Question: This case draws on material from Chapters 3-7. Adam bas just graduated, and has a good job at a decent starting salary. He bopes to

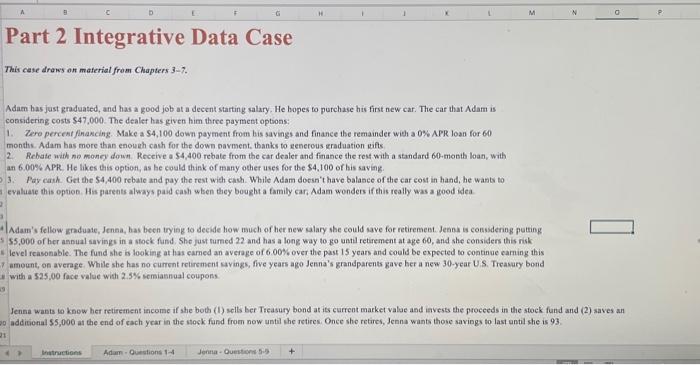

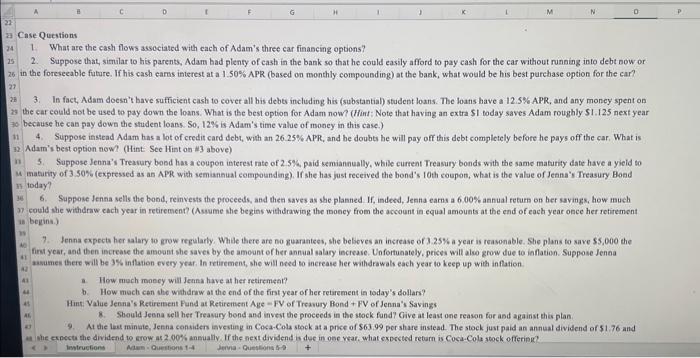

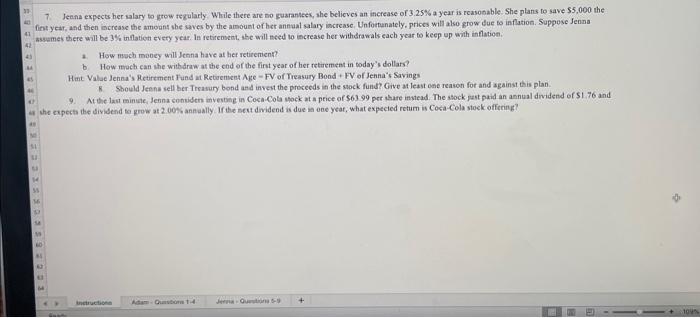

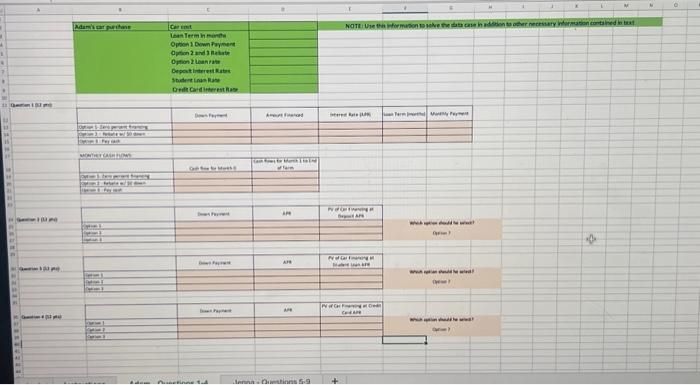

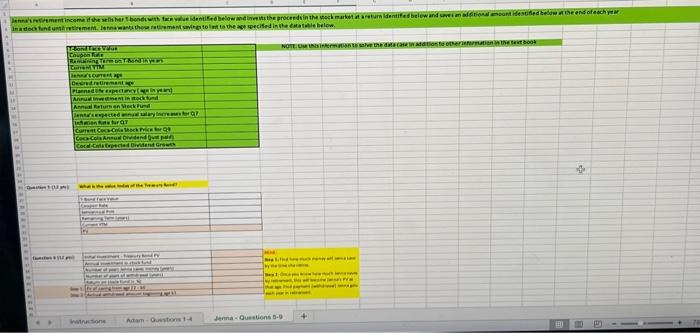

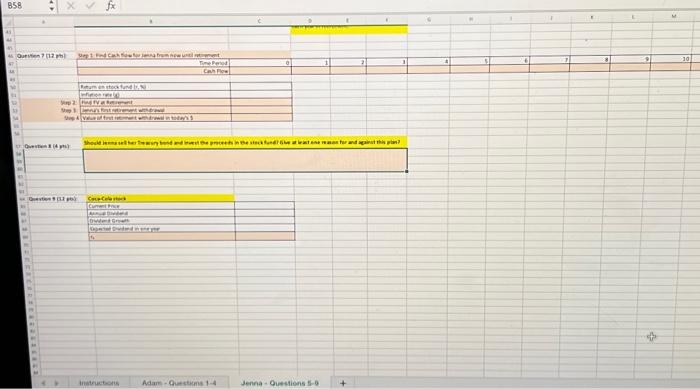

This case draws on material from Chapters 3-7. Adam bas just graduated, and has a good job at a decent starting salary. He bopes to purchase his first new car. The car that Adam is considering costs $47,000. The dealer has given him three paymest options: 1. Zere perent flrancing. Make a 54,100 down payment from bis savingt and finance the remainder with a 0%APR loan for 60 months. Adam bas more than enouah cach for the down navment. thanks to eenerous eraduation vifts 2. Rebate with no moncy down. Receive a $4,400 rebate from the car dealer and finance the rest with a standard 60 -month loan, with an 6.00%APR. He likes this optioti, as he could think of many other uses for the $4.100 of his saving. 3. Pay cask. Get the 54,400 rebate and pay the rest with cach. While Adam doesn't have balance of the car cost in hand, he wants to evaluate this optioe. His parents always paid cash wben they bought a family can. Adam wonders if this really was a good idea. Adam's fellow zaduate, Jenna, has been trying to decide how much of her new salary she could save for retirement. Jenna is considering putsing $5,000 of ber annual savings in a stock fund. She just turned 22 and has a long way to go unti retirement at age 60 , and she considers this nisk level reasonable. The fund she is looking at has earned an average of 6.00% over the past 15 year and coulis be expected to continue carning this amount, on average. While sbe has no current retirement mvings, five years ago Jenna's grandparents gave her a new 30 -year U.S. Treasury bond with a 525.00 face value with 2.5% semiasnual coupons Jenna wants to know her retiretnent income if she both (1) selts ber Tieasury bond at its current market value and iavests the proceeds in the stoek fund and (2) saves an additional 55,000 at the end of cach ycar in the stock fund from now until she retires. Once she retires, Jenna wants those savings to last entil she is 93. Case Q uections 1. What are the cash flows associated with cach of Adam's three car financing options? 2. Suppose that, simular to his parents, Adam bad plenty of cash in the bank so that he could easily afford to pay cash for the car without running into debt bow or in the foresecable future. If his cash earns interest at a 1.50% APR (based on monthly compousding) at the bank, what would be his best purebase option for the car? 3. In fact, Adam doesn't have sufficient cash to cover all bis debts including his (substantial) student loans. The loans bave a 12.5% APR, and any moncy spent on the car could not be used to pay down the loans. What is the best option for Adam now? (Hint: Note that having an extra $1 today saves Adam roughly 51 . 25 next year because he can pay down the student loans. So, 12% is Adam's time value of money in this case.) 4. Suppose instead Adam has a lot of credit card debr, with an 26.25% APR, and be doubti he will pay off this debt completely before he pays off the car. What is Adam's best option now? (Hint: See Hint on #3 above) 5. Suppose Jenna's Treasury boed has a coupon interest rate of 2.5% paid semiannually, while curtent Treasury bonds with the same matutity date have a yield to maturity of 3.50% (expressed as an APR with semianaual compounding). If she has just received the bond's 10 th coupon, what is the value of Jeana's Treasury Boad 10day? 36 6. Suppose Jenna sells the bond, reinvests the proceeds, and then saves as she planned If, indeed, Jenna earns a 6.00% annual return on ber savitga, how much could she withdraw each year in retirement? (Asume she begins withdrawing the moncy from the account in equal amounts at the end of each year once her retirement begins.) 7. Jenna expect her salary to grow regularly. While there are no guarantees, she betoves an increase of 1.25% a year is reasonable. She plans to save 55,000 the firm year, and then iscrease the arsoant she saves by tbe amount of her annual salary increase. Unfortunately, prices will also grow due to iaflation. Suppose Jenea asames there will be 3% inflation every year, In retiremen, she will need to increase her withdrawals each year to keep up with inflation. a. How much moscy will Jenna have at her retiremeat? b. How mach cen the withdnw at the end of the fint year of her retirement ia today's dollars? Hint: Value Jenna's Retirement Fund at Retirement Age - FV of Treakury Bond + FV of Jenna's Savings 8. Sbould Jesna sell her Treasury bond and invelt the proceeds in the stock fond? Give at least one reason for and against this plan 9. At the last minate, Jenna censiden isvesting in Coca-Cola stock at a proe of $63.99 per share instead. The stock just paid an annual dividend of 51.76 and Whe expecta the dividend to erow as 2.00% aneually. If the next dividend is dee in one vear. what expocted retarn is Coca.Cola stock offeripe? 7. Jenna expects her salary to grow tegularly. While there are no guarantees, ahe belicves an increase of 3.25% a year is reasonable. She plans to save $5,000 the fint year, and then iscrease the amount sbe saves by the amount of ber annual salary increase, Unfortunately, prices will also grow due to inflation. Suppese Jenna assemes there wall be 3% inflation every year. In retirenemt, ahe will need to increase her withitawals each year to kecp op with inflation. a. How moch movey will Jenna have at het retirement? b. How moch can the withdraw at the end of the firt year of her retirement in today's dollars? Hent Valee Jenna's Retirement Fund at Retioenent Age - FV of Treasury Bond + FV of Jenna"s Savings 8. Sbould Jesnus sell ber Trrasury bond and invent the procecds in the sock fund? Give at least one reason for and against this plan. 9. Metie last minute, Jenna conviden enventing in Coca-Cota sock at a price of $6399 per ahare imsiead. The atock gant paid an annual dividend of 51 . 76 and the expect the dividend to grow at 2 . 00\%hannually. If the seut dwidend is due ia one ycar, what expecied retum is Cosa-Cola stoek offering? This case draws on material from Chapters 3-7. Adam bas just graduated, and has a good job at a decent starting salary. He bopes to purchase his first new car. The car that Adam is considering costs $47,000. The dealer has given him three paymest options: 1. Zere perent flrancing. Make a 54,100 down payment from bis savingt and finance the remainder with a 0%APR loan for 60 months. Adam bas more than enouah cach for the down navment. thanks to eenerous eraduation vifts 2. Rebate with no moncy down. Receive a $4,400 rebate from the car dealer and finance the rest with a standard 60 -month loan, with an 6.00%APR. He likes this optioti, as he could think of many other uses for the $4.100 of his saving. 3. Pay cask. Get the 54,400 rebate and pay the rest with cach. While Adam doesn't have balance of the car cost in hand, he wants to evaluate this optioe. His parents always paid cash wben they bought a family can. Adam wonders if this really was a good idea. Adam's fellow zaduate, Jenna, has been trying to decide how much of her new salary she could save for retirement. Jenna is considering putsing $5,000 of ber annual savings in a stock fund. She just turned 22 and has a long way to go unti retirement at age 60 , and she considers this nisk level reasonable. The fund she is looking at has earned an average of 6.00% over the past 15 year and coulis be expected to continue carning this amount, on average. While sbe has no current retirement mvings, five years ago Jenna's grandparents gave her a new 30 -year U.S. Treasury bond with a 525.00 face value with 2.5% semiasnual coupons Jenna wants to know her retiretnent income if she both (1) selts ber Tieasury bond at its current market value and iavests the proceeds in the stoek fund and (2) saves an additional 55,000 at the end of cach ycar in the stock fund from now until she retires. Once she retires, Jenna wants those savings to last entil she is 93. Case Q uections 1. What are the cash flows associated with cach of Adam's three car financing options? 2. Suppose that, simular to his parents, Adam bad plenty of cash in the bank so that he could easily afford to pay cash for the car without running into debt bow or in the foresecable future. If his cash earns interest at a 1.50% APR (based on monthly compousding) at the bank, what would be his best purebase option for the car? 3. In fact, Adam doesn't have sufficient cash to cover all bis debts including his (substantial) student loans. The loans bave a 12.5% APR, and any moncy spent on the car could not be used to pay down the loans. What is the best option for Adam now? (Hint: Note that having an extra $1 today saves Adam roughly 51 . 25 next year because he can pay down the student loans. So, 12% is Adam's time value of money in this case.) 4. Suppose instead Adam has a lot of credit card debr, with an 26.25% APR, and be doubti he will pay off this debt completely before he pays off the car. What is Adam's best option now? (Hint: See Hint on #3 above) 5. Suppose Jenna's Treasury boed has a coupon interest rate of 2.5% paid semiannually, while curtent Treasury bonds with the same matutity date have a yield to maturity of 3.50% (expressed as an APR with semianaual compounding). If she has just received the bond's 10 th coupon, what is the value of Jeana's Treasury Boad 10day? 36 6. Suppose Jenna sells the bond, reinvests the proceeds, and then saves as she planned If, indeed, Jenna earns a 6.00% annual return on ber savitga, how much could she withdraw each year in retirement? (Asume she begins withdrawing the moncy from the account in equal amounts at the end of each year once her retirement begins.) 7. Jenna expect her salary to grow regularly. While there are no guarantees, she betoves an increase of 1.25% a year is reasonable. She plans to save 55,000 the firm year, and then iscrease the arsoant she saves by tbe amount of her annual salary increase. Unfortunately, prices will also grow due to iaflation. Suppose Jenea asames there will be 3% inflation every year, In retiremen, she will need to increase her withdrawals each year to keep up with inflation. a. How much moscy will Jenna have at her retiremeat? b. How mach cen the withdnw at the end of the fint year of her retirement ia today's dollars? Hint: Value Jenna's Retirement Fund at Retirement Age - FV of Treakury Bond + FV of Jenna's Savings 8. Sbould Jesna sell her Treasury bond and invelt the proceeds in the stock fond? Give at least one reason for and against this plan 9. At the last minate, Jenna censiden isvesting in Coca-Cola stock at a proe of $63.99 per share instead. The stock just paid an annual dividend of 51.76 and Whe expecta the dividend to erow as 2.00% aneually. If the next dividend is dee in one vear. what expocted retarn is Coca.Cola stock offeripe? 7. Jenna expects her salary to grow tegularly. While there are no guarantees, ahe belicves an increase of 3.25% a year is reasonable. She plans to save $5,000 the fint year, and then iscrease the amount sbe saves by the amount of ber annual salary increase, Unfortunately, prices will also grow due to inflation. Suppese Jenna assemes there wall be 3% inflation every year. In retirenemt, ahe will need to increase her withitawals each year to kecp op with inflation. a. How moch movey will Jenna have at het retirement? b. How moch can the withdraw at the end of the firt year of her retirement in today's dollars? Hent Valee Jenna's Retirement Fund at Retioenent Age - FV of Treasury Bond + FV of Jenna"s Savings 8. Sbould Jesnus sell ber Trrasury bond and invent the procecds in the sock fund? Give at least one reason for and against this plan. 9. Metie last minute, Jenna conviden enventing in Coca-Cota sock at a price of $6399 per ahare imsiead. The atock gant paid an annual dividend of 51 . 76 and the expect the dividend to grow at 2 . 00\%hannually. If the seut dwidend is due ia one ycar, what expecied retum is Cosa-Cola stoek offering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts