Question: This company uses intermediate debt, long-term debt and common equity to finance its operations. With the information presented above: a. Calculate the firm's debt

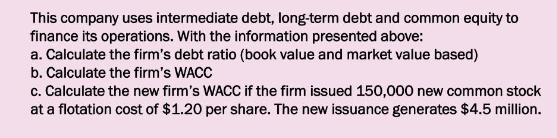

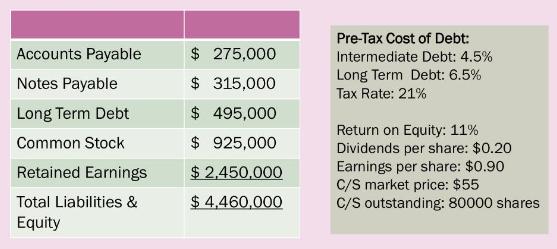

This company uses intermediate debt, long-term debt and common equity to finance its operations. With the information presented above: a. Calculate the firm's debt ratio (book value and market value based) b. Calculate the firm's WACC c. Calculate the new firm's WACC if the firm issued 150,000 new common stock at a flotation cost of $1.20 per share. The new issuance generates $4.5 million. Accounts Payable Notes Payable Long Term Debt Common Stock Retained Earnings Total Liabilities & Equity $ 275,000 $ 315,000 $495,000 $ 925,000 $ 2,450,000 $ 4,460,000 Pre-Tax Cost of Debt: Intermediate Debt: 4.5% Long Term Debt: 6.5% Tax Rate: 21% Return on Equity: 11% Dividends per share: $0.20 Earnings per share: $0.90 C/S market price: $55 C/S outstanding: 80000 shares

Step by Step Solution

There are 3 Steps involved in it

To calculate the firms debt ratio WACC and the new WACC after issuing 150000 new common stock with flotation costs we need to follow these steps a Cal... View full answer

Get step-by-step solutions from verified subject matter experts