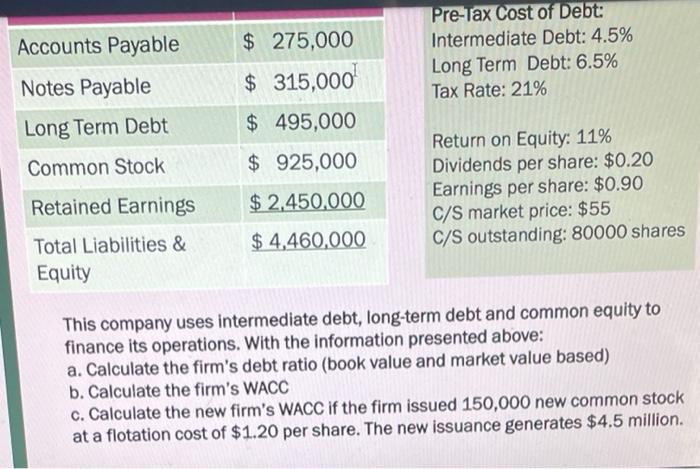

Question: This company uses intermediate debt, long-term debt and common equity to finance its operations. With the information presented above: a. Calculate the firm's debt ratio

This company uses intermediate debt, long-term debt and common equity to finance its operations. With the information presented above: a. Calculate the firm's debt ratio (book value and market value based) b. Calculate the firm's WACC c. Calculate the new firm's WACC if the firm issued 150,000 new common stock at a flotation cost of $1.20 per share. The new issuance generates $4.5 million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock