Question: This assignment refers to the task detailed below. Some parts can be calculated in advance while other parts will need to be calculated once you

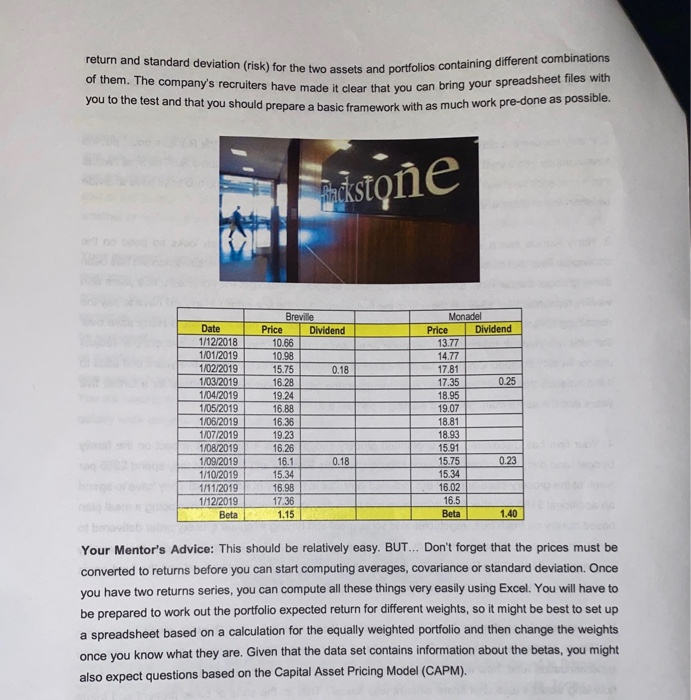

This assignment refers to the task detailed below. Some parts can be calculated in advance while other parts will need to be calculated once you access the assignment question set. Read the task below and prepare as much as you can in Excel (or by hand) and then log in once the assignment question set opens to answer a series of questions. The link to the question set is found under the 'assessment tab'. Grades will be released once the deadline passes. In accordance with USQ policy, no attempts will be allowed once the deadline passes and the correct answers are available. USQ policy allows extensions to be granted, in compelling circumstances, if the application is received before the due date. Scenario #3: Risk & Reward Imagine, finally, that you are applying for a position as an analyst at Blackstone Asset Management. You are attending a testing session today. Some basic portfolio analysis skills will be tested. You have been given two series of prices (below) and you guess that you will have to compute the expected 3 return and standard deviation (risk) for the two assets and portfolios containing different combinations of them. The company's recruiters have made it clear that you can bring your spreadsheet files with you to the test and that you should prepare a basic framework with as much work pre-done as possible. mikstone Date 1/12/2018 1/01/2019 1/02/2019 1/03/2019 1/04/2019 1/05/2019 1/06/2019 1/07/2019 1/08/2019 1/09/2019 1/10/2019 1/11/2019 1/12/2019 Beta Breville Price Dividend 10.66 10.98 15.75 0.18 16.28 19.24 16.88 16.36 19.23 16.26 16.1 0.18 15.34 16.98 17.36 1.15 Monadel Price Dividend 13.77 14.77 17.81 17.35 0.25 18.95 19.07 18.81 18.93 15.91 0.23 15.75 15.34 16.02 16.5 Beta 1.40 Your Mentor's Advice: This should be relatively easy. BUT... Don't forget that the prices must be converted to returns before you can start computing averages, covariance or standard deviation. Once you have two returns series, you can compute all these things very easily using Excel. You will have to be prepared to work out the portfolio expected return for different weights, so it might be best to set up a spreadsheet based on a calculation for the equally weighted portfolio and then change the weights once you know what they are. Given that the data set contains information about the betas, you might also expect questions based on the Capital Asset Pricing Model (CAPM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts