Question: This case allows us to consider the problem of excess cash faced by many companies these days? Cash balances are on the rise: Large

This case allows us to consider the problem of "excess cash" faced by many companies these days?

• Cash balances are on the rise: Large U.S. firms hold $3 Tri in cash today, 5× the amount held 10 years earlier?

• Investors often see this as "inefficient balance sheets" and demand stock repurchases?

• CFOs must decide what to do with excess cash and modulate firms' capital structure?

• The case allows us to consider factors that are important when setting capital structure: Tax shields, costs of financial distress, credit ratings, etc.

Put yourself in the shoes of BBBY's CEO, Steven Temares

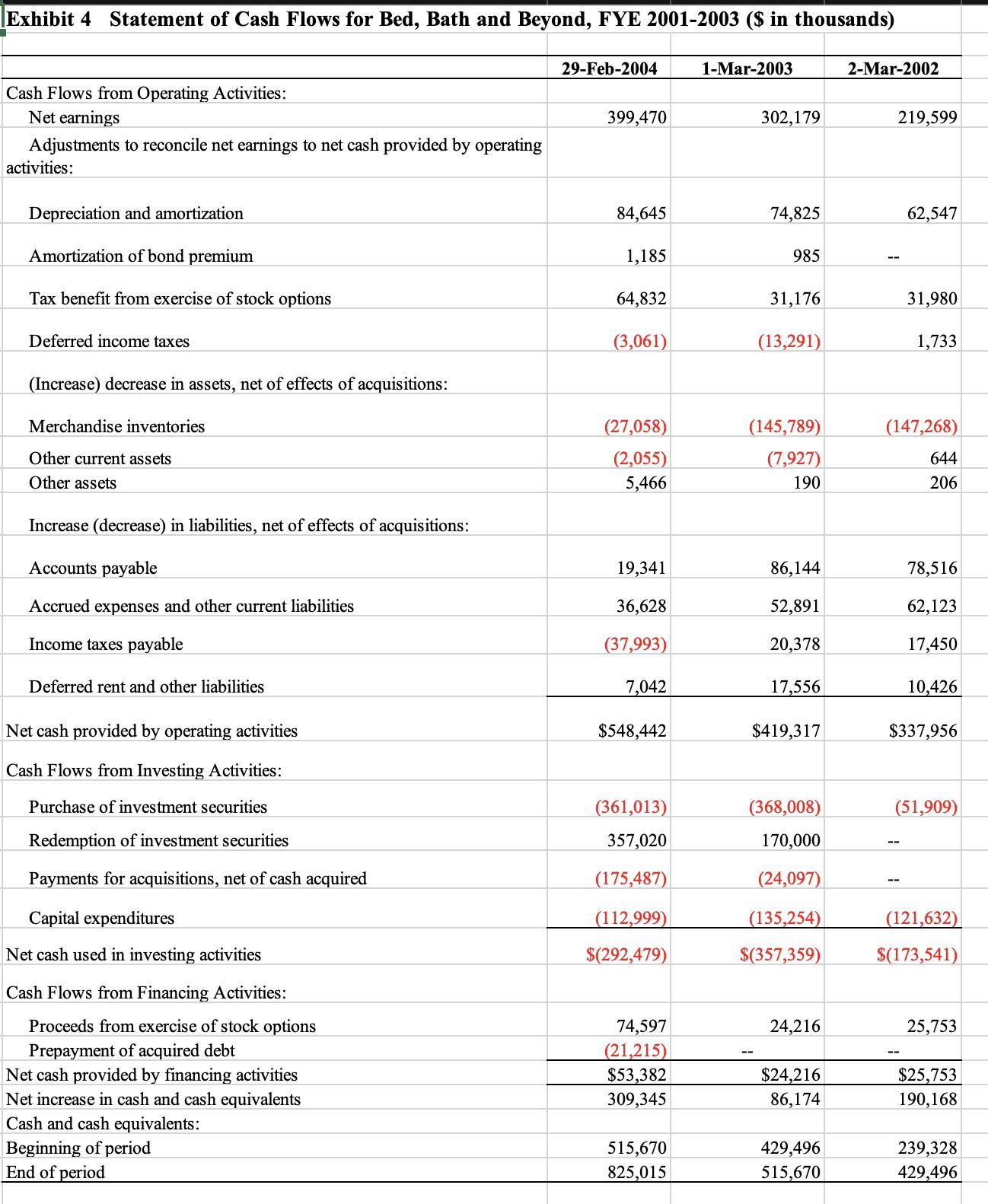

• It's April 2004 and you're about to decide what to do with the $400 million "excess cash" in the firm:

1. Keep it?

2. Pay it out?

3. Issue debt?

4. All of the above?

• What factors should you consider when choosing the "optimal capital structure"?

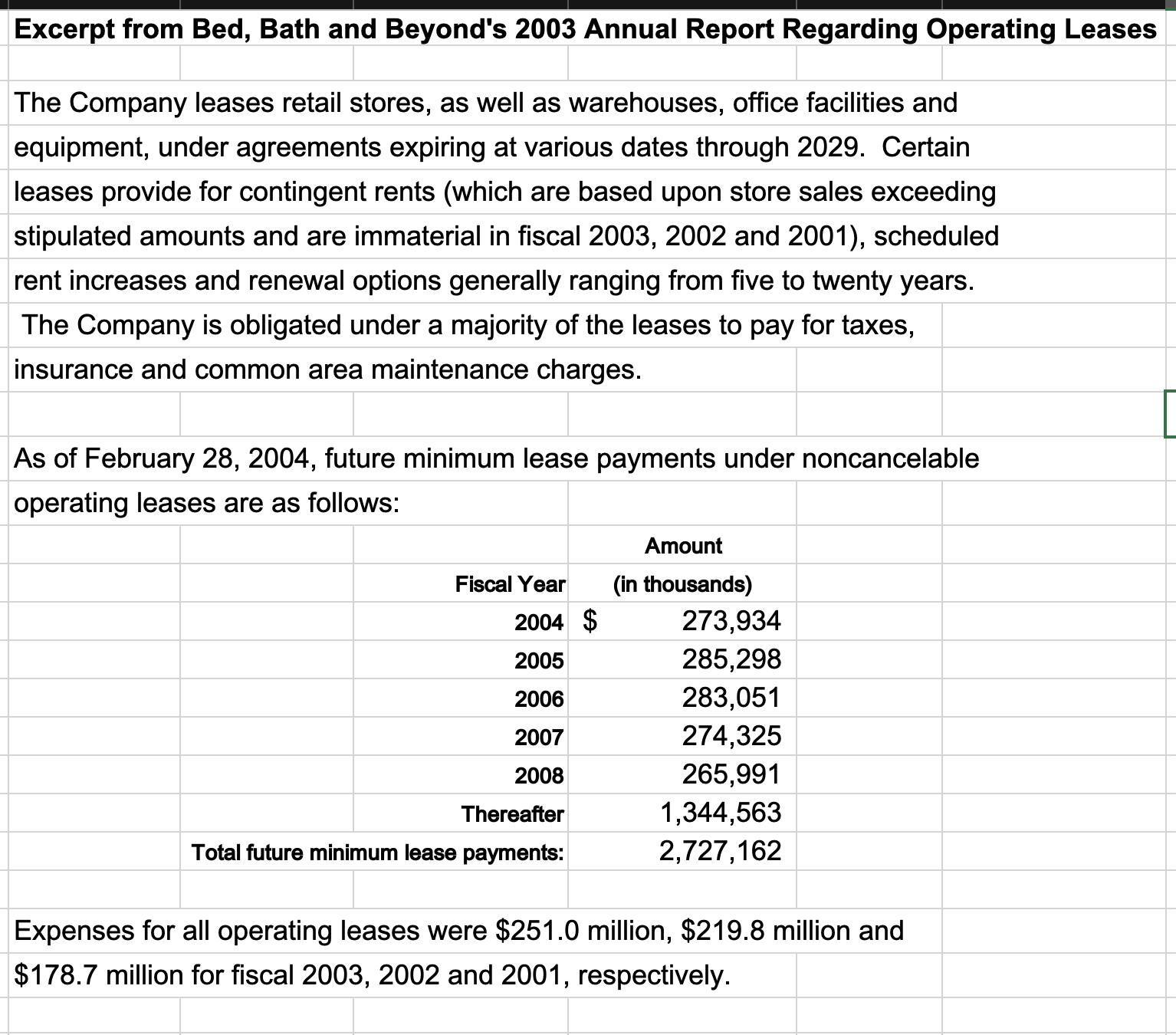

• Note BBBY's non-cancellable leases (tax-deductible pmts)

- They look and behave a lot like "secured debt" claims

• An excel spreadsheet is provided to help you with the case (check attachments)

Consider a concrete program...BBBY combines:

1. Use $400 million excess cash, and

2. Borrow funds (at 4.5%) to conduct a share repurchase

Under the above program, compute the PV of tax shields and estimate the bond ratings for the following D/E ratios: 20%, 40%, 60%, and 80%?

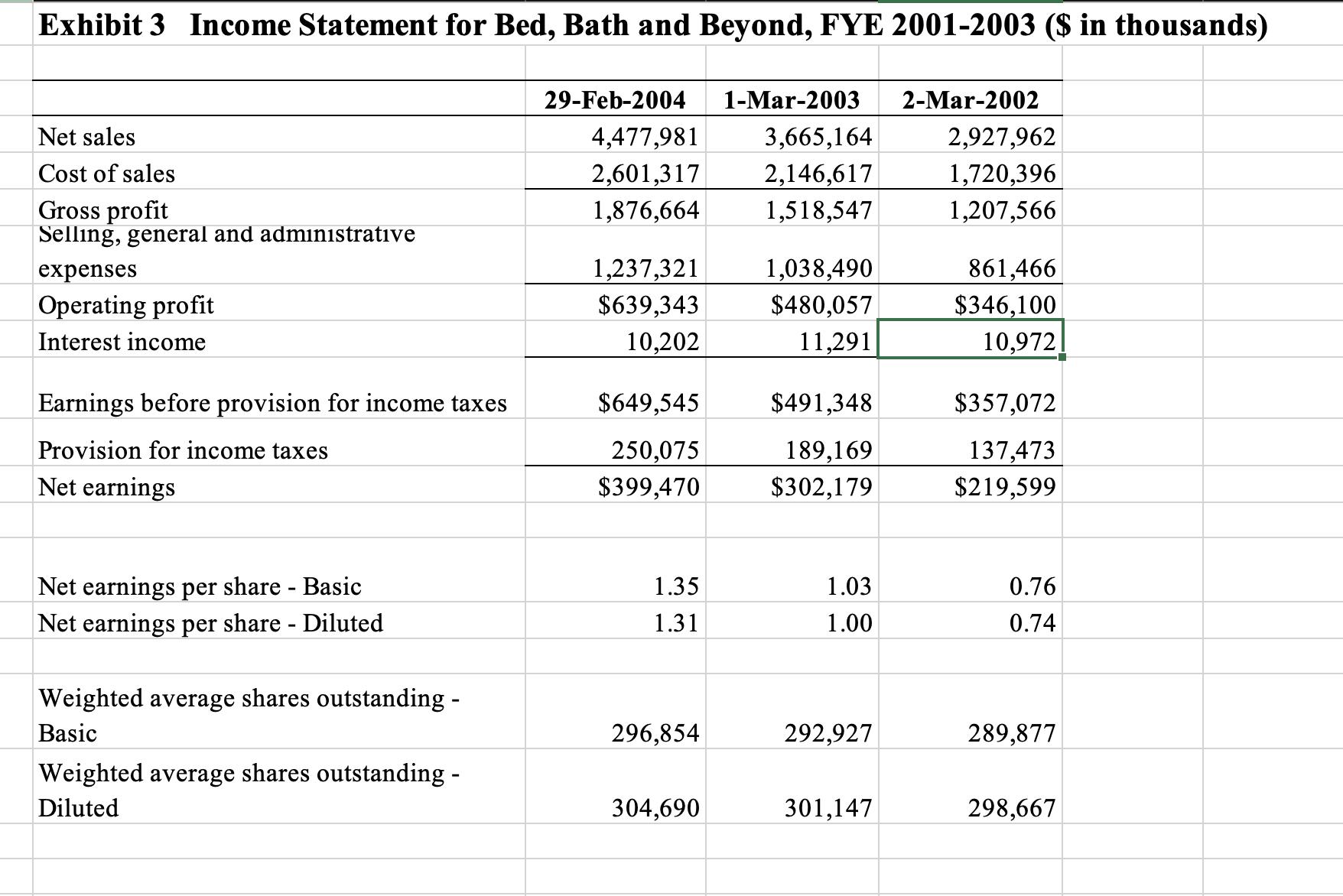

The corporate tax faced by BBBY is 38.5%?

The rationale and details of your response must be given in a professional memorandum prepared individually?

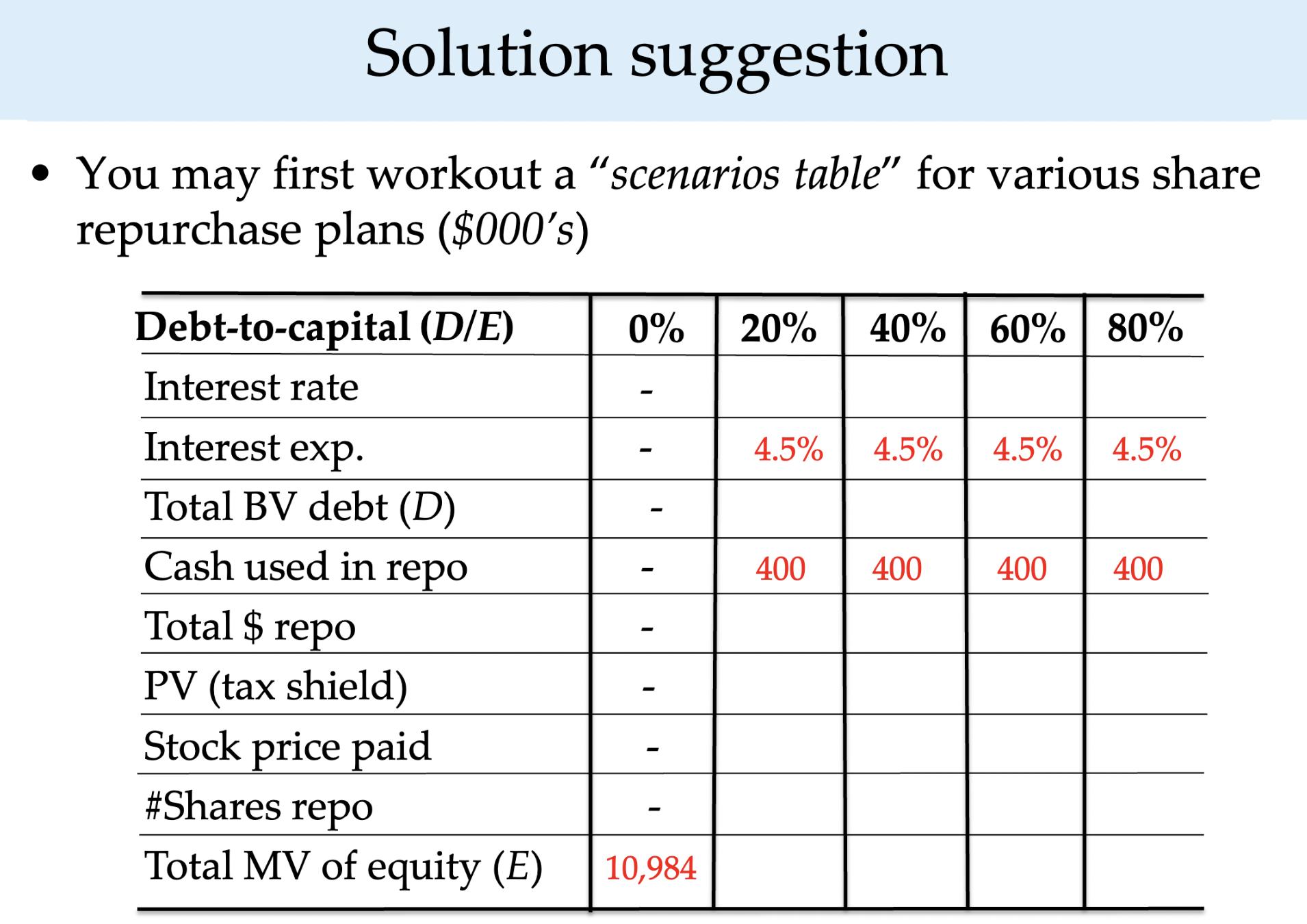

Solution suggestion You may first workout a "scenarios table" for various share repurchase plans ($000's) Debt-to-capital (D/E) 0% 20% 40% 60% 80% Interest rate Interest exp. Total BV debt (D) Cash used in repo Total $repo PV (tax shield) Stock price paid #Shares repo Total MV of equity (E) I - 10,984 4.5% 4.5% 4.5% 4.5% 400 400 400 400

Step by Step Solution

3.59 Rating (153 Votes )

There are 3 Steps involved in it

You have provided various financial data for Bed Bath Beyond BBBY and a scenarios table needing to be filled out for different debttoequity DE ratios ... View full answer

Get step-by-step solutions from verified subject matter experts