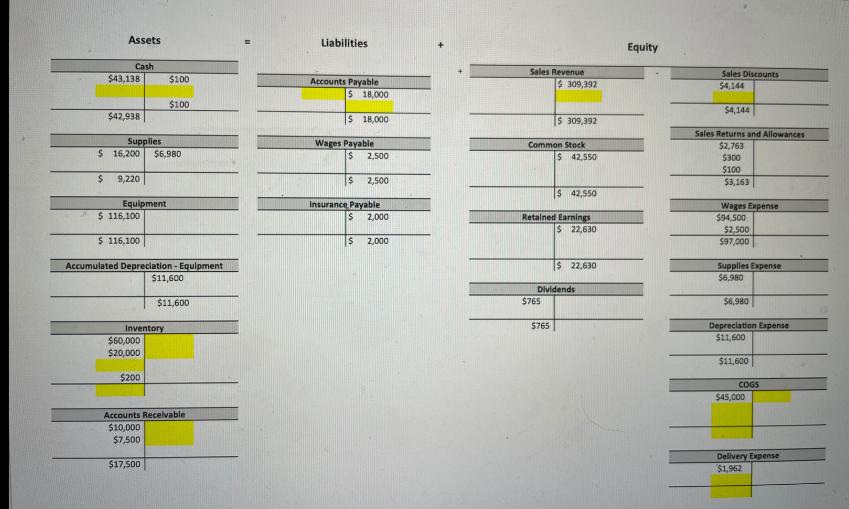

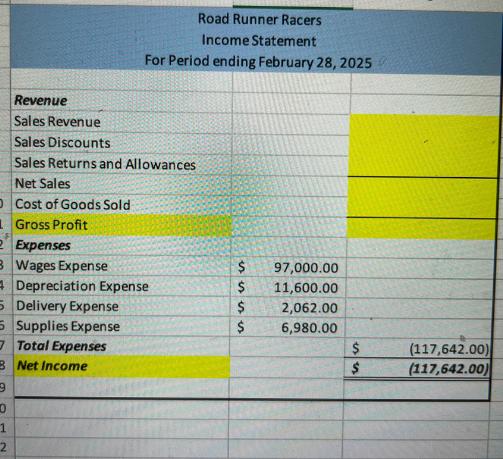

This assignment is designed for practicing both the retailer/merchandiser accounting cycle and your basic excel skills. Below are select sales transactions for Road Runner Racers. You will need to enter the missing pieces of each transaction on the journal entry tab. Each missing piece of information is highlighted in yellow. The only cell where an actual number is to be input is on the journal entries worksheet. Please note: not every yellow cell requires input (it could be left blank if appropriate). After completing the journal entries, you must then complete the missing pieces of the T accounts, trial balance, and statements highlighted in yellow.

Only excel functions may be used to calculate the appropriate cell value on these pages.

DO NOT INPUT THE ACTUAL NUMBER INTO THE T ACCOUNTS, TRIAL BALANCE, OR STATEMENTS. Use Excel functions (such as copying the number from the journal entry page, summing numbers together, or using the plus or minus symbols to help you find the appropriate number). Your balance sheet should balance when you are complete.

Tip: After each journal entry, update the appropriate T accounts.

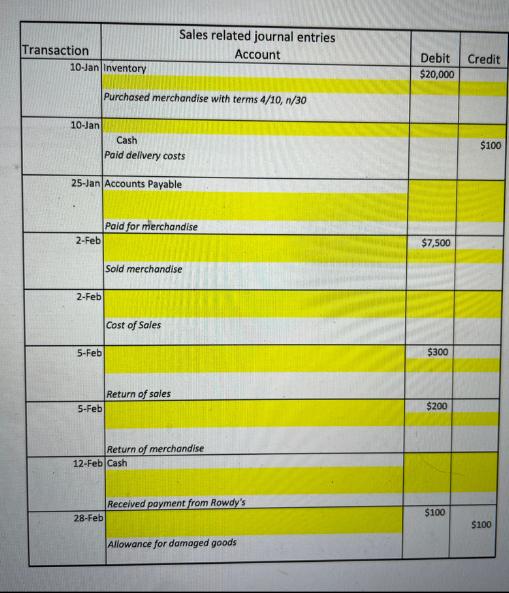

Select Retailer/Merchandiser-Related Transactions:

1) Road Runner Racers (RRR) purchased $20,000 of merchandise from Warehouser Plus on January 10. RRR was given terms of 4/10, n/30. FOB shipping point. RRR paid $100 for delivery.

2) RRR paid their invoice to Warehouser Plus on January 25th.

3) On February 2, RRR sold $7,500 of merchandise to Rowdy's Inc. RRR offered Rowdy credit terms of 2/10, n/30. RRR's cost of the merchandise was $5,000.

4) On February 5, Rowdy returned $300 of merchandise because it wasn't needed. RRR's cost was $200. RRR accepted the return and credited Rowdy's account.

5) Rowdy paid their invoice on February 12. 6) Rowdy found some minor damage on some units, but he keeps them as RRR sent a $100 cash allowance to compensate for the damage.

Transaction 10-Jan Inventory 10-Jan 2-Feb Cash Paid delivery costs 25-Jan Accounts Payable 2-Feb 5-Feb 5-Feb Purchased merchandise with terms 4/10, n/30 28-Feb Sales related journal entries Account Paid for merchandise Sold merchandise Cost of Sales Return of sales 12-Feb Cash Return of merchandise Received payment from Rowdy's Allowance for damaged goods Debit Credit $20,000 $7,500 $300 $200 $100 $100 $100

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

128 129 Transaction 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 ... View full answer

Get step-by-step solutions from verified subject matter experts