Question: This comprehensive problem requires you to evaluate such a decision. Use the information from the following scenario to complete the required computations below. Fly Away

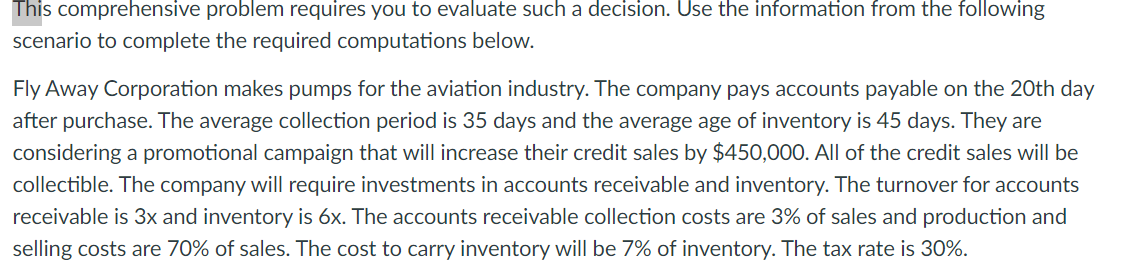

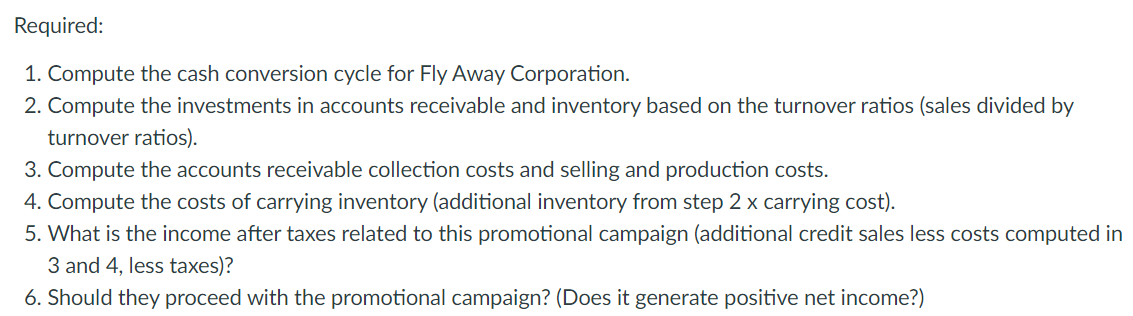

This comprehensive problem requires you to evaluate such a decision. Use the information from the following scenario to complete the required computations below. Fly Away Corporation makes pumps for the aviation industry. The company pays accounts payable on the 20th day after purchase. The average collection period is 35 days and the average age of inventory is 45 days. They are considering a promotional campaign that will increase their credit sales by $450,000. All of the credit sales will be collectible. The company will require investments in accounts receivable and inventory. The turnover for accounts receivable is 3x and inventory is 6x. The accounts receivable collection costs are 3% of sales and production and selling costs are 70% of sales. The cost to carry inventory will be 7% of inventory. The tax rate is 30%. Required: 1. Compute the cash conversion cycle for Fly Away Corporation. 2. Compute the investments in accounts receivable and inventory based on the turnover ratios (sales divided by turnover ratios). 3. Compute the accounts receivable collection costs and selling and production costs. 4. Compute the costs of carrying inventory (additional inventory from step 2 x carrying cost). 5. What is the income after taxes related to this promotional campaign (additional credit sales less costs computed in 3 and 4, less taxes)? 6. Should they proceed with the promotional campaign? (Does it generate positive net income?) This comprehensive problem requires you to evaluate such a decision. Use the information from the following scenario to complete the required computations below. Fly Away Corporation makes pumps for the aviation industry. The company pays accounts payable on the 20th day after purchase. The average collection period is 35 days and the average age of inventory is 45 days. They are considering a promotional campaign that will increase their credit sales by $450,000. All of the credit sales will be collectible. The company will require investments in accounts receivable and inventory. The turnover for accounts receivable is 3x and inventory is 6x. The accounts receivable collection costs are 3% of sales and production and selling costs are 70% of sales. The cost to carry inventory will be 7% of inventory. The tax rate is 30%. Required: 1. Compute the cash conversion cycle for Fly Away Corporation. 2. Compute the investments in accounts receivable and inventory based on the turnover ratios (sales divided by turnover ratios). 3. Compute the accounts receivable collection costs and selling and production costs. 4. Compute the costs of carrying inventory (additional inventory from step 2 x carrying cost). 5. What is the income after taxes related to this promotional campaign (additional credit sales less costs computed in 3 and 4, less taxes)? 6. Should they proceed with the promotional campaign? (Does it generate positive net income?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts